Traders react with visible stress on the trading floor as markets tumble amid rising US bond yields and escalating trade tensions. Getty Images

Confidence in the US economy is taking a hit as investors rapidly offload government US bond. The trigger? Donald Trump’s aggressive tariff policies and fears of a spiraling trade war with China.

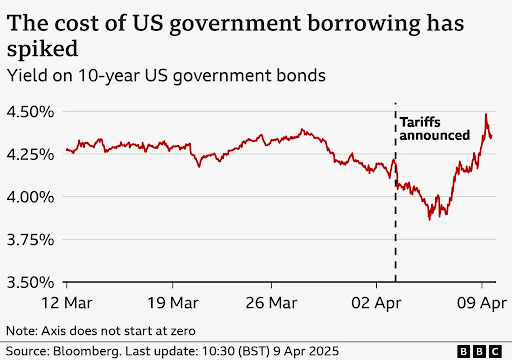

US Bond Yields Surge to 4.5%

Traditionally seen as a safe bet, US government bonds have taken a sharp turn. On Wednesday, 10-year bond yields jumped from 3.9% to 4.5%—a level not seen since February. This signals falling demand, as yields rise when bond prices drop.

The sudden spike follows Trump’s implementation of a 104% tariff on Chinese imports. China retaliated with an 84% tariff on US goods, prompting Trump to raise the rate further to 125%. Although a 90-day pause was later announced for certain nations and a 10% reciprocal tariff introduced, the damage was already done.

Why This Matters

Higher bond yields mean increased borrowing costs—not just for the government, but also for businesses. “Bonds are supposed to be a safe haven in uncertain times, but that’s no longer the case,” said Laith Khalaf of AJ Bell.

Investors are moving away from US debt as uncertainty around inflation and government budgets grows. Mohammed El Erian, economic advisor at Allianz, said there’s been an “erosion” in the perception of US bonds as a financial refuge.

A Possible Fed Intervention?

Some experts believe the Federal Reserve may be forced to intervene. George Saravelos of Deutsche Bank suggested emergency Treasury purchases could be necessary to calm the market. “We are in uncharted territory,” he said, noting a sharp loss of faith in US assets.

El Erian echoed this view, saying the Fed is now caught between managing inflation and protecting jobs. This dilemma could shape the central bank’s response in the days ahead.

Tariffs Could Trigger a Recession

Economists warn that American consumers and businesses will bear the brunt of Trump’s tariffs. Importers facing higher costs may pass them on, leading to price hikes and lower consumer spending. As profits shrink, businesses might reduce hiring or even lay off workers.

JP Morgan now estimates a 60% chance of a US recession, up from 40%. Simon French, chief economist at Panmure Liberum, described it as a “coin toss” whether the downturn becomes official.

Ripple Effects Beyond the US

The bond market chaos isn’t limited to American shores. UK bonds have also felt the heat. El Erian remarked, “When US Treasuries sneeze, UK bonds catch a cold.” Higher yields in the UK suggest rising borrowing costs for businesses and households.

The Bank of England has raised concerns too. It warned that US tariffs are adding serious risks to global growth and financial stability.

A Divided Outlook

While US Treasury Secretary Scott Bessent remains optimistic—stating the goal is to bring jobs and manufacturing back to America—others are skeptical. There’s even speculation that foreign holders of US debt, including China with $759 billion in US bonds, may be selling.

Deutsche Bank’s Saravelos summed up the growing anxiety: “There may be no winner in this trade war. The loser could be the global economy.”