Alibaba's stock soars with new merchant fee plans. Yahoo Finance.

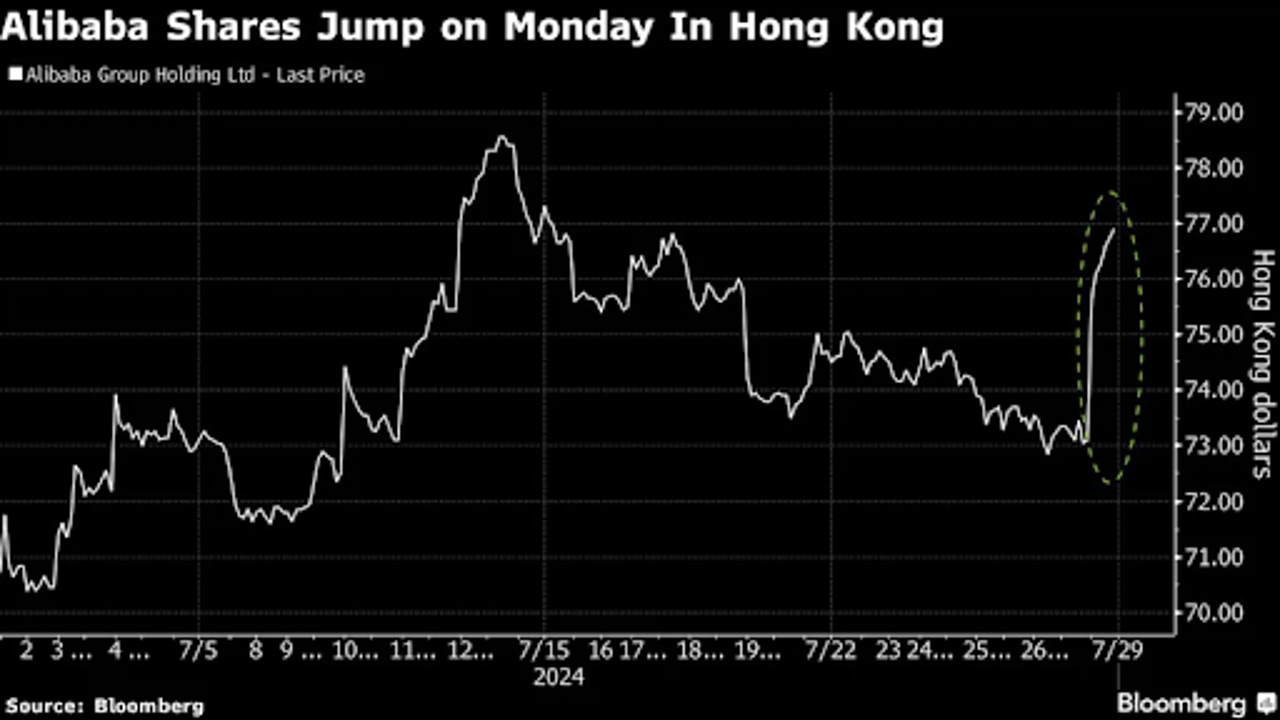

Shares of Alibaba Group Holding Ltd. surged to their highest in two months as investors responded positively to the company’s new plan to increase service fees for merchants. The stock jumped by up to 5.8% in Hong Kong trading, reflecting strong market confidence in Alibaba's latest financial strategy.

The company announced that starting in September, it will implement a new service fee of 0.6% on confirmed transactions for vendors using its popular platforms, Tmall and Taobao. This shift was communicated to merchants on Friday and marks a significant change in Alibaba’s fee structure. Under the new policy, merchants will be charged a percentage-based fee rather than a fixed annual amount. This change aligns Alibaba with other major e-commerce platforms, such as PDD Holdings Inc., JD.com Inc., and ByteDance, which have already adopted similar fee structures.

Analysts view this fee adjustment as a positive development for Alibaba’s core merchant revenue. Jefferies Financial Group Inc. noted that the new fee arrangement would likely enhance Alibaba’s revenue from Taobao and Tmall, both of which are crucial to the company’s business model. Merchants on these platforms will now pay a variable fee based on the volume of their transactions, which is expected to contribute significantly to Alibaba’s financial performance.

Despite the increase in service fees, Alibaba has indicated that it may offer exemptions for smaller merchants to help ease the transition. The company is also planning to support its vendors by adjusting traffic allocation criteria and offering free refund policies.

This move by Alibaba is seen as a strategic effort to boost its revenue streams and stay competitive in the rapidly evolving e-commerce landscape. The increase in share value reflects investor optimism about the potential for higher earnings and an improved market position for Alibaba.

The company’s stock performance has been notable on the Hang Seng Index, contributing to the index’s overall gain of up to 2%. As Alibaba prepares for this fee adjustment, the broader market is watching closely to see how these changes will impact the company's financial results and market dynamics.