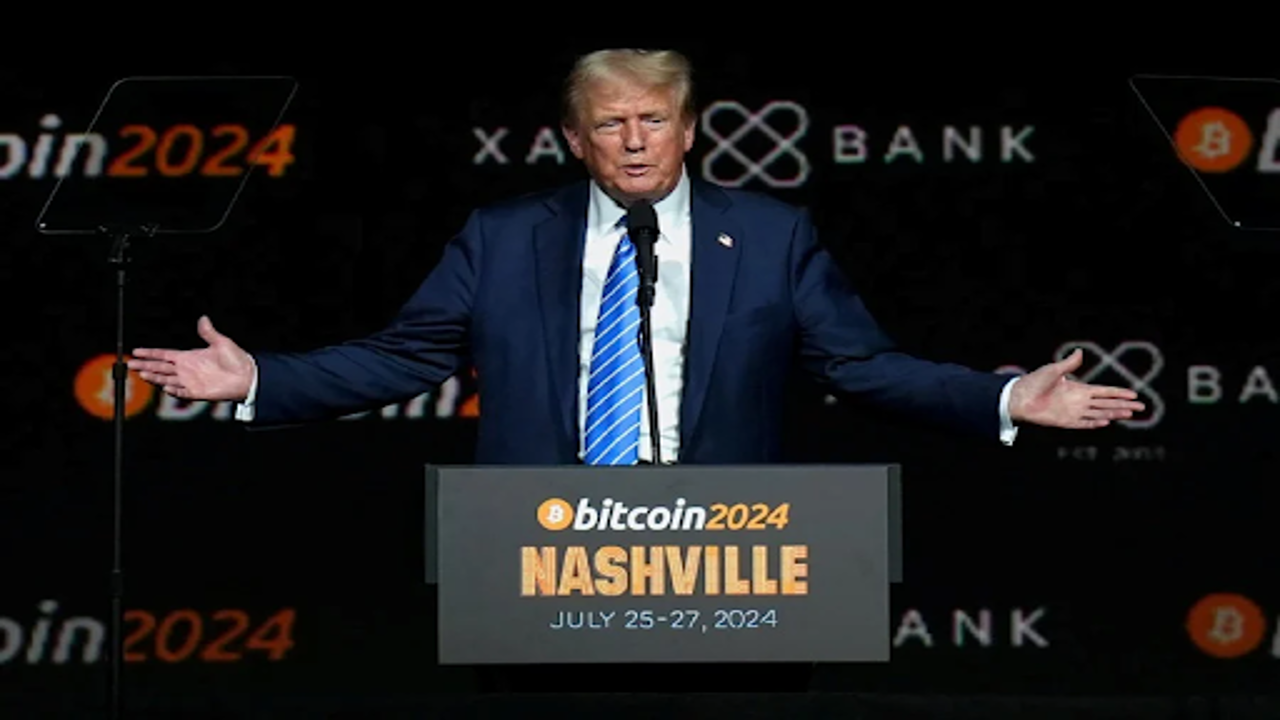

The drop in stock prices wiped out earlier gains that had been driven by enthusiasm following Donald Trump's supportive speech about cryptocurrencies. Reuters

Shares of cryptocurrency companies listed in New York experienced a decline on Monday, following a brief surge in bitcoin's value. The digital currency had briefly surpassed $70,000, marking its highest level since mid-June, but then saw a drop as investors cashed in on profits.

The initial boost in cryptocurrency stocks was driven by enthusiasm surrounding a speech by Donald Trump, who is running for president as a Republican. Trump's pro-crypto stance had initially lifted the stocks, but the excitement quickly faded. This is not uncommon with cryptocurrencies, which often experience fluctuations after reaching significant price points as investors decide to lock in their gains.

Trump's speech had sparked optimism in the crypto industry because he promised less stringent regulation if elected. Bernstein analysts noted that a potential Trump presidency could mean increased investments in bitcoin and related stocks. They suggested that investors might want to consider increasing their exposure to bitcoin and its associated stocks if Trump’s campaign gains momentum.

Trump has positioned himself as a supporter of bitcoin, contrasting with the current administration’s more cautious approach. He has pledged to fire Gary Gensler, the head of the Securities and Exchange Commission (SEC), who has been critical of the volatility and speculative risks associated with cryptocurrencies. Trump also mentioned plans to create a national "stockpile" of bitcoin, using digital assets that the U.S. government has seized.

Despite these bold promises, some experts urge caution. Danny Scott, CEO of CoinCorner, warned that while the idea of a U.S. bitcoin reserve is significant, it hinges on Trump's victory in the upcoming election. The reality of such plans becoming a reality is still uncertain.

In the wake of these developments, shares of crypto exchange Coinbase fell by 3.6%, even after an earlier increase of 5%. Other companies involved in cryptocurrency mining, such as Bitfarms, Riot Platforms, and CleanSpark, also saw their stock prices decline between 4.9% and 5.2% after initially rising. Similarly, MicroStrategy, a major backer of bitcoin, ended the day down 3.9%.

Despite the recent dip, the overall mood towards bitcoin remains positive. Michael Saylor, a prominent advocate for the cryptocurrency, noted that global sentiment has been notably upbeat this year, setting the stage for what many anticipate to be a strong bull market for bitcoin in 2024 and 2025.

Cryptocurrencies have increasingly gained mainstream acceptance, thanks in part to institutional investors and the approval of exchange-traded funds that track the price of bitcoin and ether. This growing acceptance reflects a broader shift from viewing crypto as a niche investment to a significant component of the financial landscape.