Stock Prices Increase as Investors Look Ahead to Upcoming U.S. Economic Data

European stocks gained, and U.S. equity futures saw slight increases as the week closed out, with investors eagerly awaiting the release of crucial U.S. economic data. The Stoxx Europe 600 Index rose by 0.7%, wrapping up a volatile week that saw significant market swings due to concerns over the U.S. economy and the unwinding of yen carry trades. Meanwhile, futures for the S&P 500 and Nasdaq 100 edged up after the S&P 500 experienced its best daily performance since November 2022. Treasury yields dipped, and the dollar weakened slightly.

Thursday’s U.S. jobless claims report, which was better than expected, helped ease recession fears sparked by last week’s disappointing employment data. Now, all eyes are on next week's U.S. economic reports, particularly consumer inflation and retail sales figures. Investors are hoping these reports will confirm that the U.S. economy is on track for a soft landing.

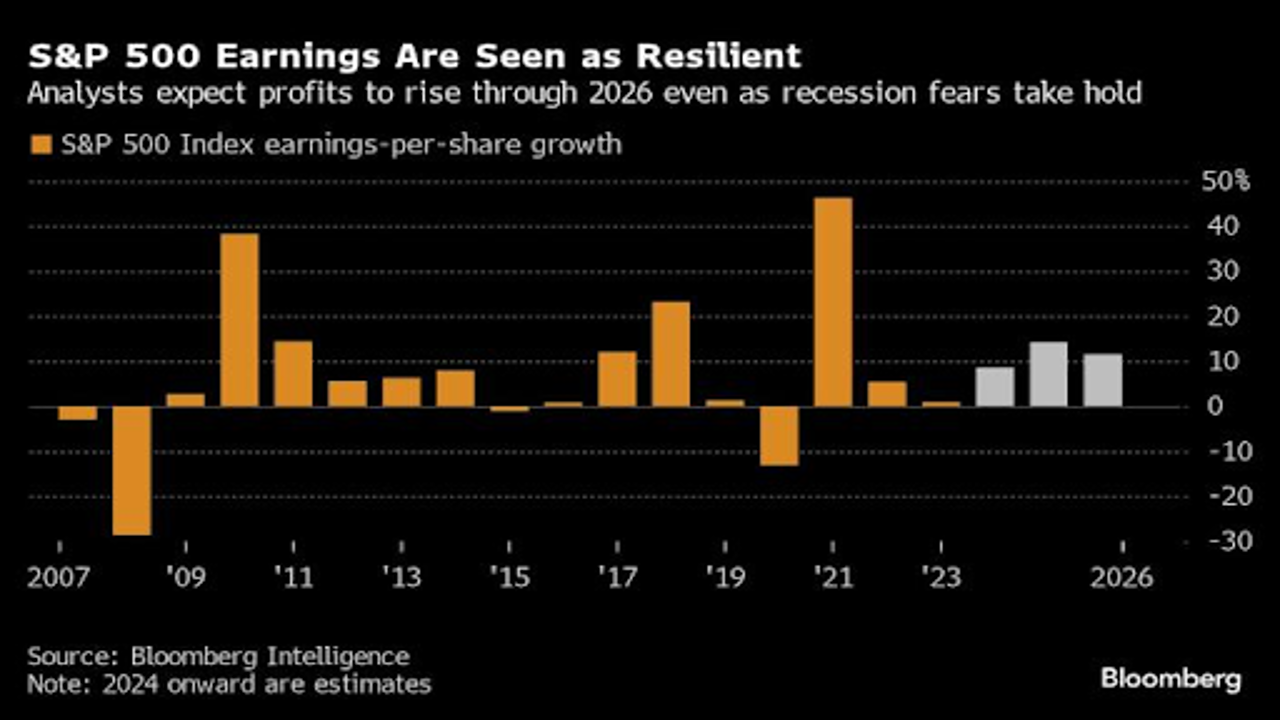

Mark Haefele, Chief Investment Officer at UBS Global Wealth Management, cautioned that market volatility might persist. However, he advised investors not to overreact to the fluctuations in market sentiment. Despite the current uncertainty, Haefele remains optimistic, predicting that the S&P 500 could finish the year around 5,900, up from Thursday’s close of 5,319. He attributed this outlook to the strength of economic and earnings fundamentals and the possibility of the Federal Reserve lowering interest rates.

Despite the positive outlook, mixed signals from U.S. Federal Reserve officials could make investors wary. For instance, Federal Reserve Bank of Kansas City President Jeffrey Schmid expressed reluctance to support an interest rate cut as long as inflation remains above the target. This cautious stance has led swap traders to reduce their bets on aggressive rate cuts by the Fed in 2024. The sharp global repricing at one point suggested a 60% chance of an emergency rate cut by the Fed before its next scheduled meeting in September. However, current pricing now indicates a 40 basis point reduction for September.

In Europe, some stocks experienced notable movements. Italian insurer Assicurazioni Generali SpA saw its shares drop after missing earnings expectations, primarily due to claims from recent storms and flooding across Europe. On the other hand, shares of Hargreaves Lansdown Plc rose after a consortium, including CVC and ADIA, agreed to buy the investment manager in a deal valued at £5.4 billion ($6.9 billion).

In Asia, the stock rally showed signs of slowing, with Japan's Topix Index narrowing its gain to 0.9% after earlier rising by as much as 2%. Chinese shares leveled off after an initial advance, as investors realized that the better-than-expected inflation data was largely influenced by seasonal factors like weather.

Meanwhile, the yen continued to strengthen, leading to further unwinding of carry trades. According to Bob Savage, head of market strategy at BNY Mellon Capital Markets, short-yen positions will likely keep shrinking as the Japanese currency gains ground. He predicted that the yen could eventually strengthen to 100 per dollar.

In commodities, oil prices remained steady following Thursday’s rally, while gold prices slipped slightly.