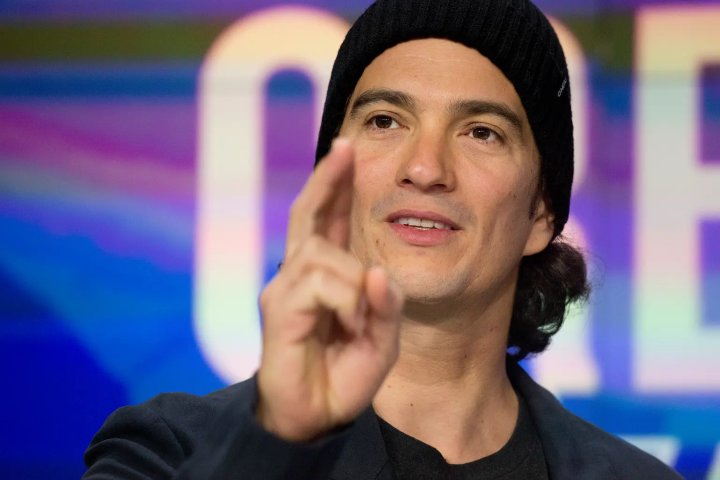

Adam Neumann, WeWork's ex-CEO, seeks to buy back the company for over $500M despite bankruptcy, stirring financial intrigue. (AP)

Adam Neumann, the co-founder of WeWork, has reportedly made a bid exceeding $500 million to repurchase the embattled office-sharing company, according to a source familiar with the matter speaking to Reuters.

The source, who requested anonymity due to the confidentiality of the discussions, noted that the specifics of Neumann's financing plan remain unclear.

Last month, Reuters had disclosed Neumann's interest in reclaiming control of the flexible workspace provider, which filed for bankruptcy in November.

In response to inquiries, WeWork issued a statement affirming its status as an "extraordinary company" that regularly receives expressions of interest from external parties. The company emphasized its commitment to evaluating such approaches in accordance with its long-term interests.

WeWork reiterated its dedication to ongoing restructuring endeavors, aiming to emerge from Chapter 11 in the second quarter as a financially robust and profitable entity.

During Neumann's tenure, WeWork experienced exponential growth, becoming the most valuable startup in the US with a valuation of $47 billion. However, his prioritization of expansion over profitability, coupled with reports of unconventional behavior, ultimately led to his removal and disrupted the company's initial public offering in 2019.

Notably, Neumann's legal team had previously indicated his exploration of a joint bid for WeWork alongside Daniel Loeb's hedge fund, Third Point, and other potential investors. However, Third Point clarified to Reuters that these discussions were preliminary and did not involve financial commitments.

WeWork, supported by SoftBank, faced substantial losses on its lease obligations as remote work surged during the COVID-19 pandemic, diminishing demand for traditional office spaces.

Initial reports of Neumann's bid were disclosed by The Wall Street Journal earlier this Monday.