David Doyle, the chief economist at Macquarie Group, shares his insights ahead of the Bank of Canada's interest rate decision, which is expected Wednesday morning.

The Bank of Canada is expected to keep interest rates steady this Wednesday as officials weigh the economic strain from the ongoing trade tensions triggered by U.S. President Donald Trump’s tariff decisions.

Governor Tiff Macklem and his team are widely anticipated to maintain the current rate of 2.75%, marking the first pause after a series of hikes across the last eight meetings. Though the forecast leans toward a hold, opinions remain divided—only a slight majority of the 30 economists surveyed by Bloomberg predict the rate will stay put.

Earlier this month, Canada was spared from Trump’s immediate “reciprocal tariffs,” but several Canadian exports like automobiles, steel, and aluminum are already facing penalties. In response, Prime Minister Mark Carney imposed a 25% tariff on select U.S. goods, although he has offered a few exemptions as of Tuesday.

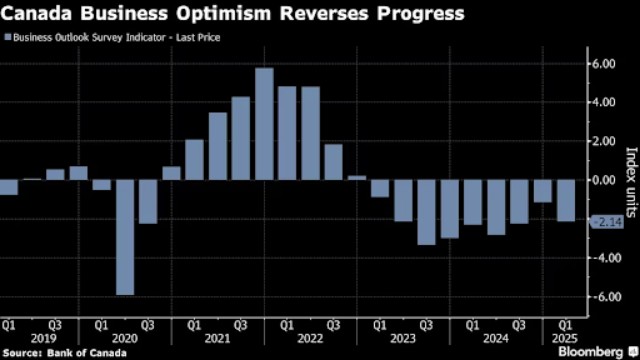

These tit-for-tat tariff moves have shaken business confidence and dented consumer sentiment. Growth projections have dropped, while inflation expectations have gone up, leaving the country with a troubling economic mix.

The uncertainty is making it difficult for the central bank to chart a clear path. Governor Macklem acknowledged this challenge in a speech on March 20, stating that the bank would proceed cautiously until the economic outlook becomes clearer. He suggested that the bank might skip detailed inflation forecasts in its next report, instead offering a range of scenarios—similar to its approach during the early days of the COVID-19 crisis.

Ian Pollick of the Canadian Imperial Bank of Commerce believes that this uncertainty and the temporary relief from tariffs may lead the Bank of Canada to resist cutting rates further—for now.

Some policymakers had already discussed hitting the brakes during their March meeting, arguing that more data was needed before making further decisions. The central bank has been easing rates since June in an effort to fight inflation, but despite some progress, inflation still sits near the upper edge of the bank’s target.

A bit of relief came when March inflation figures, released Tuesday, showed a drop. This development initially had markets torn between expecting a cut or a hold, but sentiment has now shifted more strongly toward a pause.

There are also political considerations. With a national election campaign underway, the bank may avoid bold moves that could stir public or market reaction. RBC's chief economist Eric Lascelles noted that while politics shouldn't drive monetary policy, taking a step back during such a sensitive period may be a wise choice.

Despite everything, economists from the Royal Bank of Canada argue that Canada is well-armed to handle the uncertainty. With both federal and provincial fiscal support and prior rate cuts in play, the economy has some cushion. Still, they believe a rate cut remains possible if signs of economic slowdown grow stronger.

For now, officials seem content to wait, observe, and act only when necessary.