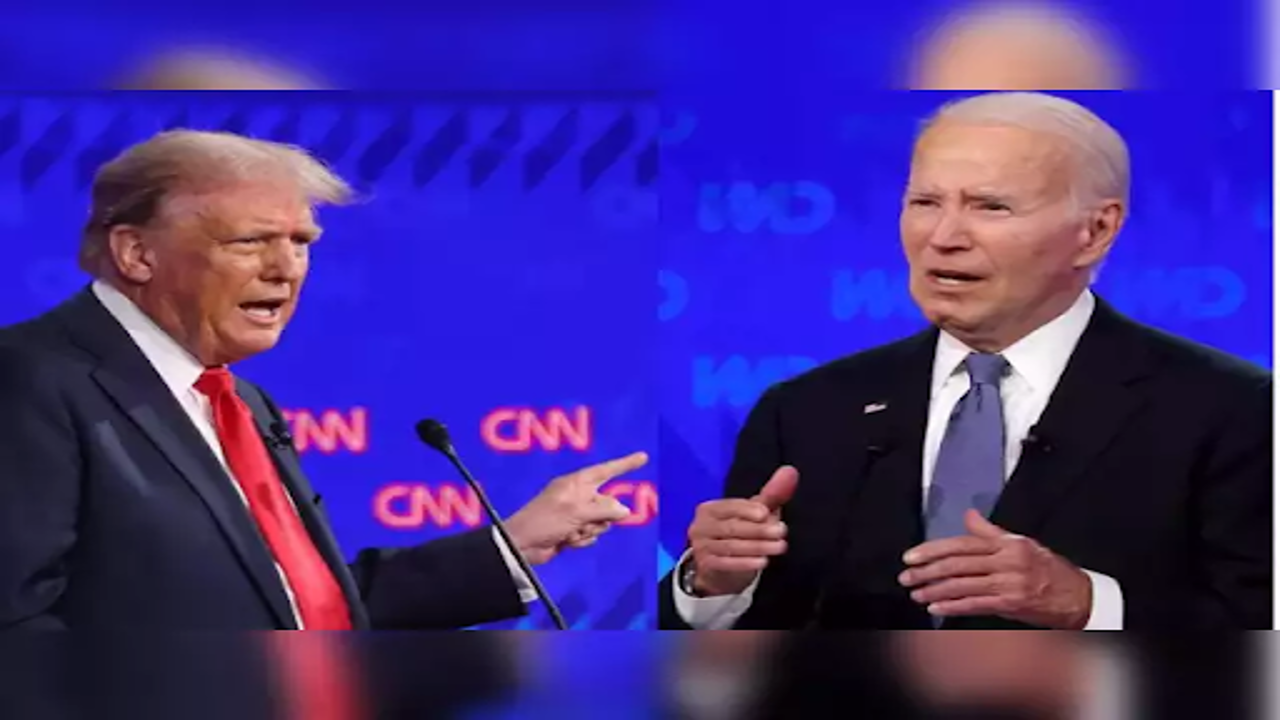

Image courtesy: The Economic Times

Investors have been positioning themselves for Donald Trump's potential return to the White House by reducing their holdings in long-term US bonds and increasing their investments in Bitcoin and other assets. However, with Joe Biden's recent decision to exit the race, investors are now re-evaluating their strategies and considering the impact of a potential Democratic victory.

Biden's announcement, although anticipated given his age and the pressure from allies, introduces significant uncertainty into the political landscape, which is likely to affect market stability. Gene Munster, co-founder and managing partner at Deepwater Asset Management, emphasized that markets are not favorable to uncertainty, particularly when it disrupts the previously strong confidence in Trump's victory.

The decision came after a series of political events that had already shaken the markets. Biden's poor performance in a debate against Trump and a failed assassination attempt on Trump had both led investors to believe more strongly in Trump's chances of winning the election. Biden's withdrawal and endorsement of Vice President Kamala Harris is the latest twist, leaving investors to speculate about the future.

As the news of Biden's exit spreads, the "Trump trade"—a strategy that benefits from Trump's policies of looser fiscal policy, higher trade tariffs, and weaker regulations—faces new challenges. Investors are also cautious about the incoming wave of second-quarter earnings and potential Federal Reserve interest rate cuts, adding to the overall market volatility.

In response to Biden's announcement, the dollar weakened slightly in Asian markets, with gains seen in the euro, Swiss franc, and Mexican peso. Treasury yields fell, and US equity futures remained largely unchanged. Glen Capelo, managing director at Mischler Financial, noted that the bond market's reaction reflects the new uncertainty, and traders may need to adjust their positions.

Traders are now waiting to see if Harris can secure the Democratic nomination and mount a serious challenge to Trump. PredictIt, a betting market, currently has Harris as the favorite for the Democratic nomination, but Trump remains the favorite to win the presidency. Investors will be watching for new polls to gauge how Biden's absence affects the race.

The core of the Trump trade includes support for rising US bond yields, gains in bank, health, and energy stocks, as well as Bitcoin, despite Trump's preference for a weaker US dollar. Some of these trends had already begun to shift as investors focused on economic data and the Fed's actions. Recently, there has been a move away from Big Tech stocks towards smaller companies in previously underperforming sectors.

Dave Mazza, CEO of Roundhill Financial, warned of increased market volatility in the coming weeks. If Harris can quickly gain momentum against Trump, volatility may persist. However, if Trump maintains his lead, the Trump trade could dominate and volatility might decrease.

Bloomberg strategists suggest that unless there's a significant change in Trump's prospects, traders will likely prepare for a weaker dollar, with potential verbal attacks on foreign currencies. Treasury markets will likely see curve steepening amid concerns about larger deficits, even as the Federal Reserve approaches its first interest rate cut of the year.

There is little historical precedent for a sitting president not seeking a second term, with the last instance being Lyndon Johnson in 1968. A new Democratic ticket could cause the Trump trades to fluctuate as markets adjust their expectations. Grace Fan, managing director of global policy research at GlobalData, believes the Trump trades might not change much if Harris becomes the candidate.

In Asia, some investors had anticipated Biden's exit might benefit Trump trades, potentially impacting China stock benchmarks and Korean battery makers. Japanese and Indian shares were expected to perform well. However, Trump's criticism of the weak yen and yuan might limit pressure on these currencies, even if a Trump victory strengthens the dollar overall.

Johanna Chua of Citigroup Inc. highlighted that Biden's exit introduces new uncertainties, prompting the market to reassess the probabilities of the presidential race and its implications on congressional outcomes.