Bitcoin Falls Below $100,000 as Investors Cash In on Trump-Related Gains

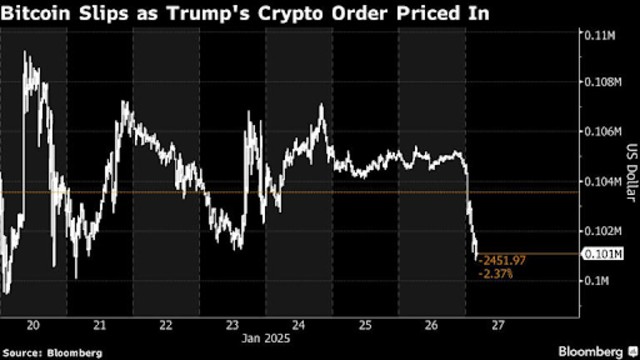

Bitcoin, the world’s leading cryptocurrency, slipped below the $100,000 mark on Monday as traders capitalized on profits following recent developments in U.S. crypto policy. The cryptocurrency dropped over 4.6%, trading at $99,800 early Monday, while smaller digital coins like Solana and Cardano recorded even sharper declines, according to Bloomberg data.

The dip comes after President Donald Trump issued an executive order on Friday, highlighting the significance of the digital-assets sector for U.S. innovation. The order created a working group tasked with developing a regulatory framework for cryptocurrencies within six months. While the directive stopped short of establishing a Bitcoin reserve—a move Trump had championed during his campaign—it proposed exploring the creation of a crypto reserve.

Sean McNulty, head of APAC derivatives at FalconX, commented, “The market got most of what it wanted with the executive order, but the absence of an immediate Bitcoin reserve was a letdown.” He added that expectations for the reserve had already been priced into the market, explaining the muted reaction to the announcement.

Bitcoin’s decline follows a remarkable rally since Trump’s election win in November, with the cryptocurrency climbing over 50% in just a few months. Once a crypto skeptic, Trump shifted his stance during the campaign as the industry became more engaged, contributing significant political donations. He pledged to make the U.S. a global crypto hub, even appointing venture capitalist David Sacks as the country’s crypto and artificial intelligence czar in December.

Ahead of his inauguration, Trump and his wife Melania embraced the sector, launching controversial meme coins. While such tokens are known for their volatility and lack of intrinsic value, they underscored the administration’s growing support for digital assets.

Market watchers believe the recent pullback in Bitcoin and other cryptocurrencies is a natural pause after weeks of bullish developments, including regulatory appointments, new ETF filings, and the executive order itself. Justin d’Anethan, head of sales at Liquifi, noted, “The market seems to be taking a breather after a string of positive news.”

However, broader market sentiment faced additional pressures. Asian stocks rose slightly on Monday, but trade war concerns resurfaced after Trump imposed sanctions on Colombia over its refusal to accept U.S. deportation flights. Meanwhile, U.S. stock futures tumbled amid fears of disruption from a Chinese artificial intelligence model, DeepSeek, which some believe could reshape the tech industry. This uncertainty spilled over into digital assets, with analysts linking it to the latest declines in cryptocurrency prices.

Bitcoin, once the poster child of financial innovation, remains resilient despite short-term volatility. However, its recent dip signals a market that continues to adjust to evolving regulations and global economic shifts.