Upcoming EMEA Earnings: Carmakers Face Challenges, UBS Prepares New Moves. Bloomberg

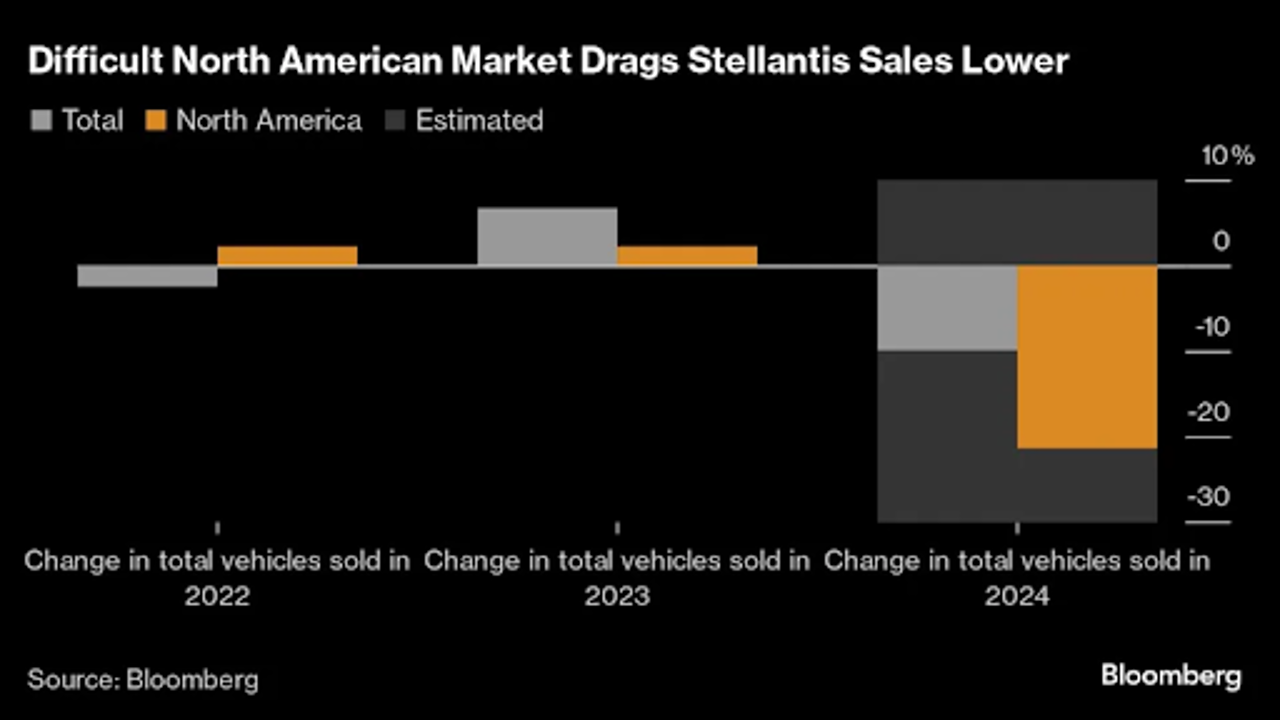

This week, major European companies face critical earnings announcements as industries navigate economic challenges across the automotive, finance, and energy sectors. Stellantis and Aston Martin, prominent names in car manufacturing, prepare to release earnings reports after warning of turbulent times ahead. Stellantis, which owns Fiat and Peugeot, faces weak demand in the U.S. while Aston Martin struggles with declining sales in China, reflecting broader slowdowns affecting the auto industry worldwide.

In the finance sector, UBS Group, alongside BNP Paribas and Société Générale, is set to reveal performance insights. After merging with Credit Suisse, UBS is eyeing its next moves under CEO Sergio Ermotti. Analysts expect shifts in strategy for this financial powerhouse, following Credit Suisse's integration. BNP Paribas’ third-quarter revenue growth is expected to come from its equities and fixed-income trading segments, while Société Générale hopes its French retail business will contribute to earnings growth.

Germany’s BASF, a leader in the chemicals industry, continues to grapple with high energy costs and a slump in Chinese demand. As part of its restructuring, BASF is considering a separate listing for its agriculture division, a move aimed at shoring up profits. For the oil giants BP, Shell, and TotalEnergies, high costs and fluctuating oil prices are major concerns, especially as Shell faces its weakest quarter yet due to lower oil prices and expected losses in chemicals. Nonetheless, Shell aims to maintain its $3.5 billion buyback program.

In healthcare and pharmaceuticals, Novartis, GSK, and Philips are set to disclose earnings. Philips recently lowered its growth forecast, citing slow demand from China, while GSK focuses on sales for Shingrix, a shingles vaccine, and Arexvy, an RSV vaccine with promising demand among high-risk adults. Analysts anticipate steady revenues from Novartis, though the company faces challenges with upcoming patent expirations on major drugs like Entresto and Promacta.

Tuesday’s highlight will be BP’s report, with a close watch on its buyback strategy and debt status. As BP anticipates a slower buyback pace, the company has also hinted at rising debt levels, reflecting the impact of weaker oil trading and slimmer refining margins. Novartis, under scrutiny for its conservative outlook, may keep guidance unchanged given patent expirations in the pipeline.

UBS reports on Wednesday, and analysts anticipate a seasonal dip in investment banking due to uncertainties tied to U.S. election activity. Despite this, the wealth management arm likely benefited from equity market volatility, especially in Asia, where positive trends were reported last quarter. Meanwhile, Aston Martin’s shares have dipped following a recent profit warning. Under new CEO Adrian Hallmark, the company is working to stabilize its production and order trajectory to address recent struggles.

For BASF, volume growth in chemicals will need to show improvement to reassure investors, as the company remains focused on cash flow management with high capital expenditures projected until 2026. Analysts expect GSK’s Shingrix to see a resurgence in sales after a previous quarter dip, with RSV vaccine Arexvy also showing strong promise.

Thursday’s focus turns to Stellantis, where North American sales have dropped 36% this quarter. Stellantis’ shakeup in leadership, including the recent exit of finance chief Natalie Knight, has created uncertainty as CEO Carlos Tavares works to guide the company forward. Energy giant Shell and TotalEnergies will also report, with Shell expecting poor results in chemicals despite resilience in natural gas sectors.

This week’s earnings offer a key look at how European giants are adapting to shifting demands, particularly in China and the U.S. Investors will watch closely for signs of stability or growth amid ongoing challenges.