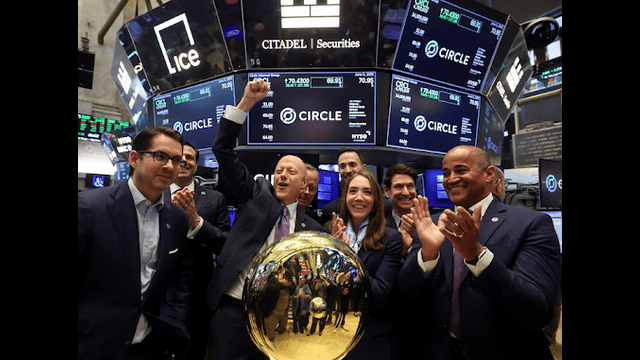

Jeremy Allaire, the CEO and co-founder of Circle Internet Group—the company behind one of the world’s most widely used stablecoins—reacts as the company’s stock begins trading on the New York Stock Exchange (NYSE) during its IPO on June 5, 2025, in New York City. (Photo: Brendan McDermid/Reuters/File)

Stablecoin firm Circle Internet made headlines on Friday after its shares skyrocketed by 41%, following an already impressive stock market debut the day before. The company, which went public on the New York Stock Exchange (NYSE), saw its share price hit $117.45, more than triple its original offer of $31. This puts Circle’s total market worth at an estimated $30.5 billion, making it one of the most talked-about listings of the year.

Circle’s sharp rise signals more than just success in the crypto world—it reflects a shift in broader investor sentiment. For many on Wall Street, this dramatic performance is being seen as a green light for more companies to step forward with public offerings. It suggests the IPO (initial public offering) space might finally be bouncing back after months of uncertainty tied to global tariffs and market volatility.

Experts are calling Circle’s launch a milestone event. Matt Kennedy, a senior strategist at Renaissance Capital, noted that the company’s breakthrough is significant even beyond cryptocurrency. “This isn't just a win for digital assets. It’s a sign that the public markets are warming up again,” he said.

Executives across the financial world echoed this upbeat view. NYSE President Lynn Martin called Circle’s IPO a “bellwether” for the year ahead, hinting that more successful listings could be just around the corner. Nasdaq CEO Adena Friedman agreed, pointing out that investors are adjusting to long-term uncertainty and are once again ready to support companies that show promise.

While market watchers remain cautious about lingering trade and tariff concerns, they believe the IPO market is gaining real traction. Kennedy added that although summer activity may remain slow, many firms are lining up for the fall season, which could see a wave of new public listings.

Already, more companies are preparing to follow Circle’s lead. Chime, a popular digital banking startup, is expected to launch its IPO next week. Others like Caris Life Sciences, Jefferson Capital, and Slide Insurance have also entered the IPO pipeline recently.This week’s events have left many investors hopeful that the worst may be over for the IPO market slump. Circle’s triumph not only boosts confidence in crypto-based businesses but also sends a broader message—strong, innovative companies can still thrive, even in unpredictable times.