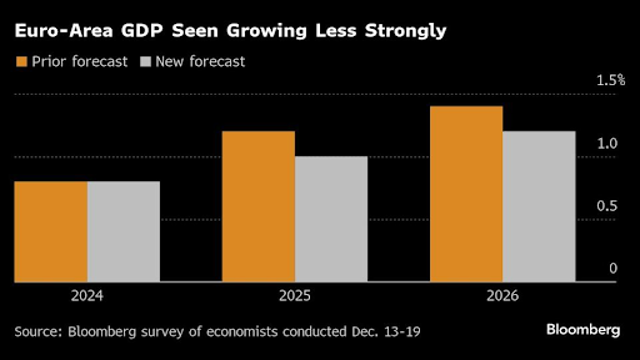

Economists have lowered their growth predictions for the Eurozone in 2025.

The economic prospects for the eurozone in 2025 appear dimmer than initially anticipated. According to a Bloomberg survey, the region’s economy is now projected to grow by just 1% in 2025—slightly better than the 0.8% expected for 2024 but lower than the earlier forecast of 1.2%. The outlook for 2026 has also been adjusted downward to 1.2% from 1.4%.

Economic Challenges for Key Players

Germany, the eurozone’s largest economy, continues to grapple with a sluggish manufacturing sector, contributing to the reduced growth forecasts. Analysts now predict Germany will expand by only 0.4% in 2025 and 1% in 2026, both lowered by 0.3 percentage points. Similarly, France’s prospects have dimmed, while Spain is projected to see a modestly improved growth rate.

Central Bank Optimism Meets Reality

The European Central Bank (ECB) remains cautiously optimistic despite cutting interest rates for the fourth time since June. The ECB envisions household spending as the driving force for recovery, supported by rising incomes and inflation stabilizing at its 2% target. However, past predictions have overestimated the pace at which consumer spending might revive.

“There are solid reasons to believe the economy will improve in the coming years,” remarked Philip Lane, the ECB's Chief Economist, during a podcast on Friday. He acknowledged, however, that uncertainties might cause people to delay spending, slowing down economic recovery.

Inflation Projections

Economists foresee inflation reaching the ECB’s 2% target by mid-2025 and maintaining that level before dipping to 1.9% in 2026. Core inflation, a critical concern for the ECB, is expected to decline faster than previously thought, hitting 2% in the third quarter of 2025.

Mixed Signals and Uncertainty Ahead

While the ECB’s outlook hints at gradual stabilization, the revised predictions highlight the challenges ahead for the eurozone. Uncertainty around consumption patterns and uneven economic recovery across member nations underline the complexity of achieving sustained growth.