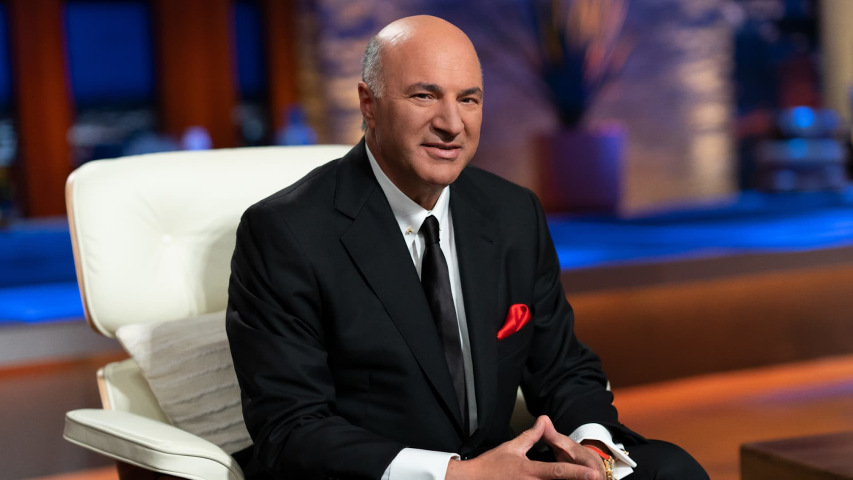

Kevin O'Leary suggests buying TikTok from ByteDance amid US ban talks. His plan aims to address security concerns and ensure user safety. (CNBC)

Following the approval of a bill by the U.S. House that could potentially result in the banning of TikTok, prominent entrepreneur Kevin O'Leary has put forward a proposition to acquire the platform's assets from ByteDance Ltd. and establish a new American entity.

In a recent LinkedIn post, O'Leary underscored the significance of TikTok while addressing persisting concerns. He expressed apprehensions regarding data leakage to the Chinese Communist Party and advocated for the necessity of a sale.

O'Leary outlined his proposal, emphasizing the relocation of servers to American territory, the closure of potential vulnerabilities in the code, and the assurance of user safety for both individuals and businesses. He reiterated his commitment to establishing an American-owned and operated enterprise.

The bill, which recently secured passage in the U.S. House by a vote of 352-65, threatens a ban on TikTok within the United States if ByteDance, headquartered in Beijing, fails to divest its ownership. The legislation is slated to proceed to the U.S. Senate for further consideration.

President Joe Biden has affirmed his readiness to endorse the bill upon its approval by Congress.