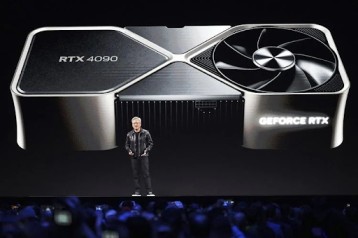

Nvidia’s CEO and founder, Jensen Huang, speaks at a press conference in Las Vegas on January 6, 2025, ahead of the CES tech event. (AP Photo/Abbie Parr)

Nvidia has once again shattered expectations, reporting a record surge in sales and profits for the fourth quarter, driven by soaring demand for its AI-powered Blackwell chips. The company’s revenue soared to $39.3 billion, a 12% increase from the previous quarter and an astonishing 78% jump compared to last year. Its net income also exceeded predictions, reaching $22.06 billion.

AI Demand Fuels Nvidia’s Success

The surge in Nvidia’s sales is largely due to the growing adoption of artificial intelligence across industries. The company’s latest Blackwell chips have become a powerhouse for AI-driven applications, with demand exceeding initial projections. CEO Jensen Huang emphasized that AI is evolving rapidly, setting the stage for the next technological leap.

"AI is advancing at lightning speed," Huang stated. "Agentic AI and physical AI will transform industries, fueling our next phase of growth."

Unmatched Growth in Data Centers

Nvidia’s data center segment, the backbone of its success, generated a staggering $35.6 billion in revenue—marking a 93% rise from the previous year. These centers are crucial in powering AI models and cloud services, with major tech giants investing heavily in Nvidia’s cutting-edge hardware.

One of the most significant developments is Nvidia’s role in the Stargate Project, a $500 billion AI infrastructure initiative involving OpenAI, Oracle, and SoftBank. This ambitious venture aims to expand AI-driven data centers and energy solutions, further solidifying Nvidia’s dominance in the AI market.

Stock Soars Amid AI Frenzy

With a market value now exceeding $3 trillion, Nvidia has cemented itself as Wall Street’s second-largest company, trailing only Apple. Its influence on the stock market has been immense, contributing to the S&P 500’s record-breaking streak despite economic uncertainties.

However, challenges remain. Nvidia is closely monitoring potential trade policies under President Donald Trump’s administration, as tariffs and export restrictions could impact future sales. CFO Colette Kress assured investors that Nvidia is prepared to adapt to any regulatory changes.

Competition and Innovation in AI

Nvidia faces growing competition, particularly from China’s DeepSeek, which recently introduced a cost-efficient AI model using Nvidia chips. Although the announcement momentarily shook Nvidia’s market value, the company welcomed DeepSeek’s innovation as a step forward in AI development.

"DeepSeek R1 is an exciting breakthrough," Huang said. "It has open-sourced a world-class reasoning AI model that is being widely adopted."

Looking ahead, Nvidia remains at the forefront of AI’s next phase, focusing on enterprise AI, robotics, and sovereign AI systems tailored for different regions. Huang confidently stated that Nvidia is positioned at the center of this revolution, ready to drive the future of artificial intelligence.