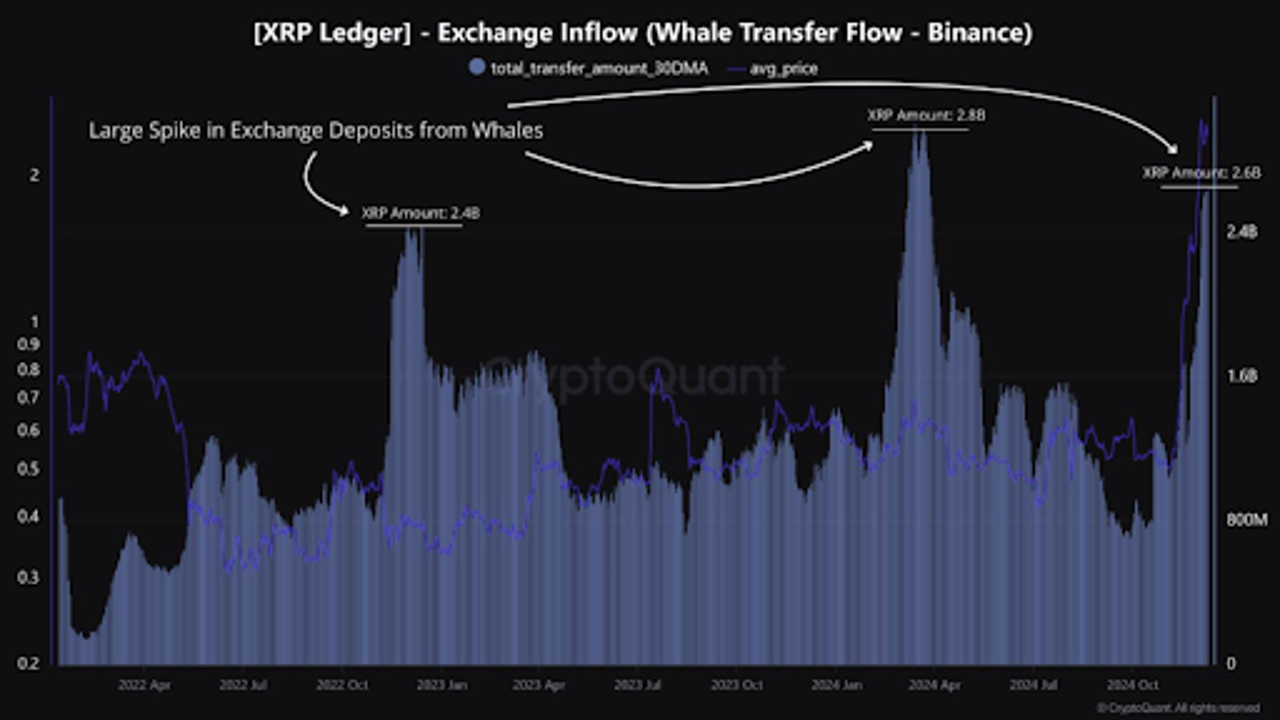

A significant XRP transaction involving a whale was recently recorded on Binance, according to CryptoQuant data. The transfer highlights notable activity within the cryptocurrency market.

Ripple’s XRP could regain its upward momentum after receiving a significant boost from the New York Department of Financial Services (NYDFS). The approval for Ripple’s stablecoin RLUSD, announced by CEO Brad Garlinghouse, marks a key milestone for the company. Following the announcement, XRP witnessed a 7% surge, sparking optimism among investors despite some recent challenges in the market.

Ripple’s RLUSD Stablecoin Gets the Green Light

On December 10, Ripple CEO Brad Garlinghouse revealed that RLUSD, the company’s US Dollar-pegged stablecoin, had been approved by NYDFS. This regulatory nod clears the way for RLUSD to debut on major cryptocurrency exchanges. Similar to other stablecoins like USDT and USDC, RLUSD is backed by actual US Dollar deposits, short-term government treasuries, and cash equivalents. Ripple has emphasized that RLUSD will provide a stable and efficient option for remittances and settlements, addressing the volatility typically associated with cryptocurrencies.

Ripple began developing RLUSD in April 2024 and initiated beta testing on the XRP Ledger and Ethereum platforms in August. In October, Ripple announced partnerships with exchanges like Uphold, Bitstamp, and MoonPay to facilitate RLUSD’s launch. Liquidity support will be provided by market makers such as B2C2 and Keyrock.

XRP’s Market Reaction and Whale Activity

XRP experienced a 7% jump, climbing from $1.90 after the RLUSD announcement. However, this positive movement follows a period of decline, driven in part by significant selling pressure from whale accounts. According to CryptoQuant, over 2.66 billion XRP tokens were transferred to Binance in the past month, marking the highest inflow since April. Despite this, Binance's overall XRP reserves dropped by 320 million during the same period, suggesting strong buying interest from bulls.

Market observers believe RLUSD’s introduction could strengthen Ripple’s ecosystem, offering a less volatile asset and potentially driving demand for XRP. Yet, traders remain cautious, noting that XRP’s recent price volatility is partly due to thin liquidity.

XRP/USDT daily chart

XRP’s Road to $3

XRP is showing signs of recovery, trading above the $1.96 support level and staying above the 23.6% Fibonacci retracement. Analysts predict that if this trend continues, XRP could reclaim the $2.58 level and eventually challenge the $3 psychological barrier. However, achieving this milestone depends on maintaining an uptrend, as any dip below $1.96 could halt the rally.

Momentum indicators like the Relative Strength Index (RSI) and Awesome Oscillator show signs of weakening bullish strength. A daily close below $1.35 would invalidate bullish predictions.