The Bank of Canada is expected to reduce interest rates more significantly and at a quicker pace over the coming year.

Economists are predicting that the Bank of Canada will continue lowering interest rates in its upcoming meetings, following two consecutive cuts. As inflation eases, the trend of reducing borrowing costs is expected to persist throughout the next year.

At the upcoming September 4 meeting, Governor Tiff Macklem and his team are projected to cut the central bank's key overnight rate to 4.25%. This forecast is based on the latest Bloomberg survey, which reflects the median estimate of leading economists.

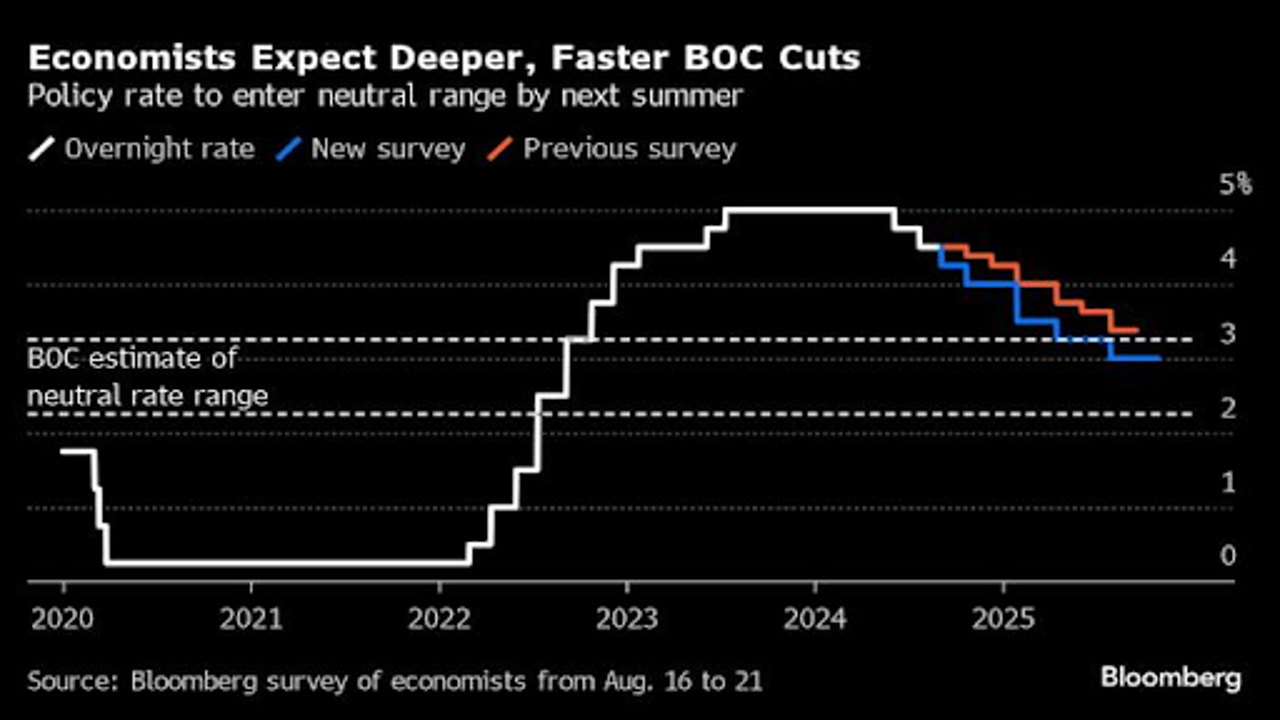

Experts are also suggesting that the central bank will take even more aggressive steps to lower rates in the coming year. They foresee the policy rate dropping from its current level of 4.5% down to 3% by July 2024. Furthermore, by the year 2026, it is expected that the overnight rate will stabilize at around 2.75%.

These predictions are in line with market expectations for the Bank of Canada to gradually ease its monetary policy. Traders involved in overnight swaps are also betting that Macklem will reduce rates by more than 150 basis points before next summer. This would bring the bank's policy rate closer to the so-called neutral rate — where interest rates neither spur economic growth nor hold it back.

Governor Macklem’s plan for a “soft landing” remains a central goal. Economists believe that the Canadian economy could grow by 1.7% in 2025, fuelled by easing interest rates and stronger export growth. This forecast matches the projected growth rate of the US, making Canada a leader in economic expansion among the Group of Seven (G7) nations. Additionally, inflation is expected to hit the bank's 2% target by the end of 2025, down from the current rate of 2.5% annually.

This shift in expectations is happening against the backdrop of changing projections for the US Federal Reserve. Chair Jerome Powell is anticipated to follow a global trend of easing monetary policy in September. Earlier in August, faster rate cuts began to be priced in for Canada after data showed that the US labour market was weakening faster than previously thought.

The Canadian and US economies are closely linked, and any slowdown in the US tends to affect Canada. As the Federal Reserve prepares to cut rates, Macklem can safely continue reducing borrowing costs in Canada without the fear of moving too far ahead of the US central bank. This alignment in policy could also help stabilize the Canadian dollar.

A broader global outlook for lower interest rates could bring much-needed relief to Prime Minister Justin Trudeau and his government, who have been facing economic and political pressure. Lower interest rates could reduce the cost of servicing Canada’s national debt, easing some financial strain. According to recent forecasts, yields on 10-year Canadian government bonds — a key factor in the government’s interest payments — will likely average about 3% over the next year. This is down from the July projection of over 3.25%.