Nvidia's dominance in the AI chip market fuels record-breaking profits, but investor expectations remain high, causing a dip in share prices despite strong financial performance

Nvidia recently reported a significant surge in profits, driven by its stronghold in the chipmaking sector, which has solidified its status as a leader in the booming artificial intelligence (AI) industry. Despite this, investors responded with less enthusiasm, as Nvidia's shares dropped nearly 4% in after-hours trading.

The company posted a net income of $16.6 billion, or $16.95 billion when adjusted for one-time items. Revenue climbed to $30 billion, marking a 122% increase from the previous year and a 15% rise from the prior quarter. By contrast, companies in the S&P 500 are expected to achieve only about 5% revenue growth this quarter, according to FactSet.

Ryan Detrick, chief market strategist at Carson Group, noted that although Nvidia’s revenue growth is impressive, the expectations this earnings season were particularly high. "Death, taxes, and Nvidia beating earnings are three things you can count on," Detrick remarked. "However, this time, the margin by which they surpassed expectations was smaller than in previous quarters."

Nvidia reported second-quarter adjusted earnings per share of 68 cents, up from 27 cents a year ago. The company also anticipates third-quarter revenue to increase to $32.5 billion, plus or minus 2%.

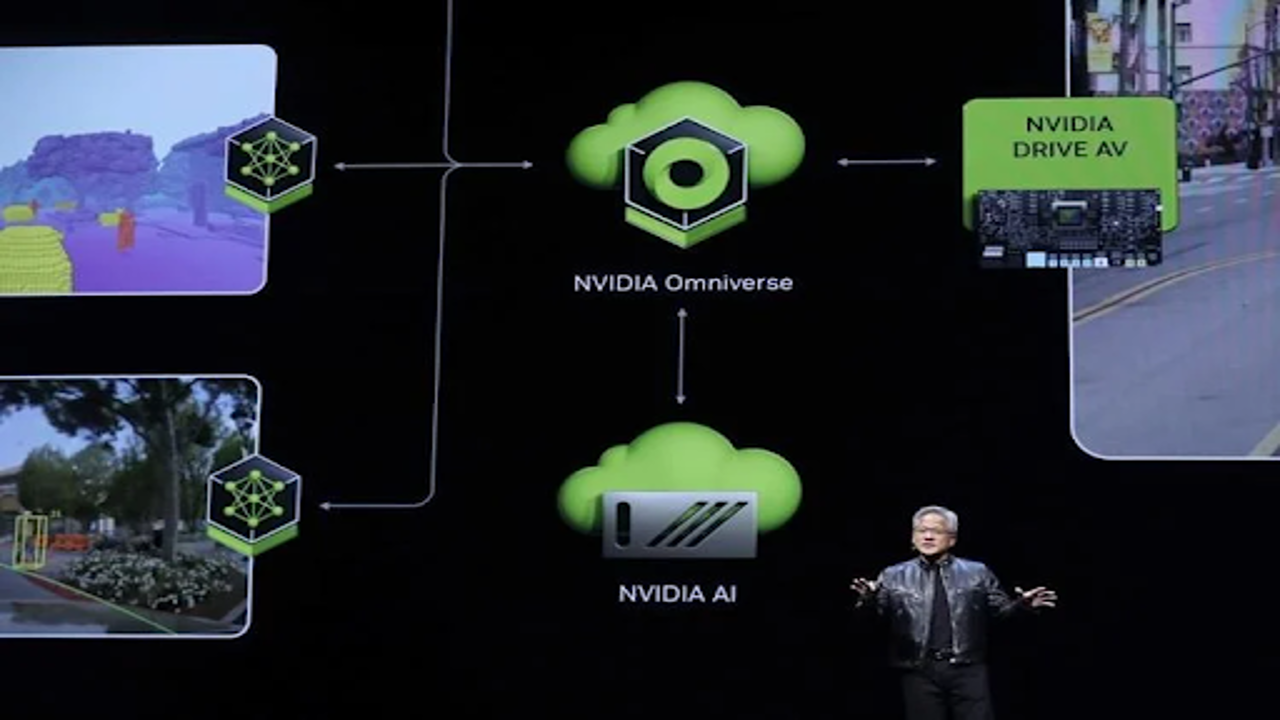

Nvidia has become one of the stock market's giants, largely due to its leadership in the AI sector. Tech companies are heavily investing in Nvidia’s chips and data centers, which are essential for training and running AI systems. "Investing in Nvidia infrastructure is providing immediate returns," said Jensen Huang, Nvidia’s founder and CEO, during a call with analysts. "It’s the best investment you can make in computing infrastructure today."

The growing demand for generative AI tools that create documents, images, and personal assistants has significantly boosted sales of Nvidia’s specialized chips over the past year. In June, Nvidia briefly became the most valuable company in the S&P 500, with a market value now exceeding $3 trillion.

Nvidia's CFO, Colette Kress, announced plans to ramp up production of its Blackwell AI chips starting in the fourth quarter, continuing through fiscal 2026. She projected that Blackwell could generate several billion dollars in revenue by the fourth quarter, with an increase in shipments of the Hopper graphics processor unit expected in the second half of fiscal 2025.

Jensen Huang expressed confidence about the company’s future, predicting another strong year ahead. Nvidia's stock price has already surged nearly 150% in the first half of the year, trading at over 100 times the company’s earnings over the last 12 months. Analysts caution, however, that any sign of slowing AI demand could lead to a selloff.

Dan Ives, an analyst at Wedbush Securities, described Nvidia's earnings as part of a "historic rise," attributing much of the success to Jensen Huang, whom he dubbed the "godfather of AI." While some analysts had expected slightly higher revenue projections, Ives believes the demand for AI is only accelerating. He views the earnings as a positive force for the market, despite any short-term concerns from investors.