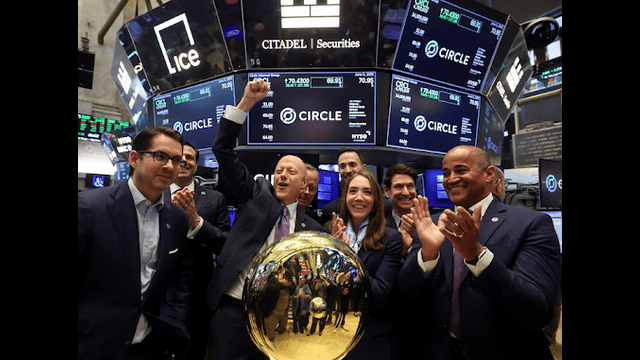

Jeremy Allaire, the Co-Founder, Chairman, and CEO of Circle, is seen talking with specialist Peter Giacchi on the floor of the New York Stock Exchange just before the company’s IPO began on Thursday, June 5, 2025. (AP Photo/Richard Drew)

On Thursday, Canada’s main stock market managed a small upward move while major U.S. indexes dipped. Investors faced a day filled with unpredictable headlines, including tense global trade updates and a heated online clash between U.S. President Donald Trump and Tesla CEO Elon Musk.

The S&P/TSX composite index rose by 13.29 points, closing at 26,342.29. This came just a day after the U.S. hiked tariffs on steel and aluminum imports. While such policies often send shockwaves through the markets, Canadian stocks remained largely steady.

Macan Nia, co-chief investment strategist at Manulife Investment Management, explained that Canadian markets weren’t rattled by the tariff news. “The TSX hasn’t been deeply shaken by the recent tariff talks,” he said. “Things in trade have shifted so often that nothing feels permanent anymore.”

U.S. markets, however, painted a more dramatic picture. The Dow Jones Industrial Average dropped 108 points to 42,319.74. The S&P 500 fell 31.51 points to 5,939.30, and the Nasdaq took the biggest hit, down 162.04 points to 19,298.45—largely due to Tesla stock plunging over 14%. The decline followed a public fallout between Trump and Musk, souring investor confidence and wiping out early tech gains.

Alongside political drama, U.S. investors processed weak labor data. A rise in jobless claims followed Wednesday’s lackluster employment report, leading to uncertainty about the health of the job market. Investors are now turning their focus to Friday’s economic updates, hoping for clarity on whether the soft sentiment is finally catching up with the harder economic numbers.

Nia emphasized that this is a moment of truth for investors. “People want to know if these negative signals are actually showing up in real data,” he said. “And honestly, we’re starting to see cracks.”

In Canada, April’s trade deficit hit a record $7.1 billion. Though worrisome, it didn’t come as a shock given the ongoing turbulence in global trade. Despite this, the Canadian dollar ticked upward to 73.21 cents US, slightly up from Wednesday’s 73.12 cents.

What’s behind the loonie’s rise? Nia pointed to market expectations that the U.S. Federal Reserve might hike rates more aggressively than the Bank of Canada in the months ahead. “We’re skeptical,” he added. “Canada’s economic foundation looks shakier than America’s.”

Commodity markets also saw mixed action. Oil prices climbed, with July crude up 52 cents to US$63.37 per barrel. However, natural gas slipped four cents to US$3.68 per mmBTU. Gold prices tumbled by US$24.10 to US$3,375.10 an ounce, while copper gained four cents, closing at US$4.93 per pound.

As the week wraps up, all eyes are on upcoming economic data that could either ease or heighten fears about where North American markets are headed next.