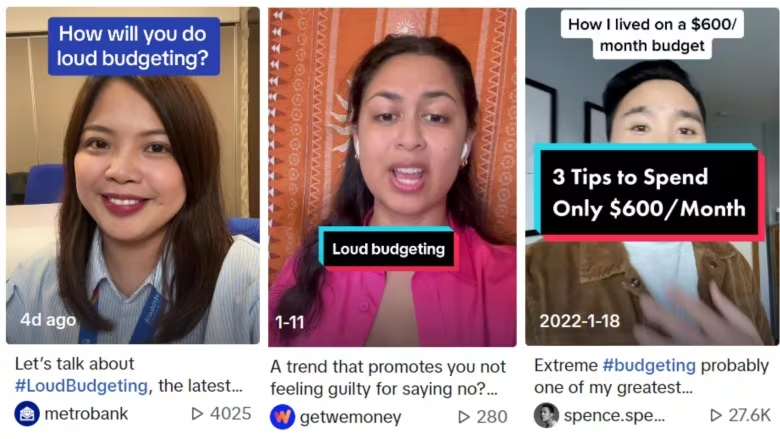

Loud budgeting has taken TikTok by storm. Social media users describe it as a trend where people are open and honest about their finances in an attempt to create accountability and empowerment. (Illustration: CBC News Photos: metrobank/TikTok, getwemoney/TikTok, spence.spends/TikTok)

In the realm of personal finance on TikTok, a new trend called "loud budgeting" is gaining traction, swiftly surpassing previous trends like "girl math" and "quiet luxury." Originating from a video by TikToker Lukas Battle, the concept involves individuals openly discussing and sharing details about their finances, aiming to foster accountability and empowerment. The hashtag #loudbudgeting has garnered over 10 million views on TikTok within just three weeks of the new year.

Understanding Loud Budgeting:

Loud budgeting, as the name suggests, centers on being vocal about one's financial situation and expenditures, promoting financial accountability. Lukas Battle distinguishes it as the antithesis of "quiet luxury," a trend from the previous year that emphasized subtle displays of wealth through high-quality, logo-less products. Zainab Williams, a certified financial planner with Elleverity Wealth Management, highlights the trend's essence—encouraging individuals to advocate for themselves, especially in challenging financial circumstances.

The surge in interest in loud budgeting coincides with a heightened awareness of rising costs among Canadians. The country's annual inflation rate reached 3.4 percent in December, with key contributors being airfares, fuel, passenger vehicles, and rent. The trend resonates with many, particularly the younger demographic, as a response to the current economic climate.

Realistic Approaches:

While loud budgeting may seem like a novel trend, some individuals, like Canadian content creator Reilly O'Connor, have long incorporated it into their lives. O'Connor, also an early childhood educator, shares practical aspects of her life on TikTok, emphasizing budgeting for basic living necessities. Her approach includes couponing, seeking grocery deals, reducing restaurant outings, and canceling her gym membership. O'Connor finds that being open about her financial status not only leads to tangible savings but also empowers her and reduces the pressure of comparison.

Empowerment and Accountability:

According to Zainab Williams, loud budgeting has the potential to empower individuals by exposing them to diverse financial ideas and strategies. Social media platforms like TikTok serve as spaces where people can share financial tips and experiences, creating a supportive online community. However, Williams advises caution, noting that while such trends can be beneficial, individuals should remain true to themselves and not succumb to external pressures.

Online Finance Trends:

Loud budgeting is not the first financial trend to gain popularity on social media. Trends like "girl math" and "quiet luxury" have previously dominated discussions on money matters. The impact of participating in such trends varies based on personal comfort levels, as money is a deeply personal and emotional subject. Williams emphasizes the importance of being discerning about online content consumption and evaluating its potential long-term impact.

In essence, loud budgeting on TikTok serves as a dynamic response to economic challenges, encouraging transparency and conversation around personal finances in an era of rising prices.