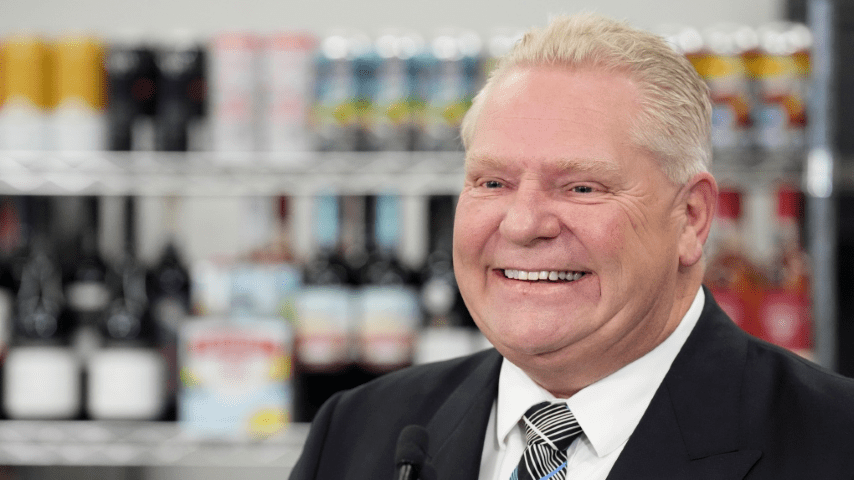

On Thursday, December 14, 2023, Ontario Premier Doug Ford participates in a media session at a convenience store located in Toronto. (The Canadian Press/Chris Young)

Ontario's Premier Doug Ford revealed plans on Thursday to permit the sale of beer, wine, cider, and ready-to-drink cocktails in convenience stores and all grocery outlets in the province by 2026. This initiative, hailed as one of the most significant transformations in alcohol sales history within Ontario, would position the province as the second in Canada to offer beer in corner stores, following Quebec's lead. Additionally, Ontario would become the first to provide ready-to-drink cocktails in these retail locations.

Ford emphasized that this expansion in the marketplace would grant residents more options, convenience, and time. He articulated this move as a step toward treating the public as responsible adults.

The decision aligns with a promise made by Ford during the 2018 election and marks the government's second endeavor to introduce beer and wine sales in corner stores. A prior attempt involved legislation to terminate an agreement with the Beer Store, which did not come into effect.

The current agreement allowed beer and wine sales expansion to a maximum of 450 grocery stores across Ontario, with the Beer Store maintaining exclusive rights to sell 12- and 24-packs of beer. The government announced the termination of this deal and its terms, scheduled to cease in 2025.

Under Ford's proposed plan, various retail outlets, encompassing approximately 6,700 convenience stores and 1,800 grocery stores, will gain autonomy in setting their prices. Presently, all retail stores adhere to pricing stipulated by the Liquor Control Board of Ontario.

To support smaller beer and wine producers, certain portions of shelf space in retail outlets will be dedicated to their products.

Despite the changes, the Beer Store will retain a principal role in beer distribution and continue managing its recycling program for the next five years. Beyond this period, no definitive commitments have been established.

Upon implementation, Ontario is poised to possess the third-highest density of alcohol retail stores in Canada, a significant increase from its current status as the province with the fewest such outlets.

The government aims to augment funding for social responsibility initiatives, although the precise amount remains undisclosed.

However, concerns regarding the potential health implications have surfaced. The Ontario Public Health Association cautioned earlier this year about the adverse effects of expanding alcohol sales, citing increased consumption and related harm when alcohol becomes more affordable and accessible.

Echoing these concerns, the Canadian Centre on Substance Use and Addiction highlighted the health risks associated with alcohol consumption, stating that consuming over two drinks per week poses a moderate health risk due to alcohol's link to cancer.

As part of the modernization efforts, the government announced intentions to introduce legislation that would eliminate a 6.1 percent basic tax on all on-site retail sales of 100 percent Ontario wines, addressing a longstanding industry request.