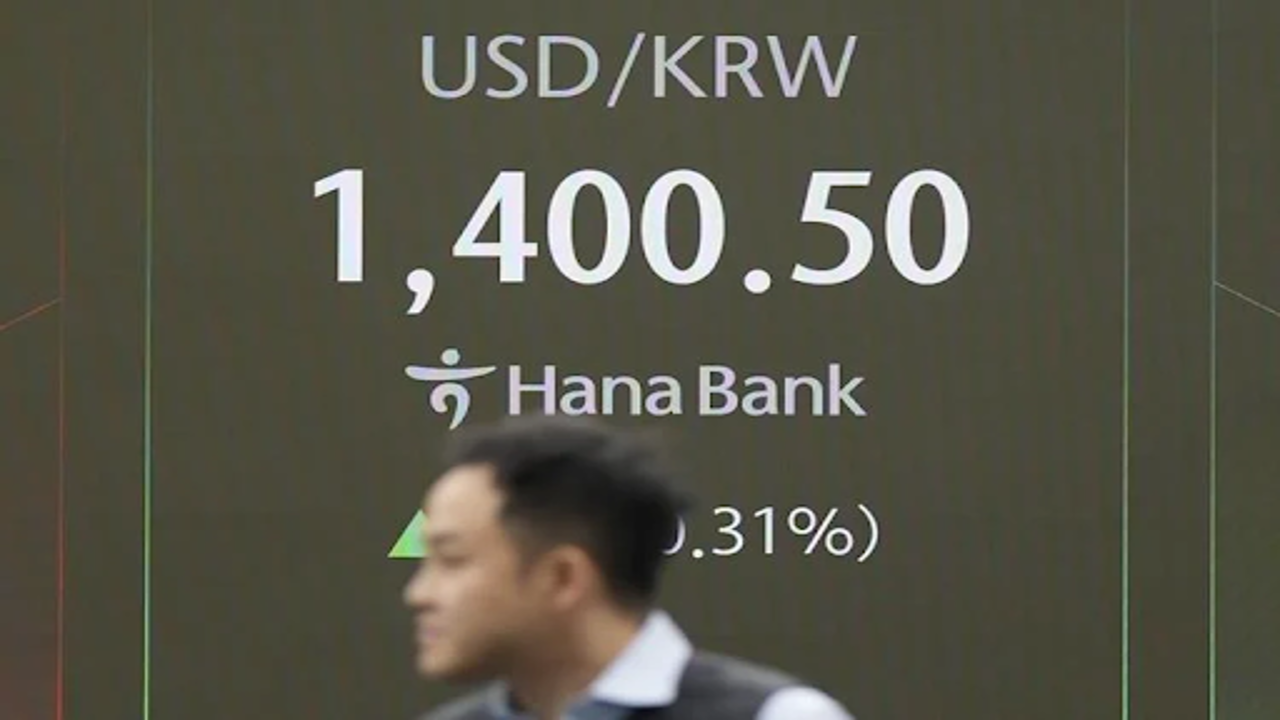

In the image foreign exchange rate between the U.S. dollar and South Korean won at the foreign exchange deal room in Seoul.(AP Photo)

Asian shares bounced back Thursday after an initial dip, following record highs in U.S. stocks as investors speculate about the economic impact of a potential return of Donald Trump to the White House.

Markets are also awaiting a decision on U.S. interest rates from the Federal Reserve, expected later in the day.

Japan's Nikkei 225 slipped 0.1% to 39,458.86, while South Korea's Kospi rose 0.5% to 2,576.30. In Australia, the S&P/ASX 200 edged up 0.1% to 8,204.80. Chinese stocks also showed gains, with Hong Kong’s Hang Seng increasing by 0.9% to 20,729.01 and the Shanghai Composite rising 0.9% to 3,413.47.

Trump has pledged to impose a blanket 60% tariff on Chinese imports, and possibly even more if China escalates tensions with Taiwan. Investors are responding to what Trump’s trade policies—combined with potential tax cuts and reduced regulations—might mean for the economy. Increased tariffs could add to China’s economic strain, as Beijing grapples with slower growth.

Higher tariffs on goods from China and other countries could risk trade conflicts and disrupt the global economy. However, Trump's potential policies have sparked expectations that China may respond with economic stimulus. China’s legislature is meeting this week and may announce new measures by Friday.

U.S. markets saw significant gains on Wednesday, as sectors like banking and technology, including Tesla and bitcoin, surged amid investor anticipation of Trump’s possible policy impacts. The S&P 500 climbed 2.5% to 5,929.04, marking its best day in nearly two years, while the Dow Jones gained 3.6% to 43,729.93, and the Nasdaq jumped 3% to 18,983.47—breaking recent record highs.

Much of Trump's influence on the economy will depend on whether Republicans gain control of Congress. If they do, investors anticipate that Trump's policies could drive economic growth. However, his proposed tax cuts might also push up the U.S. deficit, increasing Treasury yields. On Wednesday, the 10-year Treasury yield rose to 4.43% from 4.29% the previous day.

Trump’s proposed tariffs are expected to add to inflation pressures, raising costs for American households. Limiting immigration could also create labor shortages, prompting companies to raise wages and further driving up prices.

This year’s stock market rally has largely been based on expectations of Federal Reserve interest rate cuts, as inflation has moved closer to the Fed's 2% target. Lower rates typically stimulate the economy but may also keep inflation fueled. The Fed’s latest rate decision is due Thursday, with markets expecting a cut, though future rate cut predictions have tempered.

Early Thursday, the U.S. dollar weakened slightly against the yen, while the euro rose to $1.0740. U.S. crude oil climbed 45 cents to $72.14 per barrel, and Brent crude gained 55 cents to $75.47. Bitcoin eased to $75,780 after hitting an all-time high of over $76,480 on Wednesday. Trump has vowed to make the U.S. a global crypto leader and establish a "strategic reserve" of bitcoin.