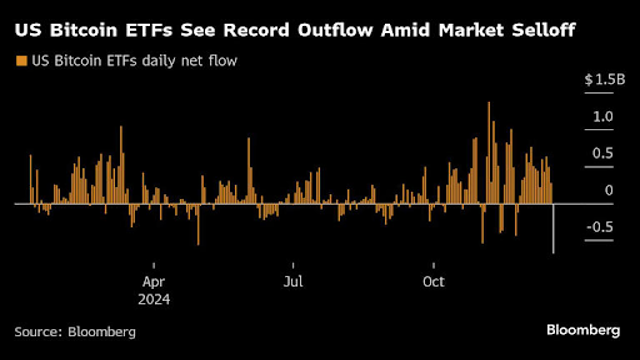

Bitcoin-focused ETFs in the US experience significant withdrawals as investors respond to the market downturns.

Bitcoin has hit a rough patch, facing its first weekly drop in nearly two months as hawkish signals from the Federal Reserve dampened enthusiasm. After an extraordinary rise this year, the cryptocurrency fell 5.3% on Friday, slipping from its record high of $108,000 earlier this week to around $97,400 by late trading in New York. This downturn has rippled across smaller cryptocurrencies like Ether and Dogecoin, even as the US stock market remains strong.

Adding to the bearish sentiment, Bitcoin-focused exchange-traded funds (ETFs) saw a record $680 million outflow on Thursday, snapping a 15-day streak of consistent inflows. Analysts suggest this marks a significant shift in market sentiment, with traders stepping back after an overly optimistic rally spurred by Donald Trump’s unexpected win in the US presidential election.

According to QCP Capital, the market’s heightened optimism left cryptocurrencies vulnerable to the Federal Reserve’s renewed commitment to controlling inflation. This shift in tone has sent traders into a cautious mode, reflecting fears of tightened monetary policy and its potential impact on digital assets.

The uncertainty comes at a sensitive time. President-elect Trump’s hardline stance on international trade—threatening tariffs against both allies and adversaries—adds to market jitters. As the Fed slows the pace of monetary easing, the focus now turns to how quickly traditional financial institutions will embrace cryptocurrencies.

Hani Abuagla, senior market analyst at XTB, highlighted the complex interplay of factors driving Bitcoin’s volatility. “Monetary policy, institutional adoption, and political developments will keep Bitcoin highly sensitive to both macroeconomic and crypto-specific events through 2025,” he noted.

Despite recent losses, activity in Bitcoin futures remains robust. Open interest at the CME Group hit near-record levels earlier this week but has since tapered off. Analysts like Chris Weston from Pepperstone Group urge caution, noting that the bullish momentum has waned while a price collapse isn’t imminent. “The buyers have clearly lost their grip, and the market is showing signs of exhaustion,” Weston observed.

The cryptocurrency market faces an uphill battle as the holiday season approaches, navigating a delicate balance between economic shifts and investor sentiment. While long-term prospects for digital assets remain strong, near-term volatility could keep traders on edge.