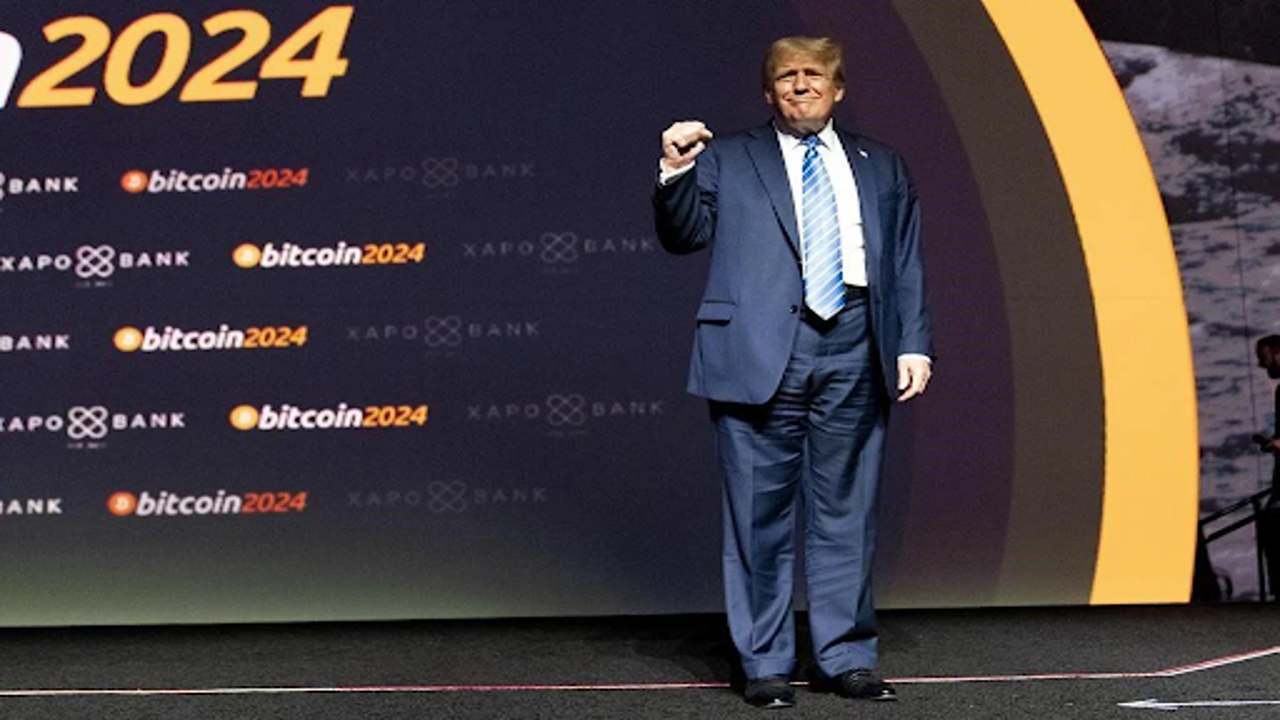

Republican presidential candidate former President Donald Trump arrives to speak at the Bitcoin 2024 conference, Saturday, July 27, 2024, in Nashville, Tenn. (AP Photo/Alex Brandon)

Bitcoin has soared to a new record, surpassing $87,000 following Donald Trump’s recent presidential election victory. The cryptocurrency’s rapid rise, jumping over 28% in the last week alone, reflects a surge of optimism across crypto markets, with many investors betting on a more crypto-friendly political climate under Trump’s administration. As of 3:45 p.m. ET on Monday, bitcoin’s price hit $87,083, according to CoinDesk.

Trump's campaign and crypto-focused promises have fueled investor enthusiasm, with many in the crypto industry anticipating regulatory changes that could benefit the sector. Throughout his campaign, Trump committed to making the U.S. a global crypto hub, even pledging to create a “strategic reserve” of bitcoin. His administration could bring regulatory clarity, potentially allowing for broader adoption and reducing some of the uncertainties that have kept investors wary. Additionally, his plans to remove Gary Gensler, the current SEC chair known for his strict stance on crypto regulation, could signal a shift toward a more accommodating regulatory landscape.

Since Election Day, cryptocurrencies have rallied significantly, with Citi analysts David Glass and Alex Saunders attributing this trend to growing confidence that Trump’s win could reshape crypto regulation in favor of industry growth. They noted that sentiment around Trump’s supportive stance for crypto was a major driver, leading to increased inflows into crypto assets and related exchange-traded funds (ETFs). In particular, the launch of spot bitcoin ETFs, a recent development in crypto investment, has played a significant role in bitcoin’s performance. Spot ETFs allow investors to gain exposure to bitcoin without directly buying it, a format that has seen strong demand since its approval by U.S. regulators.

However, while the rally has energized many investors, experts continue to caution about the risks of such volatile assets. Bitcoin and other cryptocurrencies are notorious for their sharp price swings, which can occur at any time. The past few years have seen both extreme highs and lows, with bitcoin initially rising during the pandemic but later experiencing dramatic declines amid Federal Reserve rate hikes and the 2022 collapse of the crypto exchange FTX. Such history serves as a reminder of crypto’s unpredictability. Financial experts advise that only money investors can afford to lose should be directed into crypto assets, as gains can disappear just as quickly as they arrive.

Bitcoin’s environmental impact remains a point of concern as well. The energy-intensive process of bitcoin “mining” requires vast amounts of electricity, often generated from fossil fuels. A United Nations study reported that bitcoin mining’s carbon footprint in 2020-2021 matched the emissions of burning 84 billion pounds of coal. In the U.S., the Energy Information Administration has raised concerns about increased electricity demand from crypto mining, estimating that it may account for up to 2.3% of national power consumption. Although there has been a shift toward cleaner energy sources for mining, significant reliance on coal and natural gas continues, making bitcoin’s sustainability an ongoing issue for the industry.

As bitcoin and other cryptocurrencies continue to captivate the market, investors and industry analysts alike will be watching closely to see how Trump’s presidency influences regulatory changes and how these impact the long-term trajectory of the crypto sector.