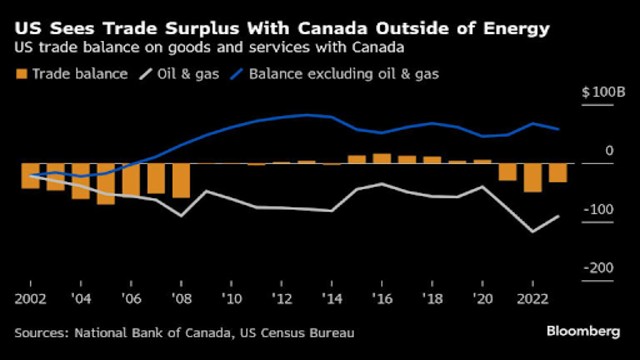

Excluding energy, the U.S. now exports more to Canada than it imports.

Canada is facing a major economic crisis after former U.S. President Donald Trump imposed hefty tariffs on Canadian imports. The move, which includes a 25% tariff on nearly all goods and a 10% duty on energy, has triggered an intense response from Prime Minister Justin Trudeau.

On a freezing night in Ottawa, Trudeau announced retaliatory measures, stating that Canada had no option but to act. Beginning Tuesday, a 25% counter-tariff will be placed on $107 billion worth of American goods. The first phase will impact $30 billion in products, including orange juice, wine, coffee, motorcycles, peanut butter, and cosmetics. A larger wave of tariffs on U.S. exports, such as cars, steel, beef, and aluminum, will follow after a 21-day consultation period.

Addressing Americans directly, Trudeau reminded them of Canada’s unwavering support during historical conflicts. He stressed that the best path for both countries is cooperation, not economic warfare. “We’ve stood with you through history’s darkest times. This is not how allies treat each other,” he said.

The Justification and Fallout

Trump justified the tariffs using emergency powers, citing Canada and Mexico’s insufficient crackdown on fentanyl trafficking. By invoking an emergency declaration, he bypassed trade rules under the U.S.-Mexico-Canada Agreement (USMCA), a deal he once celebrated as a victory. His order also warns of even harsher penalties if Canada retaliates.

Despite this threat, Trudeau affirmed that Canada’s response would be measured but firm. Some officials considered imposing levies on oil and gas, but concerns over dividing the country led to a more balanced approach. Instead, the government is exploring restrictions on critical minerals—resources the U.S. heavily depends on.

In a bold move, Trudeau urged Canadians to buy local and reconsider travel plans to the U.S. “Let’s invest in our own economy,” he stated. He reassured citizens that his administration would support them through these economic hardships without recalling Parliament, which remains suspended until March.

Provinces Take Action

Across Canada, provincial leaders are adopting their own countermeasures. British Columbia Premier David Eby ordered government liquor stores to stop selling certain U.S. alcohol brands from Republican-led states. Quebec Premier François Legault initiated a review of all U.S. suppliers working with his government, seeking ways to reduce reliance on American goods. Ontario’s Doug Ford warned that Trump’s tariffs could devastate the province’s economy, particularly its automotive sector, which is deeply linked to U.S. manufacturing.

Industry and Political Backlash

Business leaders expressed alarm over the economic impact. The Canadian Chamber of Commerce called Trump’s move “profoundly disturbing,” predicting skyrocketing prices. Linda Hasenfratz, a top executive in the auto industry, warned of collapsing markets, job losses, and supply chain disruptions. “This will be felt immediately,” she said.

Meanwhile, Conservative Party leader Pierre Poilievre called for an aggressive “Canada First” policy. He proposed that tariff revenues be used to support workers, cut taxes, and strengthen trade and energy infrastructure.

As tensions rise, industry leaders fear higher costs and economic instability. A British Columbia lumber association warned that Trump’s actions would increase U.S. building costs, worsening affordability issues. Alberta Premier Danielle Smith, however, welcomed the lower 10% tariff on energy, arguing that it softened the economic blow.

The coming weeks will reveal whether Canada’s countermeasures will force the U.S. to rethink its aggressive stance or push both countries into a deeper trade war.