Statistics Canada (Graeme Bruce/CBC)

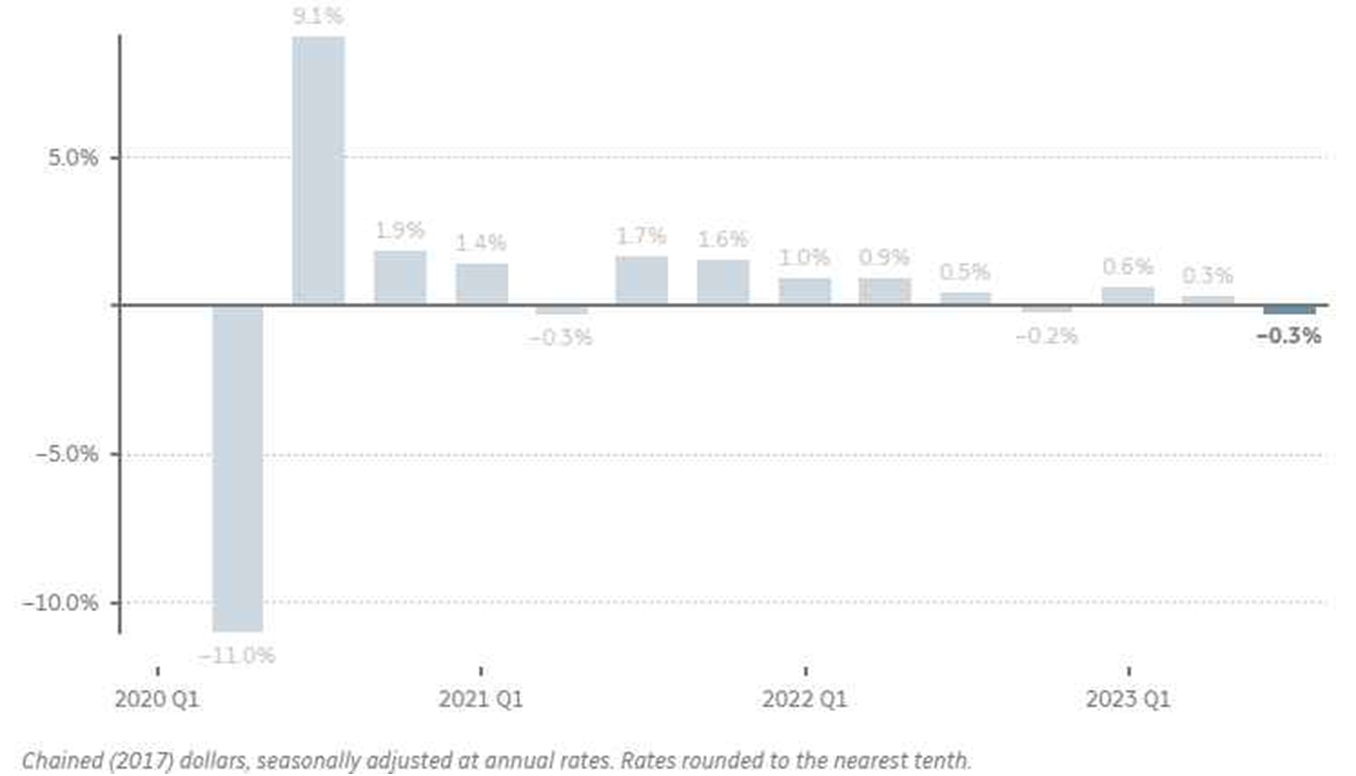

Canada's economy faced a setback in the third quarter of the year, experiencing a contraction of 0.3%, as reported by Statistics Canada. The decline was attributed to stagnant household spending and a drop in exports.

According to the data released on Thursday, exports saw a decline of 1.3%, and imports also dipped by 0.2%. Household spending remained flat for the second consecutive quarter. Notably, housing investment, which had seen five consecutive quarterly declines, witnessed a two percent increase in the quarter.

GDP in Canada

Quarterly change in real gross domestic product

The recent figures mark the second consecutive quarterly contraction, leading some experts to suggest the possibility of a recession. However, the data agency revised the numbers for the April-to-June period, indicating a growth of 0.3% in that quarter. This upward revision prompted economists like Doug Porter from the Bank of Montreal to caution against premature recessionary discussions. Regardless, he highlighted that the broader picture reveals an economy struggling to expand, even with the boost from rapid population growth.

"The big picture is that the Canadian economy is struggling to grow, yet managing to just keep its head above recession waters," Porter stated.

The subdued GDP numbers make it increasingly likely that the Bank of Canada will refrain from raising interest rates in the near future, starting with its upcoming policy decision next week. Derek Holt, an economist with Scotiabank, emphasized that the headline contraction might be misleading, attributing much of the weakness to short-term factors.

"Half the country was literally on fire over the summer, and those wildfires disrupted a broad cross-section of economic activity from shut mines and petrochemical facilities to agriculture, forestry, and tourism under the warm glow of orange skies," Holt explained.

Despite the challenging economic scenario, Holt sees no clear evidence of a recession taking hold. He suggested that those predicting a recession might need to reevaluate their stance, and the Bank of Canada is unlikely to consider easing policies based on the current data.

While Canada grapples with economic challenges, experts caution against premature recession claims, emphasizing the influence of short-term disruptions on the overall economic landscape. The subdued growth also points towards a cautious stance from the Bank of Canada in terms of interest rate adjustments.