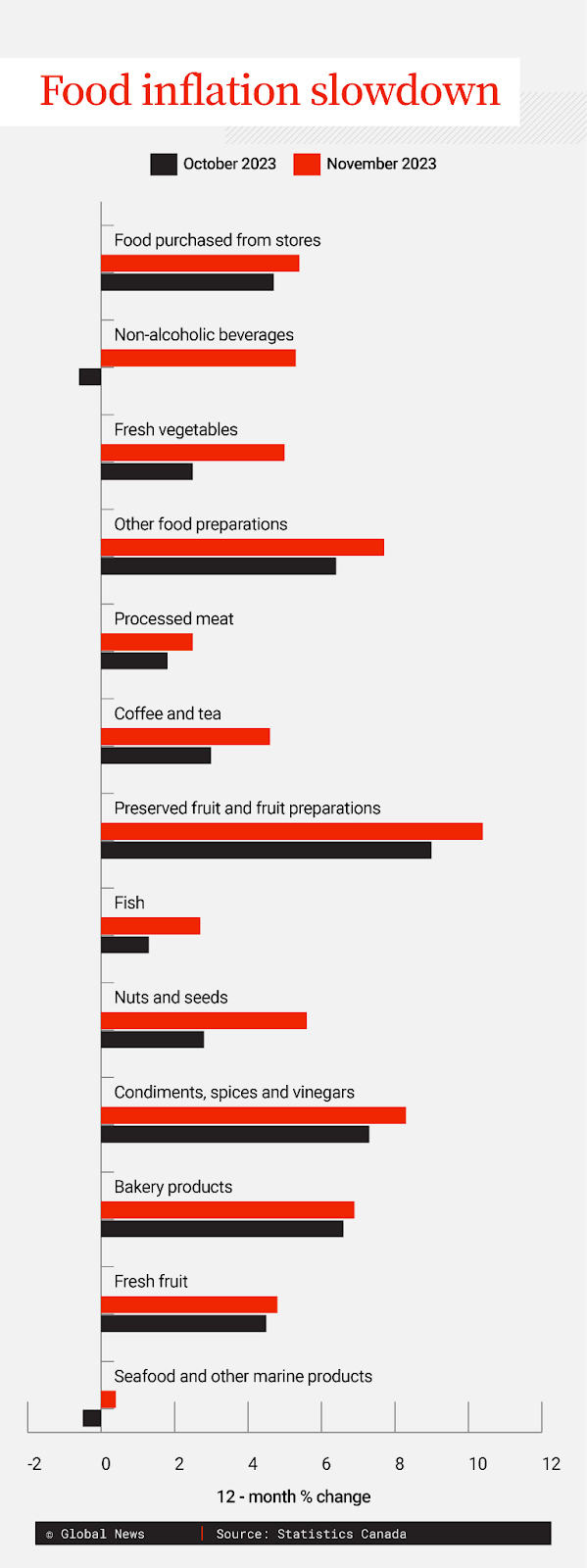

Food inflation cooled in November across the basket of goods tracked by Statistics Canada. Statistics Canada / Global News

Canada witnessed a noticeable ease in the upward trajectory of grocery prices, signaling a slowdown in food inflation, as per Statistics Canada's recent observations. However, while the annual inflation rate stabilizes at 3.1%, the nation continues to grapple with escalating costs at the grocery stores, hinting at an enduring financial strain for consumers during the festive season.

In November, the country experienced a consistent decrease in the rise of grocery prices for the fifth consecutive month. Statistics Canada's data reveals a 4.7% annual increase in grocery prices, with a notable decline in price surges across various components of the shopping basket compared to October. Notably, fresh vegetables, processed meat, and fish registered significant reductions, while non-alcoholic beverages saw an overall price decline.

Despite the apparent annual moderation in food inflation, University of Guelph food economist Mike von Massow cautions that consumers might not feel immediate relief in their wallets. Von Massow highlights that though the monthly changes might appear minor, the reality at grocery stores tells a different story. Prices for fresh vegetables surged by 7.4% from October to November due to factors like shipping costs in U.S. dollars, affecting imports from outside the country.

As the holiday season approaches, households preparing for festive feasts might find some staple items like turkey and potatoes within manageable price ranges. However, the cost of fresh greens and produce could witness continued hikes, contributing to a persistent financial pinch for shoppers during Christmas, akin to the previous years.

Global supply chain disruptions due to ongoing attacks on ships in the Red Sea, a significant trade route, pose additional risks. While immediate impacts on Canadian grocery shoppers might not be felt directly, the ripple effect from rising global oil prices could eventually translate into increased food shipping costs and, subsequently, consumer expenses.

Looking ahead, projections from the 2024 Food Price Report suggest a continued rise in costs, albeit at a slower pace compared to previous years. As Canadians anticipate increased grocery expenses, strategies to cope with higher prices, such as leveraging sales and planning meals meticulously to reduce waste, are gaining traction.

Despite a recent slowdown in inflation and positive signs for the economy, economists advise that sustained relief for consumers may only materialize with concurrent wage increases, alleviating the enduring strain posed by elevated food inflation and rising overall household expenses.

The Bank of Canada, monitoring these economic shifts closely, has maintained a stable key interest rate at five per cent. While recent inflation data may appear encouraging, economists remain vigilant about potential inflationary pressures in the coming months and anticipate a cautious approach towards interest rate adjustments.