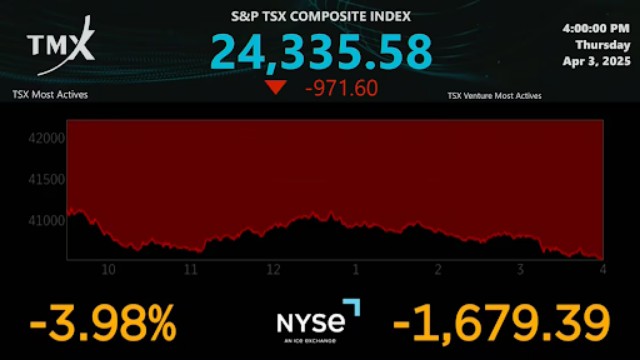

The S&P/TSX composite index display at the TMX Market Centre in downtown Toronto is shown at 4:00 p.m. on Thursday, April 3, 2025.

Wall Street was rocked on Thursday as stock markets worldwide plunged, echoing the chaos last seen during the early days of the COVID-19 pandemic. The sharp decline followed U.S. President Donald Trump’s unexpected announcement of sweeping tariffs on global imports, a move that rattled investors and triggered fears of an economic downturn.

The S&P 500 dropped 4.8%, marking its worst day since 2020. The Dow Jones Industrial Average sank 1,679 points or 4%, and the tech-heavy Nasdaq nosedived 6%. The fallout wasn’t limited to the U.S.—major stock markets across Asia and Europe followed suit, posting heavy losses.

Investors had braced for a new set of tariffs, but the scale and severity of Trump’s decision took them by surprise. A minimum 10% tariff was slapped on all imports, with steeper rates for goods from China and the European Union. Analysts at UBS warned that the new tariffs could reduce U.S. economic growth by 2% this year and push inflation close to 5%.

The tariffs hit nearly every corner of the market. Oil prices fell. Major tech stocks stumbled. Even gold, usually seen as a safe investment in uncertain times, lost ground. Small-cap U.S. companies bore the brunt of the shock, with the Russell 2000 index dropping 6.6%, now more than 20% below its peak.

Trump framed the tariffs as part of a long-term plan to bring back manufacturing jobs to the U.S.—a process experts say could take years and bring significant short-term pain. Many on Wall Street had hoped the tariffs were just a tactic in trade negotiations, but Trump’s tone suggested a firmer stance.

Sean Sun, portfolio manager at Thornburg Investment Management, warned that the markets might still be underestimating the broader impact of the tariffs. He noted that if the measures stick, more severe losses could be ahead.

Despite the market turmoil, Trump brushed off concerns. Speaking before leaving for Florida, he compared the tariffs to surgery: “It’s like when a patient is operated on. It’s big. I said this would happen.”

Amid the economic tension, all eyes turned to the Federal Reserve. The central bank may consider cutting interest rates to support growth, as it did before pausing in 2025. Lower rates could help businesses and consumers manage borrowing costs—but they also risk adding fuel to inflation.

Yields on government bonds dropped sharply. The 10-year Treasury yield fell to 4.04%, signalling growing fears about the economy’s health and expectations for rate cuts.

The U.S. economy, for now, is still expanding. Jobless claims remained low, and some service industries continued to grow, albeit at a slower pace. However, consumer-facing businesses are already feeling the strain. Best Buy shares dropped 17.8%, United Airlines fell 15.6%, and Target lost 10.9%, all reflecting growing unease among shoppers and travellers.

Across the globe, markets mirrored the U.S. downturn. France’s CAC 40 slid 3.3%, Germany’s DAX lost 3%, and Japan’s Nikkei fell 2.8%. Hong Kong and South Korea also saw sharp declines.