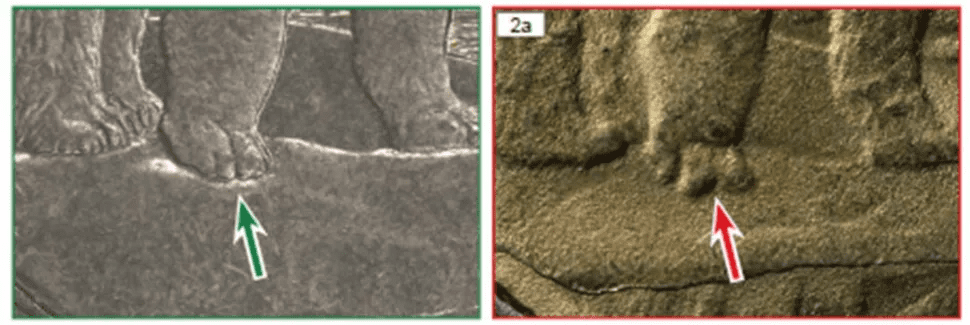

Exclusive: A side-by-side comparison reveals the authentic coin on the left and the fraudulent one on the right. The legitimate version showcases intricate details of the bear's paws. In contrast, the fake coin displays a distorted polar bear's paw, resembling camel toes. RCMP is investigating.

In a recent revelation, a 69-year-old man from Richmond Hill, Ontario, quietly pleaded guilty to possession and fraudulent use of thousands of counterfeit $2 coins, commonly known as Toonies, resulting in a hefty $100,000 fine. This unsuspecting individual, Daixiong He, admitted guilt during a brief court appearance in Newmarket on December 9, 2022.

His guilty plea stems from his involvement in injecting thousands of fake Toonies into Canada’s banking system through substantial deposits into personal accounts at BMO, HSBC, and RBC. Despite facing a maximum sentence of 14 years in jail, Mr. He received no prison time but was fined $100,000 by Ontario General Court Justice Amit Ghosh.

The charges against him, under sections 452(a) and 450(b) of the Criminal Code, were for 'uttering and possessing' counterfeit $2 coins between January 4, 2021, and November 12, 2021, "without lawful justification or excuse." The second charge of possessing fake Toonies was stayed after he paid his fine via electronic bank draft.

This case came to light after a meticulous investigation by the RCMP’s Trans-National Serious and Organized Crime unit in Toronto, led by Supt. Ann Koenig, with collaboration from Fintrac, the federal government’s financial intelligence agency. Mr. He's arrest in May 2022 was a culmination of a surge of fake Toonies circulating in Greater Toronto during the summer of 2020.

The counterfeit $2 coins at the heart of this scheme earned the moniker "Camel Toe Toonies" due to the distinctive oversized toes on the polar bear’s right paw. Richmond Hill defense attorney Thomas Richards, representing Mr. He, acknowledged his client's possession of a significant number of fake Toonies but refrained from specifying the quantity. He stated that Mr. He had divested himself of these counterfeit coins a few months before his arrest.

The RCMP investigation revealed that up to 40,000 fake Toonies had been injected into the Canadian banking system through deposits at three Toronto-area banks—RBC, HSBC, and BMO. The probe commenced in July 2021 after the Royal Canadian Mint identified a high level of fakes during statistical sampling of large coin shipments.

Notably, Mr. He made several large deposits of counterfeit two-dollar coins between January 4, 2021, and November 12, 2021, totaling around $80,000 or approximately 40,000 fake Toonies. He deposited these counterfeit coins at various locations, including an RBC account on July 26, 2021, an HSBC account on October 2, 2021, and a BMO account on November 12, 2021.

Despite the extensive scale of the counterfeit operation, Mr. He did not admit to creating the "Camel Toe Toonies." Instead, he acknowledged that, due to undisclosed circumstances surrounding how he obtained the coins, he should have exercised more caution before depositing them. He was found to be willfully blind when using the counterfeit money.

Interestingly, there is a second person of interest in this case, who managed to evade a deportation attempt. According to Mr. Richards, this individual, although known to the police as a criminal, remains at large in Canada due to the expiration of their passport, rendering them unremovable by the Canada Border Services Agency.

As this intriguing saga unfolds, it sheds light on the complexities of counterfeit operations and the challenges faced by law enforcement agencies in apprehending those involved. The "Camel Toe Toonies" case stands as a testament to the collaborative efforts of investigative units, highlighting the need for vigilance in safeguarding the integrity of the Canadian currency.