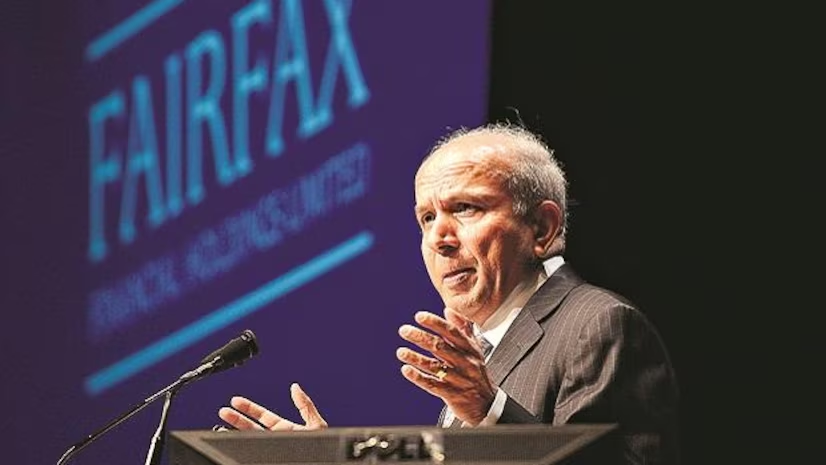

Prem Watsa, chief executive at Fairfax Financial/staff from Business Standard

Fairfax, under the leadership of Canadian billionaire Prem Watsa, has re-entered the bidding process for the acquisition of IDBI Bank. According to a report by Hindu Businessline (HBL), Fairfax has presented an improved proposal for an all-cash acquisition deal. This revised offer was communicated to government officials approximately two weeks ago.

The new offer from Fairfax not only includes an all-cash payment plan for acquiring IDBI Bank but also includes a commitment from Watsa to preserve the bank's identity post-acquisition.

The disinvestment process of IDBI Bank commenced in October 2022, with the Life Insurance Corporation of India (LIC) and the government selling 30.24% and 30.48% stakes, respectively, in the bank.

According to the HBL report, the inclusion of an all-cash component in the deal could give Fairfax a competitive advantage, as many previous bidders have shown reluctance to accept this form of compensation.

The revised offer from Fairfax introduces new conditions compared to its previous proposal. Initially, Fairfax intended to maintain IDBI Bank as a standalone entity for a few years before merging it with CSB Bank. However, concerns were raised about IDBI Bank losing its distinct identity in the merger. Under the updated offer, Fairfax India Holding, the Indian arm of the private equity firm, would submit a bid for IDBI Bank. Given Fairfax's role as the promoter of CSB Bank, there is speculation that CSB Bank may merge into IDBI Bank post-acquisition, as Indian banking regulations prohibit an investor from simultaneously promoting two banks.

In addition to its interest in IDBI Bank, Fairfax India Holdings Corporation recently agreed to provide up to $200 million in liquidity support to IIFL Finance, which faces liquidity challenges following an RBI ban on gold loans. Furthermore, Fairfax achieved impressive compounded annualized returns of over 20% in six companies, including Digit, IIFL Finance, CSB Bank, NSE, Fairchem Organics, and 5paisa, by the end of 2023.

The renewed interest from Fairfax adds another layer of complexity to the ongoing divestment process of IDBI Bank. With the government's aim to privatize the bank and attract potential investors, Fairfax's revised offer could significantly impact the final decision-making process. However, uncertainties remain regarding the future structure and operations of IDBI Bank, particularly concerning its integration with CSB Bank and the preservation of its identity post-acquisition.