Hudson’s Bay told its employees 12 days before April 20 that they would no longer receive anything beyond their regular wages, according to a letter the company sent out, reviewed by CBC News.

Hundreds of Hudson’s Bay beauty advisers are reeling after the company abruptly cut off their commission pay just weeks before many stores are set to close. The decision affects cosmeticians and fragrance experts, who usually rely on a mix of hourly wages and commission to make a decent income.

The company sent out a letter to workers, giving them just 12 days’ notice that their commission pay would stop starting April 20. From then on, they would receive only their base salary. For many, this change means losing more than $10 per hour in earnings — a major blow for employees who already earn modest wages.

One beauty adviser in British Columbia, who asked not to be named, shared their frustration: “It’s heartbreaking. I’ve gone from $28 an hour to just $17.85. I don’t know how I’ll pay my bills.” They, like many others, fear that speaking publicly might cost them their jobs.

The sudden pay cut comes as Hudson’s Bay tries to stay afloat. The retailer is currently under creditor protection and is rushing to find a buyer before the end of the month. By June 15, most stores will finish liquidation sales, leaving thousands without work.

Unifor, the union representing dozens of beauty advisers in Ontario, is challenging the commission cut, claiming it breaches the workers' contract. "This is unfair and unacceptable," said Unifor's Ontario director, Samia Hashi. "They’re slashing pay without proper talks."

Union leaders argue that beauty advisers covered by contracts should still receive commission, regardless of the company’s financial troubles. “It’s in writing. They can’t just take it away,” said Dwayne Gunness, president of Unifor Local 40.

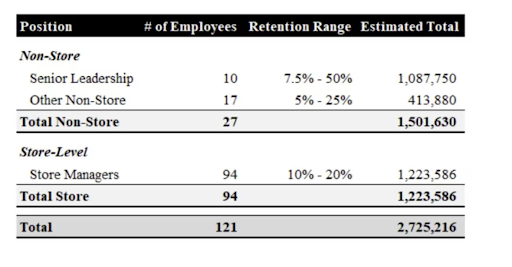

Meanwhile, court filings reveal the company plans to give up to $3 million in retention bonuses to 121 senior employees. Documents show the current total stands at $2,725,215, though the approved amount cannot go over $3 million, according to the Ontario Superior Court of Justice.

While Hudson’s Bay confirmed the cut, they declined to comment further on the issue. Meanwhile, employees are left scrambling. Legal experts say cutting pay without consent is generally not allowed — but under creditor protection, workers must file claims to try and recover lost wages, which often go unpaid.

To make matters worse, Hudson’s Bay has also announced that no severance will be paid to laid-off workers, despite offering up to $3 million in bonuses to 121 executives and managers. In contrast, front-line staff have been promised a much smaller bonus — up to $1,000 — if they stick around until liquidation ends. But many say that’s a poor substitute for lost commission.

Some are turning to government aid. Through the federal Wage Earner Protection Program, workers may receive some compensation, but only a fraction of what they’re owed.

The situation has sparked calls for stronger laws to protect employees when companies go bankrupt. While Ottawa is set to improve pension protections in 2027, workers like those at Hudson’s Bay say that’s too little, too late.

“The focus should be on the people who gave years to this company,” said Gunness. “They deserve more than broken promises and small payouts.”

As Hudson’s Bay employees prepare for their last day on the job, many are left with little more than uncertainty — and the bitter taste of being pushed aside during the company’s final days.