Photo from Bloomberg

Veteran Canadian bank analyst John Aiken warns that Toronto-Dominion Bank (TD) faces a challenging future following its alleged involvement in a money-laundering scheme. The bank may endure significant penalties and years of growth constraints in the US market, according to Aiken's analysis.

The US Department of Justice is investigating TD Bank's role in a $653 million drug money-laundering case in New York and New Jersey. The investigation focuses on how Chinese criminal organizations used TD and other banks to conceal proceeds from US fentanyl sales. Additionally, one of TD's New Jersey branch employees faces charges for accepting bribes to facilitate drug money laundering.

Aiken highlights the potential severity of the situation, suggesting that TD could experience a "lost decade" as a result of its alleged involvement in the money-laundering scheme. He anticipates that growth opportunities in the US will be limited, and it may take several years to address the regulatory issues.

TD Bank expanded into the US regional banking market nearly twenty years ago through acquisitions, particularly in the eastern US. However, its regulatory challenges have hampered its growth initiatives. Last year, TD abandoned plans to acquire First Horizon Corp due to regulatory delays.

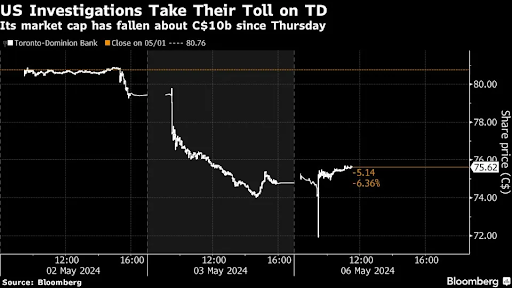

TD Bank has already set aside $450 million for regulatory penalties, but Aiken believes the total amount could reach $2 billion given the uncertainties surrounding the investigations. The bank has suffered significant market value losses since news of its connection to the drug-money case surfaced, with a drop in share price of 5.8% in Toronto, marking the worst decline since March 2020.