Russian billionaires receive $11 billion in dividends amidst economic growth fueled by the war economy

Russian billionaires received billions of dollars in dividends as their companies resumed or increased payouts amid reduced economic uncertainty over the Kremlin's conflict in Ukraine

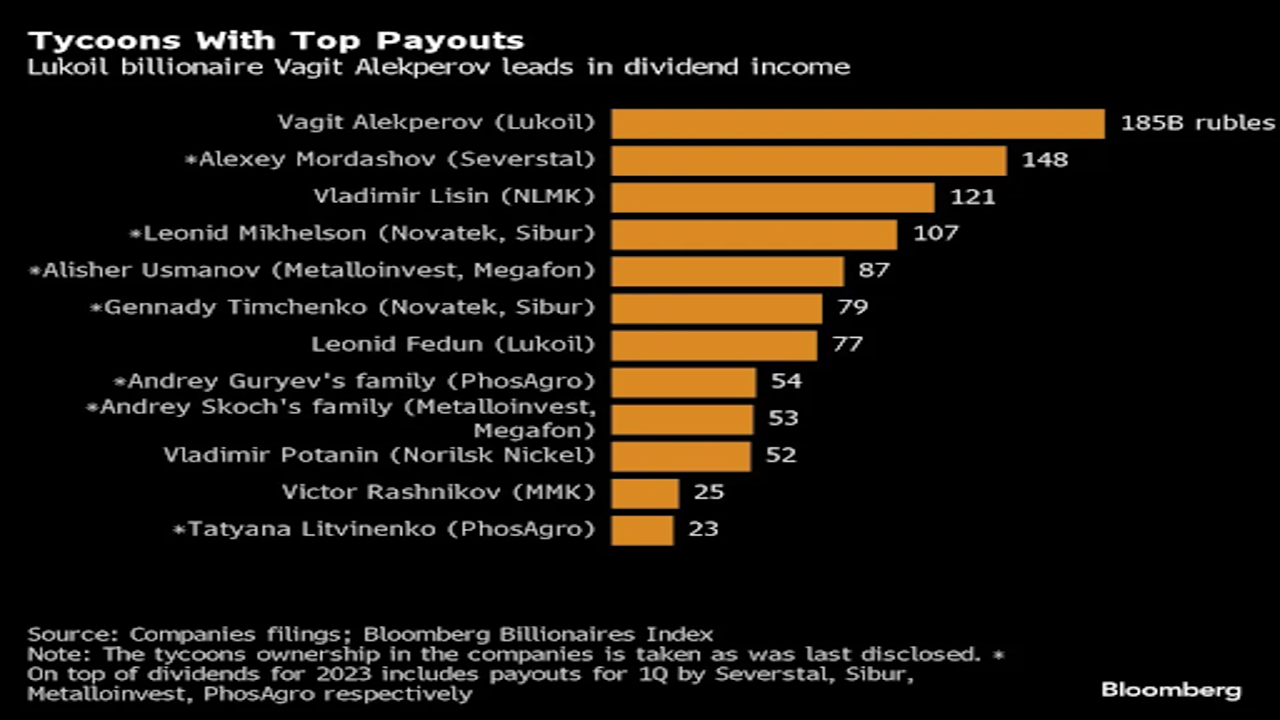

According to Bloomberg's data on publicly disclosed dividends, at least twelve business figures earned over 1 trillion rubles ($11.3 billion) in 2023 and the first quarter of 2024. Many of these individuals have close ties to President Vladimir Putin and include some who have faced sanctions due to Russia's ongoing war.

Leading the list is Vagit Alekperov, a major shareholder and former president of Lukoil PJSC, who received around 186 billion rubles in dividends. Alekperov, sanctioned by the UK and Australia, has managed to avoid penalties from the US and the European Union.

Other top earners include Alexey Mordashov of Severstal PJSC and Vladimir Lisin of Novolipetsk Steel PJSC, who earned 148 billion and 121 billion rubles respectively in dividend income. Mordashov faces sanctions from the US, UK, and EU, while Lisin operates without major restrictions.

The list also features Gennady Timchenko, a billionaire ally of Putin, and Tatyana Litvinenko, who acquired shares in PhosAgro PJSC before her husband, Vladimir Litvinenko, was sanctioned by the US in 2023. Vladimir Litvinenko, rector of St. Petersburg Mining University and a key figure in Putin's campaigns, faced sanctions due to his involvement.

Following the February 2022 invasion of Ukraine, the US and its allies imposed severe sanctions on Russia, leading many companies to halt dividend payments amid fears of economic collapse. However, as Russia's economy adjusted and exporters found new markets, these concerns proved unfounded.

Despite a contraction following the start of the war, Russia's GDP grew by 5.4% in the first quarter of this year compared to the same period last year. Many companies, particularly commodities exporters, resumed dividend payments after reorganizing operations and shifting focus to markets in China, India, and other non-sanctioning countries.

State-controlled entities like Gazprom Neft PJSC and Sberbank PJSC continued dividend payments unabated, benefiting from record profits during the conflict. Sberbank's shareholders recently approved a historic 752 billion rubles in dividends for 2023.

Looking ahead, challenges loom for Russia's economy in the latter half of this year and beyond, potentially prompting tax hikes as indicated by Chris Weafer, CEO of Macro-Advisory Ltd. Business owners are motivated to withdraw dividends now to avoid higher taxes in the future.

Moreover, increased threats of secondary sanctions on banks from countries deemed friendly to Russia, coupled with US sanctions on the Moscow Exchange, pose additional hurdles. These factors have contributed to the Finance Ministry revising its 2024 budget deficit estimate upwards.

Despite uncertainties, Russian tycoons face the dilemma of where to invest their dividends, with many opting for high-interest ruble deposits in Russian banks amid limited domestic investment opportunities. May saw a record influx of 116.3 billion rubles into the Moscow Exchange by private investors.

While investment in Russian industries surged by 14.5% in the first quarter of 2024 compared to the previous year, the prevailing uncertainty discourages major investments.