Canadian steel and aluminum businesses are already feeling the consequences — and the déjà vu — of Donald Trump's latest tariff threat, several years after he targeted the same industries with a punishing import tax. (Photo by Rob Kruk/CBC)

President Donald Trump has announced a 25% tariff on all steel and aluminum imports into the United States. The latest Trump Steel Tariffs move expands existing trade barriers and is expected to have far-reaching consequences.

Despite concerns from businesses and political leaders, Trump insists the tariffs will strengthen domestic production. The order takes effect on March 4, with no exceptions. "This is a big deal, the beginning of making America rich again," Trump declared. He emphasized the need for US industries to rely on locally produced metals rather than imports.

Global and Domestic Reactions

The decision has triggered strong reactions, particularly from Canada, the largest supplier of these metals to the US. Canada’s Minister of Innovation, Francois-Philippe Champagne, condemned the tariffs as "totally unjustified." He highlighted how Canadian steel and aluminum contribute to key American industries, including defense, shipbuilding, and automotive manufacturing.

Ontario Premier Doug Ford also criticized the move, accusing Trump of "shifting goalposts" and putting the North American economy at risk. Canadian steelmakers have urged their government to respond with retaliatory measures. Kody Blois, a key figure in Canada’s ruling Liberal Party, suggested that Canada may reconsider its trade relationship with the US.

Meanwhile, US steel manufacturers welcomed the decision. On Monday, share prices of major steel companies surged in anticipation of the order, with Cleveland-Cliffs' stock soaring nearly 20%. However, other sectors reacted cautiously, as many businesses rely on imported metals for their operations.

Potential Economic Impact of Trump Steel Tariffs

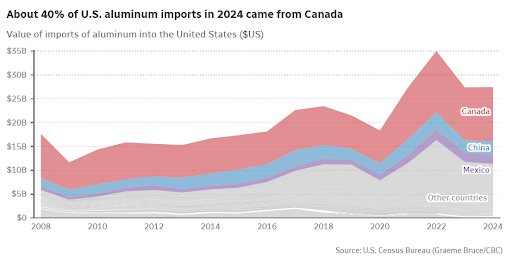

The US remains the world’s largest steel importer, with Canada, Brazil, and Mexico among its top suppliers. Last year, Canada alone supplied over half of America’s imported aluminum. The new tariffs could significantly impact cross-border trade, particularly with Canada.

Trump dismissed concerns about rising consumer costs, insisting that in the long run, it would be "cheaper." He hinted at further tariffs targeting industries such as pharmaceuticals and computer chips, reinforcing his vision of economic protectionism.

However, past experiences raise questions about the effectiveness of such policies. In 2018, Trump imposed similar tariffs—25% on steel and 15% on aluminum—but later negotiated exemptions for several countries, including Canada and Mexico. Economic experts believe history may repeat itself.

Uncertainty Over Long-Term Strategy

Some analysts view Trump’s tariffs as a negotiation tactic rather than a strict trade policy. Douglas Irwin, an economics professor at Dartmouth College, called it a "replay of 2018." He questioned whether the move was a bargaining tool or a genuine attempt to revive US steel production.

Meanwhile, trade tensions with China continue to escalate. Trump recently imposed a 10% tariff on all Chinese imports, prompting immediate retaliation from Beijing. Additional duties on Canadian and Mexican goods were also announced but later delayed by 30 days.

Future Trade Relations in Question

Trump's administration argues that the tariffs will prevent countries like China and Russia from bypassing trade restrictions by routing goods through other nations. The president also introduced stricter standards, requiring steel to be "melted and poured" and aluminum to be "smelted and cast" in North America.

Nick Iacovella, a spokesperson for the Coalition for a Prosperous America, supports the tariffs. He expressed concerns about increased steel imports from Mexico, exceeding agreed levels from a 2019 trade deal. However, he acknowledged that Canada remains a major trading partner with a significant surplus in exports to the US—an imbalance Trump has long criticized.

While the administration insists the new measures will benefit American industries, uncertainty looms over the broader economic impact. With global trade relationships at stake, the world is watching closely to see how this latest move unfolds.