U.S. Treasury prices dropped as reports suggested that Trump might ease the tariffs set for April, according to Bloomberg.

U.S. Treasury bonds took a hit as investors shifted toward riskier assets following reports that President Donald Trump’s upcoming tariffs might be less aggressive than initially expected. The yield on the 10-year Treasury note jumped by five basis points to 4.3%, while German bonds also saw a slight decline, pushing the equivalent yield up by two basis points to 2.8%. Meanwhile, U.S. stock market futures surged, with S&P 500 futures climbing over 1%.

Market Reaction to Tariff Adjustments

Trump had originally planned broad, reciprocal tariffs set to be announced on April 2, a date he dubbed “liberation day.” However, recent reports suggest that the measures will be more focused, alleviating some of the market’s fears about global trade disruptions. Investors welcomed this softer stance, boosting market confidence.

“This adjustment seems to be fueling a market rebound,” noted Gennadiy Goldberg, head of U.S. interest rate strategy at TD Securities. However, he also warned that with ongoing uncertainties, markets remain on edge.

Bond Market Volatility and Economic Concerns

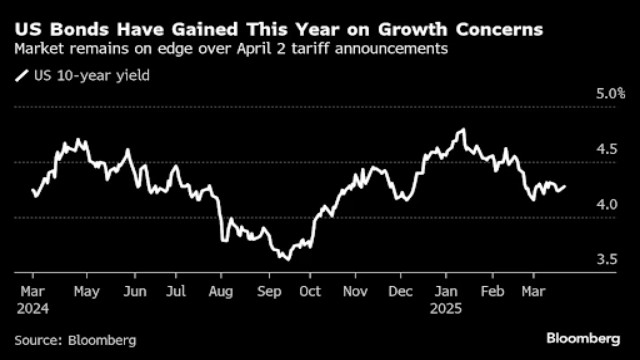

Throughout March, U.S. 10-year Treasuries have moved within a tight range after their yield dropped from the mid-January peak of 4.8%. Investors had initially sought the safety of bonds due to Trump’s aggressive trade-war rhetoric, fearing it could trigger an economic downturn.

Despite Monday’s drop in Treasury prices, some experts believe yields may fall again. Nicolas Jullien, head of fixed income at Candriam, pointed to weakening economic indicators, suggesting that confidence in the U.S. economy is fading. The upcoming U.S. Purchasing Managers’ Index (PMI) report is expected to shed light on private business activity, providing fresh insights into economic trends.

“Trade uncertainties are at a peak, weighing heavily on investor confidence,” Jullien said. “We anticipate a continued decline in U.S. 10-year yields, especially if market conditions worsen further.”

Adding to the situation, Treasury Secretary Scott Bessent has been pushing for lower bond yields, leading analysts at major banks to revise their year-end forecasts downward.

Global Market Contrasts

While U.S. economic growth appears to be slowing, the eurozone is showing signs of recovery. Fresh PMI data from Europe indicated that business activity is improving, albeit from a low point. This divergence in economic performance adds another layer of complexity for investors navigating the financial landscape.

Portfolio manager Tracy Chen of Brandywine Global Investment Management suggested that Trump’s softer tariff stance could indicate a continued effort to support the stock market. “The easing of tariff rhetoric might suggest that the ‘Trump put’ on equities remains in play, alongside the ‘Bessent put’ on Treasuries,” she remarked.

With shifting trade policies and economic uncertainties, investors remain cautious. The coming weeks will determine whether Trump’s adjusted tariffs can stabilize markets, or if fresh turbulence awaits.