President Donald Trump spoke at the White House on Monday, March 3, 2025, with TSMC Chairman and CEO C.C. Wei and Commerce Secretary Howard Lutnick by his side during a meeting in the Roosevelt Room.

The Trump administration has opened a fresh investigation into the import of pharmaceuticals and semiconductor chips, citing national security concerns. This move could pave the way for more tariffs on foreign drugs and microchips — a strategy that critics say adds uncertainty to an already fragile global economy.

Despite past backlash and ongoing controversy, former President Donald Trump appears eager to escalate trade tensions. His latest steps suggest he’s far from finished with his aggressive approach to international commerce. Market leaders are wary, as companies and investors brace for further instability.

Goldman Sachs CEO David Solomon recently noted that the economic environment has shifted drastically in recent months. He pointed to a slowdown in economic activity and growing fears of a recession. Business leaders are finding it increasingly difficult to plan due to policy unpredictability. JPMorgan Chase CEO Jamie Dimon echoed these concerns, warning of serious risks posed by new tariffs, persistent inflation, and volatile asset prices.

As the Commerce Department reviews the U.S. semiconductor sector, industry experts worry about the fallout. Once forecasted to grow to $2 trillion by 2032, the U.S. chip industry now faces major obstacles. New tariffs could cost American semiconductor equipment makers over $1 billion annually. Trump has already pressured Taiwan Semiconductor Manufacturing Company (TSMC), demanding it build facilities in the U.S. or face a 100% tariff on its exports.

These decisions could unravel vital international partnerships and disrupt supply chains. Trump’s earlier tariffs on steel, aluminum, and autos damaged U.S. manufacturing, a sector making up 10% of the national economy. Now, the pharmaceutical and tech sectors may face the same fate.

Canada, a key U.S. trade partner, could feel serious ripple effects. Its pharmaceutical industry ranks among the top ten globally and relies heavily on exports to the U.S. Generic drugmakers, already struggling with slim margins, may be hit hard. Higher tariffs could push them out of the U.S. market altogether.

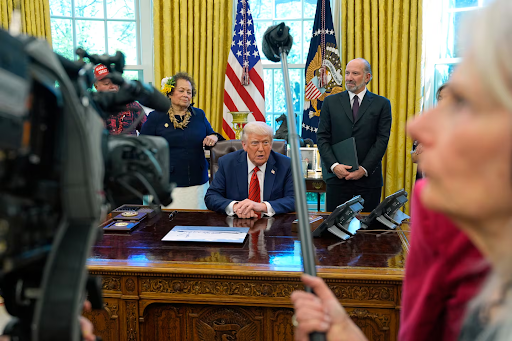

On Thursday, April 17, 2025, President Trump signed a series of executive orders in the Oval Office at the White House in Washington.

This comes at a troubling time for American healthcare. The country is experiencing shortages of 270 essential drugs, including antibiotics. Meanwhile, the administration’s recent executive order aims to reduce drug prices, a confusing contrast to its tariff threats. Experts say these mixed signals are creating widespread confusion in both the healthcare and economic sectors.

Industry leaders, global markets, and political allies are now caught in a web of growing anxiety. The fear is that these ongoing trade clashes could fracture critical alliances and slow international economic recovery. While many urge restraint and clarity, Trump seems committed to forging ahead with his combative tactics.

His unwavering stance continues to shake markets, unsettle governments, and frustrate industries around the world. The consequences are mounting, yet the appetite for disruption remains. From consumers to corporations, the fallout is real — and far from over.