(Bloomberg Intelligence)

Wall Street’s confidence in the profit potential of major U.S. companies is weakening, adding pressure to an already struggling stock market. Analysts are revising their earnings expectations downward, signalling potential trouble for investors.

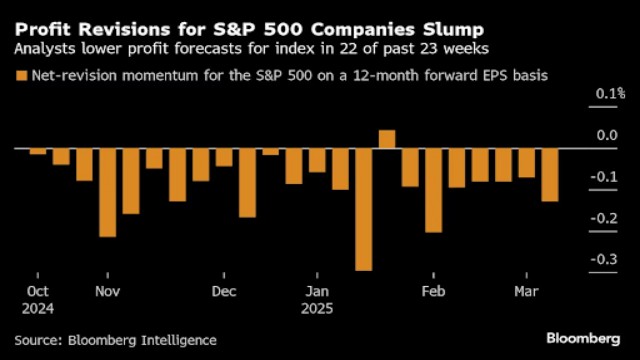

For 22 of the past 23 weeks, profit forecasts for companies in the S&P 500 have been downgraded more than they’ve been upgraded—the longest streak since early 2023, according to Bloomberg Intelligence. Despite an overall strong outlook, this shift raises concerns about the market’s ability to sustain its current valuations.

Tariffs and Market Worries Weigh on Stocks

The stock market has already taken a hit, with the S&P 500 dropping around 8% from its peak last month. Concerns over the economic impact of tariffs imposed by U.S. President Donald Trump have fueled this decline. Investors worry that if earnings fail to meet expectations, the market could sink further.

“The outlook for corporate profits is cracking,” said Eric Beiley, an executive at Steward Partners. The ongoing stock market decline, he noted, is forcing analysts to lower their earnings estimates even further.

Major Companies Signal Weakness

The first-quarter earnings season kicks off on April 11 with reports from major banks like JPMorgan Chase & Co. But some companies have already warned of weaker-than-expected profits.

American Airlines recently announced that its first-quarter losses will be double the initial forecast. Similarly, Delta Air Lines slashed its profit outlook in half, blaming weaker demand for travel. Retail giants like Walmart, Kohl’s, and Abercrombie & Fitch have also expressed caution about their financial performance.

At the start of the year, analysts predicted a 13% increase in S&P 500 profits for 2025. That forecast has since dropped to 10%, and some experts believe further reductions are likely. Yung-Yu Ma of BMO Wealth Management expects earnings growth projections to fall to single-digit percentages as companies adjust for the impact of tariffs on profit margins.

“There’s still a risk that estimates will keep declining,” said Scott Chronert, Citigroup’s head of U.S. equity strategy.

Gold and Bonds Surge as Investors Seek Safety

As fears about earnings and tariffs grow, investors are shifting funds to safer assets. Gold prices have reached record highs, and demand for U.S. government bonds has increased since mid-February.

Keith Buchanan, a senior portfolio manager at Globalt Investments, has been selling some large-cap stocks and increasing cash reserves. “Playing it safe makes the most sense right now,” he said.

Hopes for a Turnaround

Despite the gloom, corporate earnings have proven resilient in the past. Some investors are betting that Trump might soften or scrap tariffs before they significantly impact profits. However, analysts warn that even if companies don’t lower their forecasts immediately, the damage could become more apparent months down the line.

Looking back at Trump’s first term, tariffs on Chinese goods took about a year to show their full impact on corporate profits. However, at that time, the economy benefited from corporate tax cuts. With pressure mounting on Trump to pass new tax reforms, investors are watching closely to see if a similar buffer will emerge.

Michael Shaoul, CEO of Ion Macro Management, believes that the recent stock selloff is more about investors pulling money from overvalued U.S. stocks and shifting funds to Europe and Asia. He remains confident in long-term corporate profits but warns that any unexpected earnings disappointments could lead to further market turmoil.