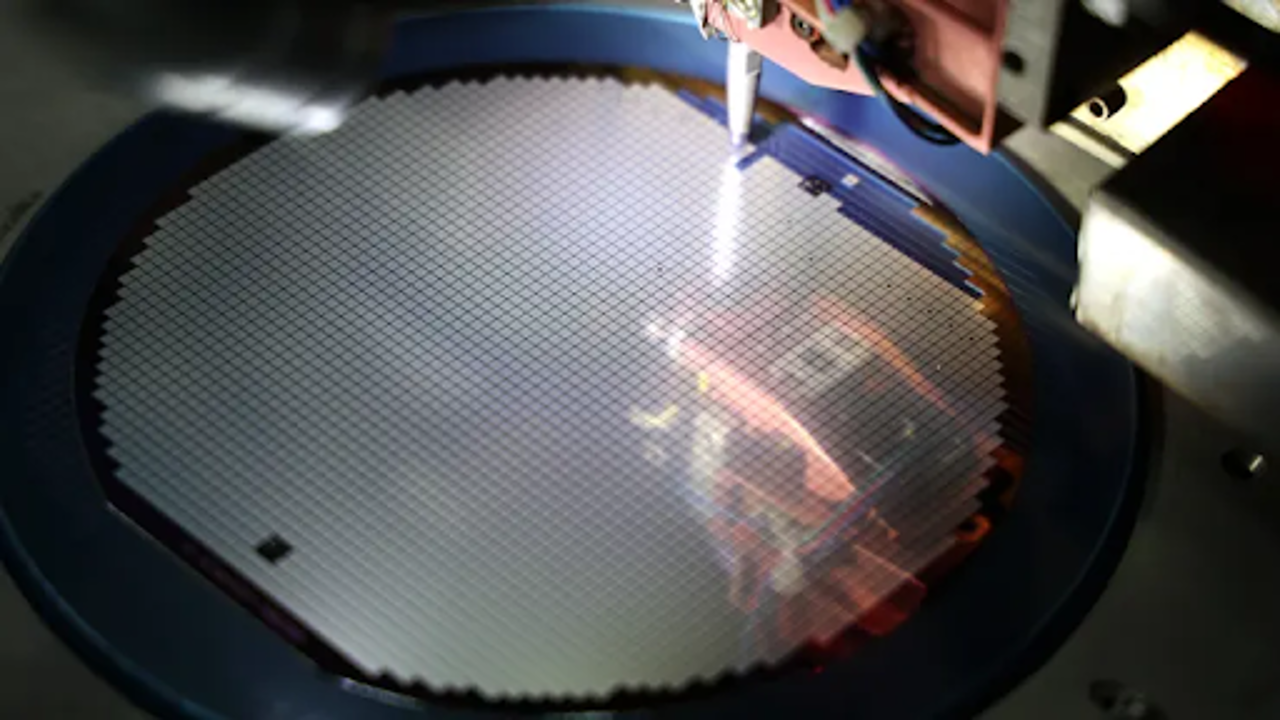

A worker makes semiconductor chips at a factory in Binzhou, China, on June 4, 2024. Getty Images

Since late 2022, four major semiconductor equipment manufacturers have seen a remarkable increase in their revenue from China, with their market share more than doubling. This shift is linked to stricter U.S. export controls imposed in October 2022, which aimed to limit China's access to advanced semiconductor technology.

According to a recent Bank of America report, companies like ASML, Lam Research, KLA Corp., and Applied Materials have experienced a dramatic rise in their revenue from China. The report highlights that these firms' revenue from the Chinese market surged from 17% of their total revenue in the last quarter of 2022 to 41% by the first quarter of 2024. This increase is a direct response to China's push to develop its own semiconductor manufacturing capabilities.

The report explains that since the U.S. imposed tighter export restrictions, China has been rapidly expanding its purchases of semiconductor manufacturing equipment. This move is part of a broader strategy by Beijing to enhance its tech self-reliance, a goal underscored in recent high-level policy meetings.

The U.S. restrictions on semiconductor exports began as part of a broader effort to curb China's access to advanced technologies, reflecting ongoing trade tensions. Last week, Bloomberg reported that the Biden administration might extend these restrictions further, potentially impacting non-U.S. semiconductor equipment manufacturers as well.

In response to the growing tensions and trade restrictions, China's push for technological self-sufficiency has become more pronounced. The country is keen on reducing its dependency on foreign technology and bolstering its domestic semiconductor production capabilities.

Despite the recent dip in the VanEck Semiconductor ETF, which tracks U.S.-listed chip companies, the sector has seen a substantial gain of nearly 46% this year. This reflects the high stakes involved in the global semiconductor industry and the impact of geopolitical developments on market dynamics.