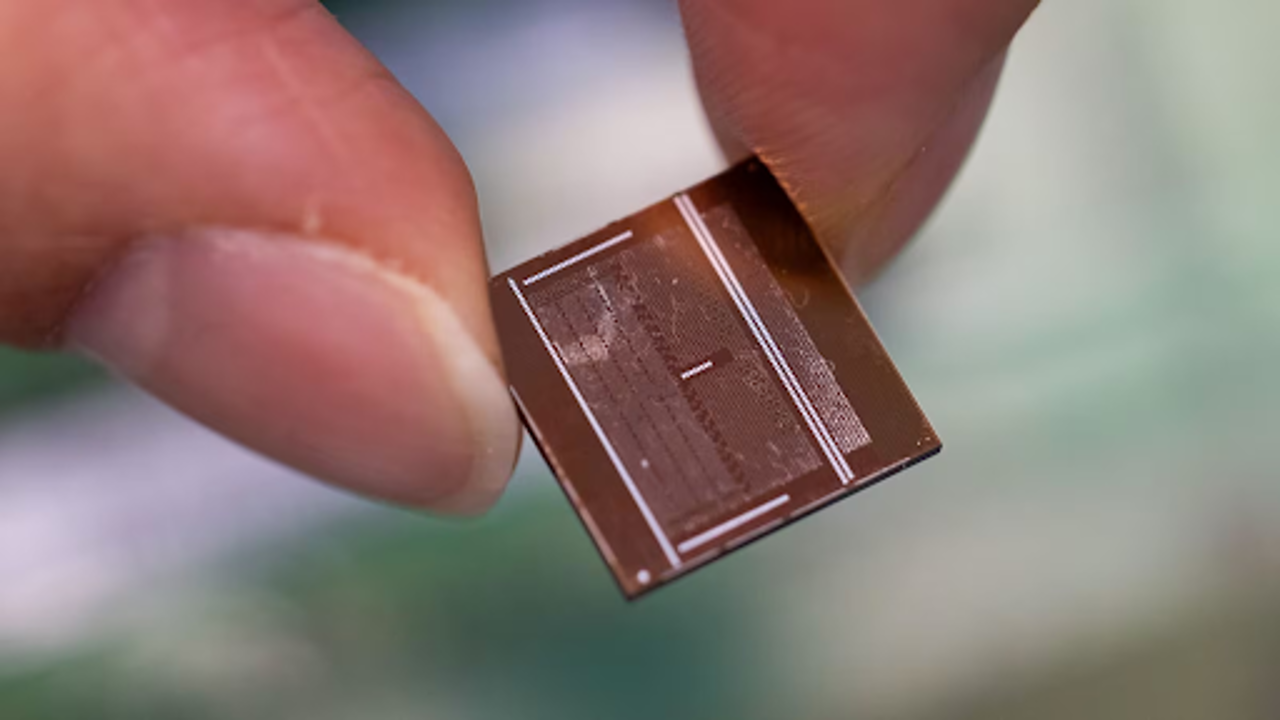

A Samsung high-bandwidth memory chip. Bloomberg

The US is contemplating new restrictions that could significantly impact China's access to crucial AI memory chips. This potential move, which may be announced as early as next month, aims to further intensify the ongoing tech competition between the world's two largest economies.

The proposed restrictions would affect high-bandwidth memory (HBM) chips, which are essential for running advanced artificial intelligence (AI) systems. Companies like Micron Technology Inc., SK Hynix Inc., and Samsung Electronics Co., which dominate the global HBM market, could be restricted from supplying these chips to Chinese firms. The US government is considering implementing measures that would limit China's access to HBM2 chips and the latest models, HBM3 and HBM3E, as well as the equipment needed to produce them.

The Biden administration has been focused on various restrictions to keep critical technologies out of the hands of Chinese manufacturers. These restrictions include controls on chipmaking equipment and memory chips vital for AI. If these measures are enacted, they would mark a significant escalation in the tech rivalry between the US and China.

Micron Technology, based in Boise, Idaho, would likely be less affected by these restrictions. The company had already stopped selling its HBM products to China after Beijing banned Micron’s memory chips from its critical infrastructure in 2023. As for South Korean companies SK Hynix and Samsung, the US is exploring options to impose restrictions, potentially using the foreign direct product rule (FDPR). This rule allows the US to control foreign products that incorporate even small amounts of American technology. Both SK Hynix and Samsung use US-designed chip software and equipment.

The US Commerce Department has stated that it continuously assesses potential threats and updates export controls to protect national security and the technological ecosystem. However, both Micron and South Korean firms have declined to comment on the matter.

The new restrictions are expected to be part of a broader package of measures that may also include sanctions against over 120 Chinese companies and new limits on chip equipment. This package would likely feature exceptions for key US allies such as Japan, the Netherlands, and South Korea.

President Joe Biden's administration has already urged Seoul to limit chip technology exports to China and to adopt controls similar to those implemented by the US. Similarly, the US has pressured Japan and the Netherlands to prevent their semiconductor equipment companies from servicing restricted gear in China.

While the new restrictions would directly impact the sale of HBM chips, it's unclear if high-end memory chips bundled with AI accelerators would still be permitted for sale in China. For instance, Samsung provides HBM3 for Nvidia’s H20 chips, which are less advanced AI accelerators and have been cleared for sale to Chinese firms.

Additionally, the US plans to introduce tighter controls on advanced dynamic random access memory (DRAM), which is a component of HBM chips. This move aims to hinder the progress of Chinese memory chipmaker ChangXin Memory Technologies Inc. (CXMT), which is now capable of producing HBM2 chips.

The Biden administration also intends to create a list of critical semiconductor components needed by China and is considering a zero de-minimis rule. This rule would impose stricter standards on products containing US technology, though a large group of US allies, including Japan and the Netherlands, would be exempt.

Huawei Technologies Co. is working on alternatives to Nvidia and AMD’s AI chips with its Ascend AI chips. However, it's unclear who supplies the HBMs bundled with these chips as Huawei seeks to enhance its self-sufficiency in key technologies amid tighter US restrictions.