Bitcoin and Ether prices tumble, marking the steepest decline for Ether since 2021, as the cryptocurrency market experiences a significant downturn.

Cryptocurrencies faced a severe downturn on Monday, causing Bitcoin to drop over 14% and Ether to suffer its worst decline since 2021.

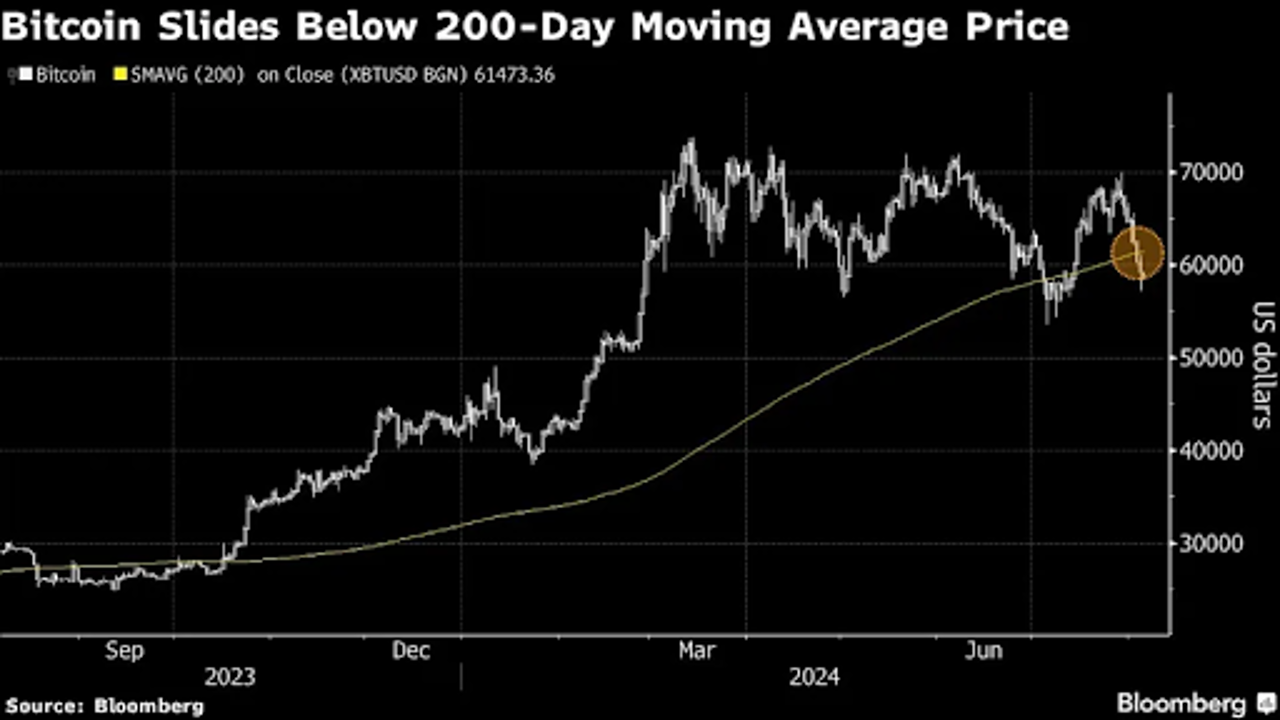

Bitcoin, the leading cryptocurrency, fell to $50,900 by 7:20 a.m. in London, extending a 13.1% loss from the previous week. This marks its steepest fall since the collapse of the FTX exchange. Ether, the second-largest cryptocurrency, lost more than 20% of its value before recovering slightly to trade at $2,286. Most major cryptocurrencies experienced significant losses.

This slump is part of a broader selloff in global stock markets, driven by concerns about the economic future and doubts about the heavy investments in artificial intelligence. Rising geopolitical tensions in the Middle East have further unsettled investors.

On August 2, Bitcoin-focused exchange-traded funds (ETFs) in the US saw their largest outflows in about three months. It's uncertain whether these funds will attract buyers looking to capitalize on the dip or continue to see more withdrawals.

The unwinding of the yen carry trade, where investors borrow in yen to invest in higher-yielding assets, has also negatively impacted digital assets. According to Hayden Hughes, head of crypto investments at Evergreen Growth, speculators are adjusting to higher interest rates in Japan and facing increased hedging costs due to volatility in the US dollar-Japanese yen trading pair.

Since reaching a record high of $73,798 in March, Bitcoin has been affected by several factors, including the US political landscape. The upcoming presidential race between pro-crypto Republican Donald Trump and Democratic Vice President Kamala Harris, who has not yet clarified her stance on digital assets, adds to market uncertainty.

Other concerns include the potential sale of Bitcoin seized by governments and the risk of an oversupply from tokens returned to creditors through bankruptcy proceedings.

Bond traders have increased their bets on US interest rate cuts beginning in September to support economic growth. Sean Farrell, head of digital-asset strategy at Fundstrat Global Advisors LLC, suggested that a less restrictive monetary policy could benefit cryptocurrencies.

Bitcoin's decline on Monday brought it to levels last seen in February. Ether also fell to prices not seen since the beginning of the year. Like Bitcoin, investors' response to new US spot-Ether ETFs remains uncertain.

Justin D’Anethan, head of Asia-Pacific business development at market maker Keyrock, noted that the crypto market downturn seemed to be led by Ether, pointing to social media rumours of institutional selling of Ether-related assets.

In the past 24 hours, approximately $790 million of bullish crypto positions using derivatives were liquidated, indicating that leveraged bets have failed, according to data from Coinglass.

Khushboo Khullar, a venture partner at Lightning Ventures, which invests in Bitcoin-linked companies, attributed the broad stock market slump to investor panic, causing a rush for liquidity to cover margin calls. Despite the downturn, she sees this as a “fine buying opportunity.”

Year-to-date, Bitcoin’s growth has slowed to around 16%, compared to an 18% increase in gold and an 8% rise in a global stock index.