Asian stock markets gained ground following a report showing slowing inflation in the United States, fuelling expectations of potential interest rate cuts by the Federal Reserve, according to Bloomberg.

Asian stock markets surged on Thursday, recovering from recent losses, after U.S. inflation data bolstered confidence in an upcoming Federal Reserve interest rate cut. Key markets in China and Japan led the gains, with the MSCI Asia Pacific Index posting its best performance in a week.

In China, the CSI 300 Index climbed nearly 1%, while Hong Kong-listed Chinese shares jumped by as much as 2%. Japan’s Topix Index rose 1.1%. U.S. stock futures showed slight declines, but optimism over a rate cut set a positive tone for Asian markets.

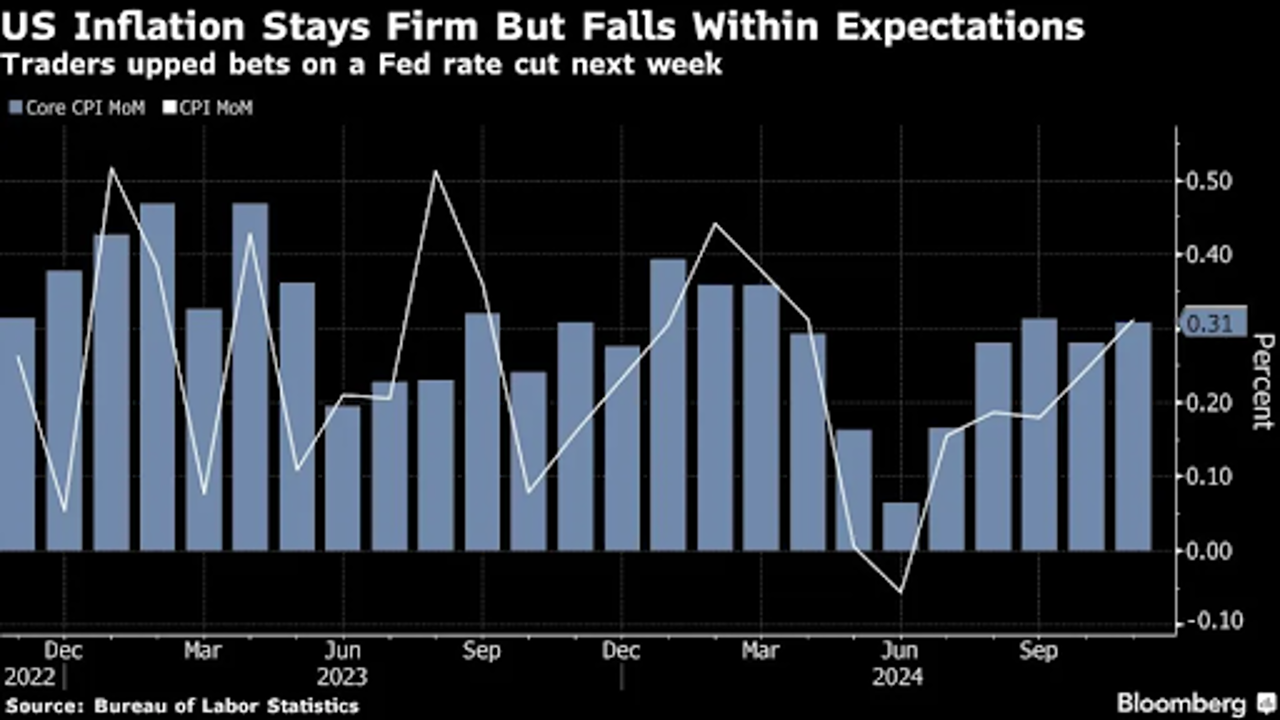

Analysts see the Fed’s likely 25-basis-point rate cut in December as a driver for stronger market performance. “Low inflation is paving the way for a friendlier environment for risk assets,” said Jun Rong Yeap, a strategist at IG Asia Pte. The sentiment aligns with expectations of steady U.S. economic growth and seasonal year-end gains.

Meanwhile, Beijing's economic measures have buoyed investor confidence. Traders are eagerly awaiting policy details from China’s Central Economic Work Conference, which is expected to outline plans for 2024. Marvin Chen, an analyst with Bloomberg Intelligence, noted that upcoming policies would likely provide more economic support.

Chinese authorities also moved to stabilize their currency, the yuan, following concerns over possible depreciation in 2024. A stronger-than-expected yuan fixing on Thursday signalled government efforts to maintain stability.

Global Market Reactions

Australian markets experienced mixed results. While government bond yields jumped and the Australian dollar strengthened due to unexpectedly strong job growth, the S&P/ASX 200 Index dipped slightly.

In South Korea, political tensions weighed on the won, with President Yoon Suk Yeol accusing the opposition of undermining his administration. Despite this, the Japanese yen posted modest gains as investors speculated on potential Bank of Japan rate hikes.

The U.S. dollar softened as Treasury yields edged higher. Bitcoin dropped nearly 1%, while Ether gained 2%. Oil prices remained steady after a three-day rally, and gold slipped marginally.

Central Banks in Focus

Investors are closely monitoring rate decisions from the European Central Bank (ECB) and Swiss National Bank, both expected to lower borrowing costs. In Japan, the Bank of Japan’s next move remains uncertain, with most analysts predicting a rate hike in January.

“Central bank signals are mixed, suggesting they are not in a hurry to raise rates,” explained Charu Chanana, a strategist at Saxo Markets. Market participants believe that strategic timing is key, particularly for the BOJ, which might wait until 2024 to act decisively.