Bitcoin Nears $100,000 Amid Federal Reserve Actions, Marking Largest Decline Since September

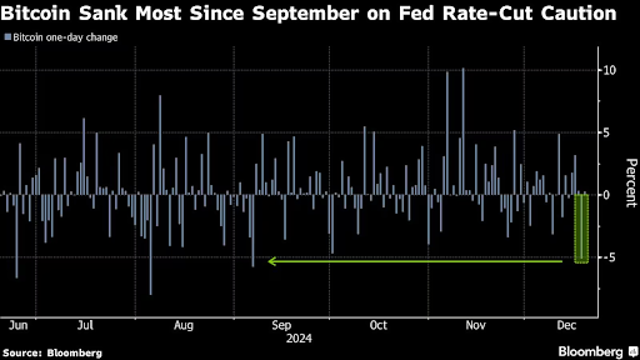

Bitcoin, the world’s largest cryptocurrency, momentarily dipped below the $100,000 mark on Thursday, reaching $98,760, after the Federal Reserve delivered a cautious update on future interest rate cuts. This marked a sharp turnaround from its record high earlier in the week. However, Bitcoin quickly recovered to cross back into six-digit territory, while other cryptocurrencies like Ether and Dogecoin also faced turbulence.

The Fed's decision to lower borrowing costs for the third consecutive time came with a hint of caution for 2025. Federal Reserve Chair Jerome Powell emphasized that significant progress is still required in addressing inflation before any further monetary easing. Market experts believe this stance hit speculative investments hard, including cryptocurrencies.

Tony Sycamore, a market analyst at IG Australia, noted that the Fed's actions were expected, given recent data showing persistent inflation and economic activity in the U.S. Nonetheless, it spurred a pullback in risk assets like Bitcoin, which had surged after the U.S. election.

The Fed's cautious tone bolstered the dollar while putting pressure on global equities and bonds. Meanwhile, a looming U.S. government shutdown, fuelled by disagreements over a funding bill, added to market jitters. U.S. equity futures showed uncertainty on Thursday amid these concerns.

Bitcoin’s recent rally, fuelled by President-elect Donald Trump’s pro-crypto stance, has seen the asset gain nearly 50% since early November. Trump has pledged to ease regulatory burdens on cryptocurrencies and even floated the idea of a national Bitcoin reserve. This support has overshadowed warnings from critics about Bitcoin's lack of traditional valuation metrics and its volatile momentum.

Despite some investors cashing out after the Fed meeting, experts believe Bitcoin’s long-term outlook remains promising. Paul Veradittakit of Pantera Capital highlighted a robust market foundation, suggesting the cryptocurrency could weather temporary setbacks.

However, caution persists. Sean McNulty, trading director at Arbelos Markets, observed a growing demand for Bitcoin hedging options post-Fed announcement, indicating traders are preparing for potential short-term declines. Zann Kwan, Revo Digital’s chief investment officer, predicted Bitcoin might briefly retreat into the low $90,000s before stabilizing.

As of early Thursday morning in London, Bitcoin was trading at $101,280, reflecting its resilience amid market volatility.