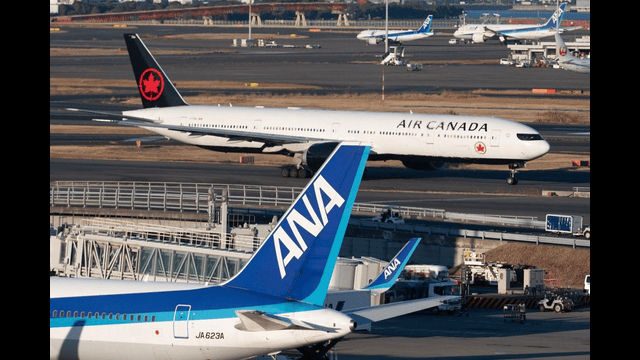

An Air Canada plane taxis after arriving at Tokyo's Haneda airport on January 4, 2025. THE CANADIAN PRESS/Craig Wong

Air Canada has revised its financial forecast for the year, citing a sharp decline in bookings to the United States as tensions over trade disputes continue to impact travel plans. The airline's CEO, Michael Rousseau, revealed that bookings for transborder flights have dropped by at least 13 percent over the next six months, with Canadian travellers showing less interest in flying to the U.S.

The ongoing trade war, along with higher costs associated with the Canadian dollar, has caused a decrease in Canadian demand for U.S. travel. Rousseau explained that while some travelers have been avoiding the U.S. due to tariffs and trade uncertainties, others are choosing not to travel to the U.S. because it is simply more expensive at the moment.

As a result, Air Canada has lowered its expected adjusted earnings for 2025, now forecasting a range between $3.2 billion and $3.6 billion, down from the earlier projection of $3.4 billion to $3.8 billion.

In response to declining demand, the airline has cut back its flight capacity to popular U.S. destinations, such as Florida, Las Vegas, and Arizona, reducing flights by 10 percent. Other airlines, including WestJet and Air Transat, have made similar adjustments.

Although the drop in U.S. travel has been significant, Rousseau emphasized that it has been a contained issue. Canadians are now opting for alternative destinations, both domestic and international. Some are choosing to explore Europe, while others are booking trips to the Pacific region, including Japan, Thailand, and Australia.

To adapt, Air Canada has shifted its resources to meet this changing demand. The airline introduced a new direct flight from Montreal to Edinburgh, and last month it launched a non-stop route from Vancouver to the Philippines. In addition, Air Canada is expanding its presence in Latin America, with a 16 percent capacity increase starting in October. This will include new routes to Brazil, Colombia, Guatemala, and Mexico, along with increased service to sun destinations from Halifax, Quebec City, and Ottawa.

However, Air Canada has also scaled back its overall growth plans. The airline now anticipates a capacity increase of only 1 to 3 percent, compared to the previous expectation of 3 to 5 percent.

Despite the uncertain market conditions, analysts have praised Air Canada’s ability to manage costs effectively. The airline reported a slight decline in revenue, with a net loss of $102 million for the first quarter of the year, compared to a loss of $81 million during the same period last year. Adjusted losses per share came in at 45 cents, beating analysts’ expectations.

Air Canada's decision to maintain its financial forecast, despite the challenges, stood in contrast to many U.S. airlines, which have opted to withdraw their 2025 projections. As a result, Air Canada’s shares rose nearly 15 percent, closing at $17.54.