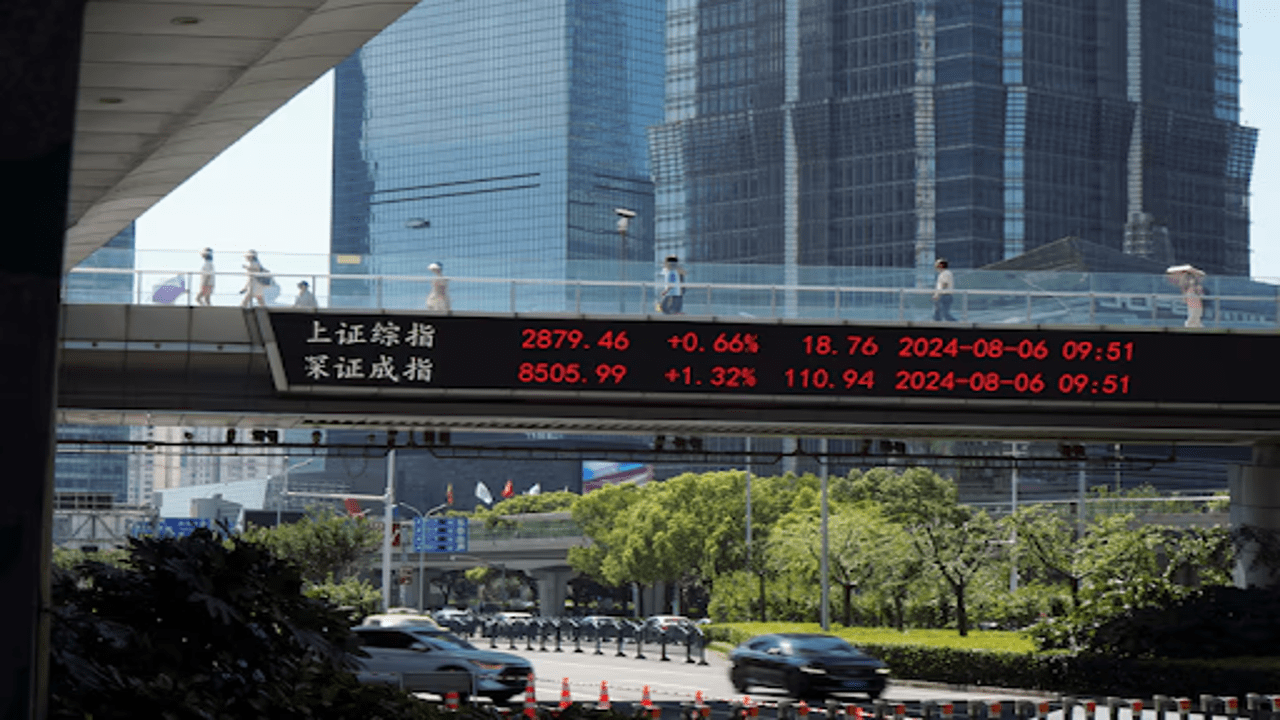

On August 6, 2024, people walked on an overpass in Shanghai's Lujiazui financial district, with stock information displayed in front of nearby buildings. This photo was taken by Nicoco Chan for Reuters.

Asian markets were mostly higher on Monday, buoyed by a calm in Japanese trading due to a holiday, and the anticipation of significant economic reports from the U.S. and China. Investors are closely watching these updates for clues about global economic growth.

The Federal Reserve is set to pay particular attention to the U.S. consumer price index (CPI), expected on Wednesday. Economists predict both the overall and core CPI to rise by 0.2%, with the annual core inflation possibly easing to 3.2%. This slight slowdown could reinforce the Fed's confidence that inflation is continuing to cool down. Analysts at Barclays suggest that such data might support the possibility of a rate cut in September. However, they also caution that the inflation rate, while lower, remains above target, which could limit the extent of any potential rate reduction.

In addition to the CPI, investors will also be examining July’s retail sales, industrial output, housing starts, and several regional manufacturing and consumer sentiment surveys. The futures market currently reflects a 49% probability of the Fed cutting rates by 50 basis points in September, a decrease from the 100% certainty seen a week ago when Japanese stocks faced a sharp decline.

In Japan, Nikkei futures showed some recovery, trading at 35,570 compared to the previous cash close of 35,025, though they haven’t fully bounced back from last week’s slump. Meanwhile, U.S. markets had mixed results: the Dow dipped by over a third of a percent, the S&P 500 was steady, and the Nasdaq saw a modest increase of 0.2%.

Across the Asia-Pacific region, the MSCI index of shares outside Japan rose by 0.3%, driven by a 1.5% gain in Taiwan’s market. Chinese blue-chip stocks remained stable. In Europe, futures pointed to a positive start, with EUROSTOXX 50 futures up by 0.5% and FTSE futures by 0.4%. In the U.S., futures for the S&P 500 and Nasdaq showed minor gains of 0.1% each, amid thin trading. Notably, about 91% of S&P 500 companies have reported earnings, with 78% surpassing expectations. This week, results from retail giants Walmart and Home Depot are expected to provide further insights into U.S. consumer health.

China is also in focus as it prepares to release data on retail sales and industrial production on Thursday. These figures are expected to underscore the country’s economic struggles, reinforcing calls for additional stimulus measures.

In the currency markets, the U.S. dollar gained 0.3% against the yen, reaching 147.08 yen, a recovery from last week’s low of 141.68 yen. The euro remained stable at $1.0919. According to BofA FX strategist Shusuke Yamada, the recent rush to unwind yen carry trades—where investors borrow at low rates in yen to invest in higher-yielding assets—appears to be winding down, with speculative short positions on the yen decreasing significantly. Yamada forecasts that the yen may weaken further, predicting the dollar could reach 155 yen by the end of the year.

In commodities, gold held steady at $2,424 per ounce, following a slight dip last week. Oil prices edged up, with Brent crude increasing by 22 cents to $79.88 a barrel, and U.S. crude rising by 38 cents to $77.22 per barrel. This comes after a 3.5% rise last week, fuelled by concerns over a potential escalation in the Middle East. Israeli Defence Minister Yoav Gallant warned of Iran’s military build-up, suggesting preparations for a large-scale attack on Israel. In response, U.S. Defence Secretary Lloyd Austin ordered the deployment of a nuclear-powered submarine to the region.