Asian stock markets rise as yen strengthens from historic lows

Asian stocks climbed following encouraging economic data that bolstered expectations for Federal Reserve interest-rate cuts, while the yen rebounded from its lowest level against the dollar since 1986.

The MSCI Asia-Pacific index reached its highest level in over two years, boosted by gains in technology stocks. Japan’s Topix hit a new intraday peak, with equities in South Korea, Australia, and China also advancing. Meanwhile, US futures remained steady after the S&P 500 and Nasdaq 100 hit records ahead of a US holiday.

The yen strengthened after hitting its lowest level since 1986 against the dollar, amid ongoing speculation that the Bank of Japan will proceed cautiously with its policy tightening. The dollar index declined for the third consecutive session.

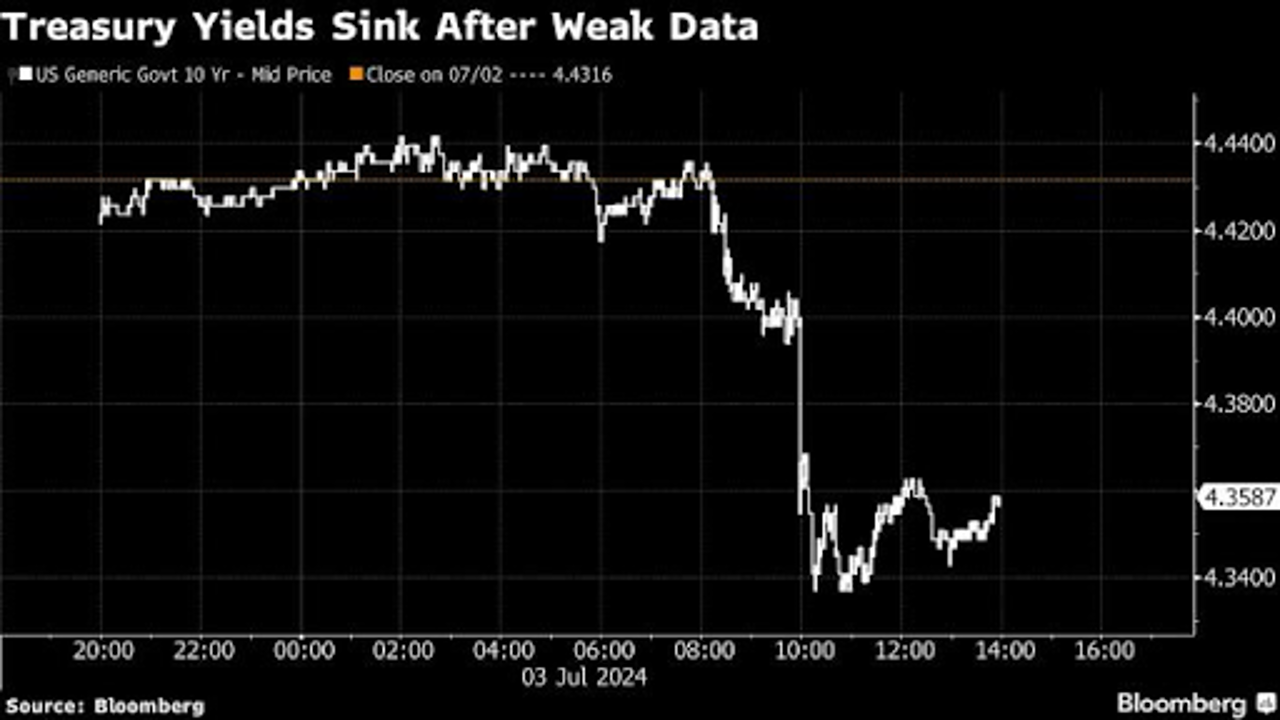

Global stocks are poised for their longest weekly winning streak since March, driven by soft US economic data reigniting discussions of rate cuts in September. Reports revealed a sharp contraction in the US services sector and continued weakness in the labor market.

“Weaker Treasury yields and a decline in the US dollar due to expectations of dovish rate decisions are likely boosting risk appetite across Asia,” commented Jun Rong Yeap, market strategist at IG Asia Pte.

Minutes from the Fed’s June meeting indicated policymakers are monitoring inflation trends closely, with divisions over the timing of rate adjustments. Market expectations now point to nearly two rate cuts in 2024, with the possibility of an initial cut in November, although bets on a September reduction have increased.

Market sentiment seemed to embrace the adage "bad news is good news," as noted by Fawad Razaqzada at City Index and Forex.com, referring to the positive market response following weak US economic indicators.

Elsewhere in Asia, Chinese electric car brands maintained their market share in a slowing European EV market, with automakers like BYD Co. accounting for 8.7% of total EV sales.

In Europe, Britons prepared for a general election while the pound remained stable in early Asian trading.

Investors are eagerly awaiting Friday’s US jobs report, with expectations of a modest increase in nonfarm payrolls and steady unemployment rate. The outcome could sway the Fed's decision-making on interest rates amid signs of a cooling economy.

Chicago Fed President Austan Goolsbee emphasized the need for more data before considering rate adjustments, underscoring the cautious approach by US central bankers.

Meanwhile, market attention is also on developments in the US presidential race, with potential impacts on financial markets depending on outcomes.

In commodities, gold prices rose for a second consecutive day after breaking out of a narrow trading range.