Bitcoin options traders are setting their sights on a potential price of $80,000 for the cryptocurrency, regardless of the outcome of the upcoming U.S. presidential election, according to Bloomberg.

Bitcoin options traders are increasingly betting that the cryptocurrency will hit $80,000 by the end of November, regardless of who wins the upcoming U.S. presidential election. As Election Day approaches, traders are focusing on call options—contracts that allow them to purchase Bitcoin at a predetermined price—indicating the widespread belief that Bitcoin will perform well no matter which political party takes control.

Market analysts suggest that traders are showing a strong preference for call options, betting on Bitcoin's price to rise. David Lawant, head of research at FalconX, a crypto trading firm, explained, “There’s a growing consensus that Bitcoin will thrive, regardless of the election outcome." He added that their research shows options trading around the election are heavily skewed toward a bullish outlook.

This optimism stems partly from the fact that both major political candidates are expected to influence the crypto market in positive ways. Republican candidate and former President Donald Trump has long been considered a crypto-friendly figure, and his election could strengthen Bitcoin’s appeal to investors. On the other hand, Vice President Kamala Harris, running on the Democratic ticket, has promised to support regulatory clarity for the industry, which could also boost confidence in the sector. This contrasts with the current Biden administration’s regulatory crackdown on cryptocurrency. Additionally, market watchers believe that Federal Reserve policies, such as potential interest rate cuts, could fuel Bitcoin’s price surge further.

In March, Bitcoin hit its all-time high at $73,798 amid rising demand for new exchange-traded funds (ETFs). Though the cryptocurrency has since calmed, it flirted with $70,000 earlier this week before retreating. As of Wednesday, Bitcoin stood at $67,100 in London, maintaining a roughly 60% increase this year.

Deribit, the largest crypto options exchange, has seen the put-to-call ratio—used to measure bearish versus bullish sentiment—trending lower as the year winds down. This suggests traders are leaning more heavily towards call options, indicating they expect Bitcoin to keep rising. According to Yev Feldman, co-founder of SwapGlobal, many traders are positioning for a breakout near the $70,000 mark. "We’ve seen a steady flow of traders buying calls near $68,000 and puts near $66,000, positioning for potential volatility," said Feldman.

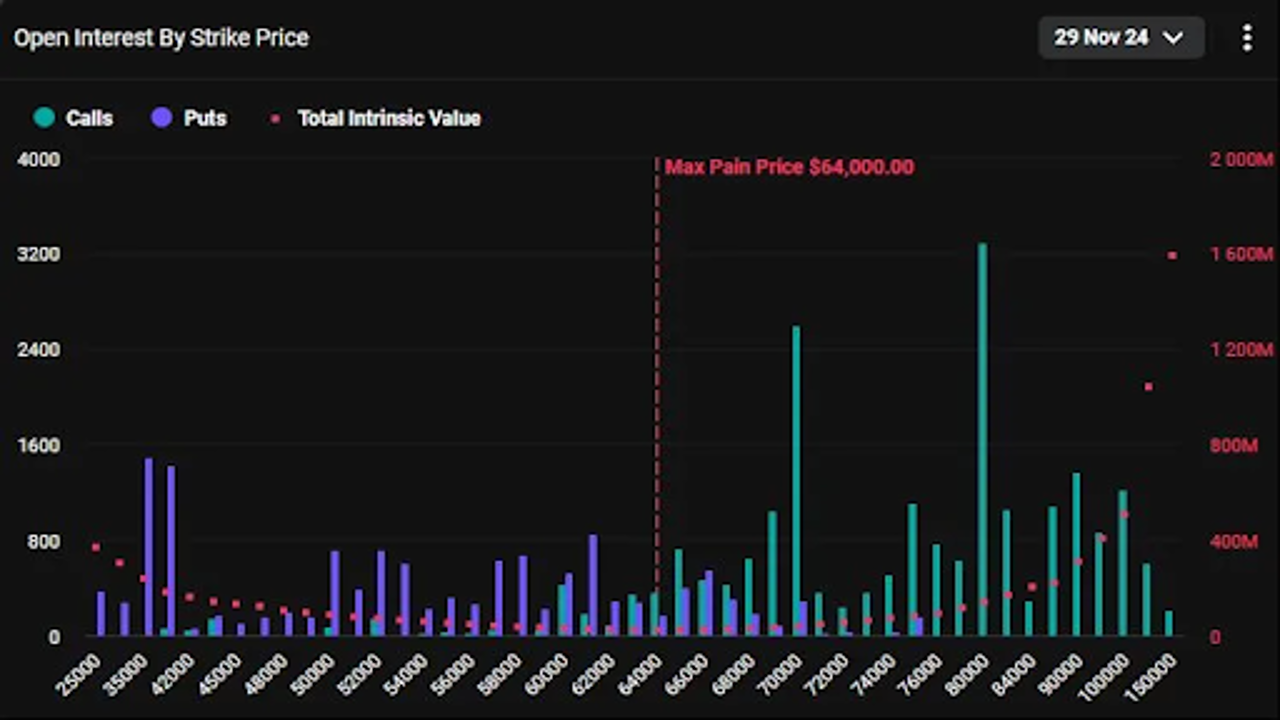

Data shows that most call options expiring on November 29 are concentrated around the $80,000 price mark, with other popular strike prices at $70,000 and $100,000 for contracts expiring in late December. For contracts set to expire shortly after the election, on November 8, traders have largely targeted the $75,000 level.

Furthermore, traders are paying higher premiums for call options compared to put options, indicating strong confidence in upward momentum. Wintermute's Jake Ostrovskis, an over-the-counter trader, noted that call premiums have surged across most contract durations. This trend suggests that investors are more interested in profiting from Bitcoin’s potential rise than hedging against a decline.

While Bitcoin’s price volatility has been more subdued compared to major events like the launch of Bitcoin ETFs or the cryptocurrency’s halving, analysts expect that could change as the election date approaches. "Although we’ve seen limited volatility so far, it may spike as we get closer to the election," added Lawant.