Bitcoin's recent surge has slowed down, as challenges linked to Donald Trump's trading activities pose obstacles for the cryptocurrency, according to Bloomberg.

Bitcoin’s recent rally is starting to lose momentum as it becomes entangled in broader market changes, especially with the possibility of former U.S. President Donald Trump returning to the White House. As Republican nominee Trump leads over Vice President Kamala Harris in key prediction markets, there has been a notable shift in investor behaviour. Bond yields and the U.S. dollar have both surged, suggesting that many investors are adjusting their expectations about future monetary policies. If Trump wins the election on November 5, he’s likely to push for pro-growth policies that could further strengthen the already resilient U.S. economy.

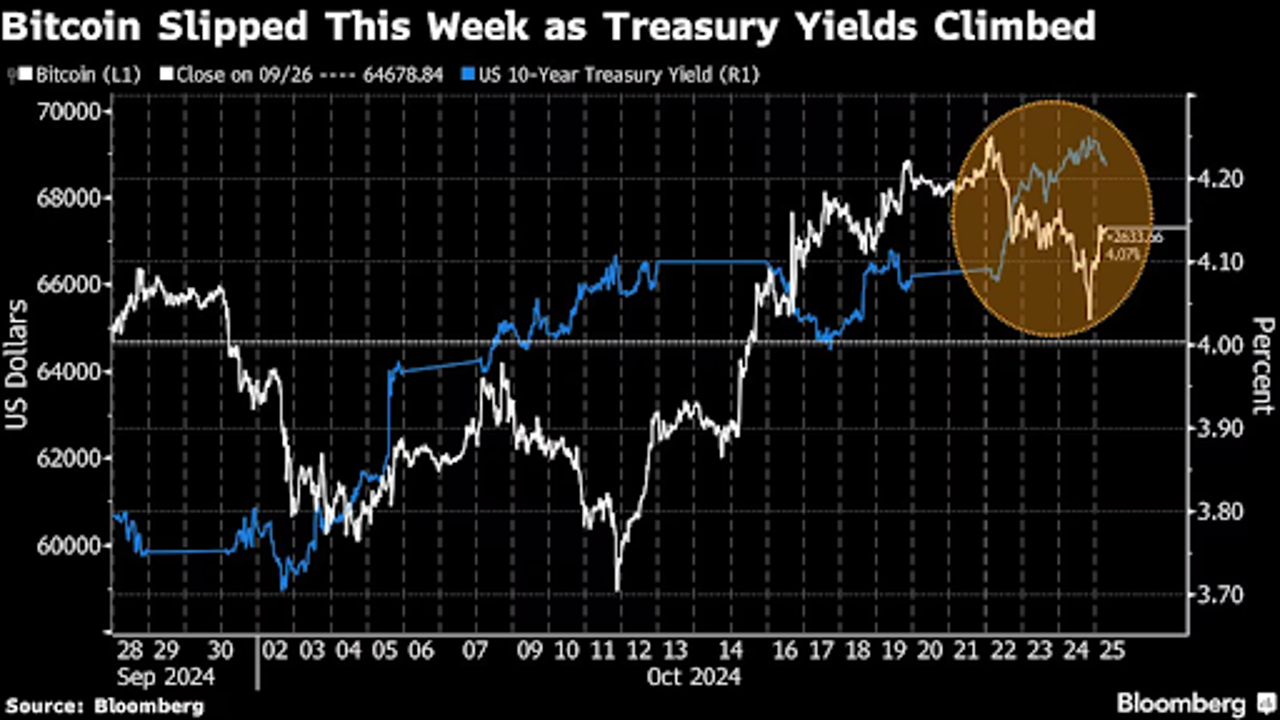

This shift in market conditions has made Bitcoin and stocks more volatile, with Bitcoin facing its first weekly decline in three weeks. While Trump’s previous support of the digital asset industry boosted optimism around cryptocurrencies, questions now arise about whether his broader economic priorities might dampen that enthusiasm.

Tony Sycamore, a market analyst at IG Australia Pty, noted that the rise in U.S. dollar value, higher bond yields, and the overall tightening of financial conditions have been unfavourable for cryptocurrencies. "While financial conditions were already loose, the speed at which tightening is happening is creating challenges for crypto," he said.

Despite these hurdles, Bitcoin saw a modest gain of about 1% on Thursday, trading at $67,300 as of early morning in London. However, this was still not enough to erase its weekly decline of around 2%. This year, Bitcoin has risen by about 60% and even reached a record high of $73,798 in March, supported by strong demand for U.S. Bitcoin exchange-traded funds.

As the U.S. presidential race heats up, Trump’s stance on cryptocurrencies continues to stand out. He has promised to make the U.S. the “crypto capital of the planet,” a move that has garnered attention in the digital asset community. In contrast, his opponent, Democratic nominee Kamala Harris, has taken a more cautious approach. Harris is advocating for a regulatory framework to manage the cryptocurrency industry, which contrasts with the stricter measures taken by President Joe Biden’s administration.

The race remains extremely close, with Trump and Harris neck-and-neck in seven key swing states, according to a Bloomberg News/Morning Consult poll. With such narrow margins, the final outcome of the election may be influenced by last-minute campaign efforts, including advertising, rallies, and door-to-door voter outreach.

A potential Trump victory could result in higher bond yields, which may harm riskier assets like Bitcoin. However, Caroline Mauron, co-founder of Orbit Markets, a company that provides liquidity for digital-asset derivatives trading, believes that if Trump wins, his expected softer regulatory approach toward the cryptocurrency industry will be more important than the rise in yields. She stated, “Even though higher yields could negatively impact risk assets, a more favourable regulatory environment under Trump would still likely benefit the crypto sector.”