Bond market steadies as investors seize opportunities with 4.5% yields. Bloomberg

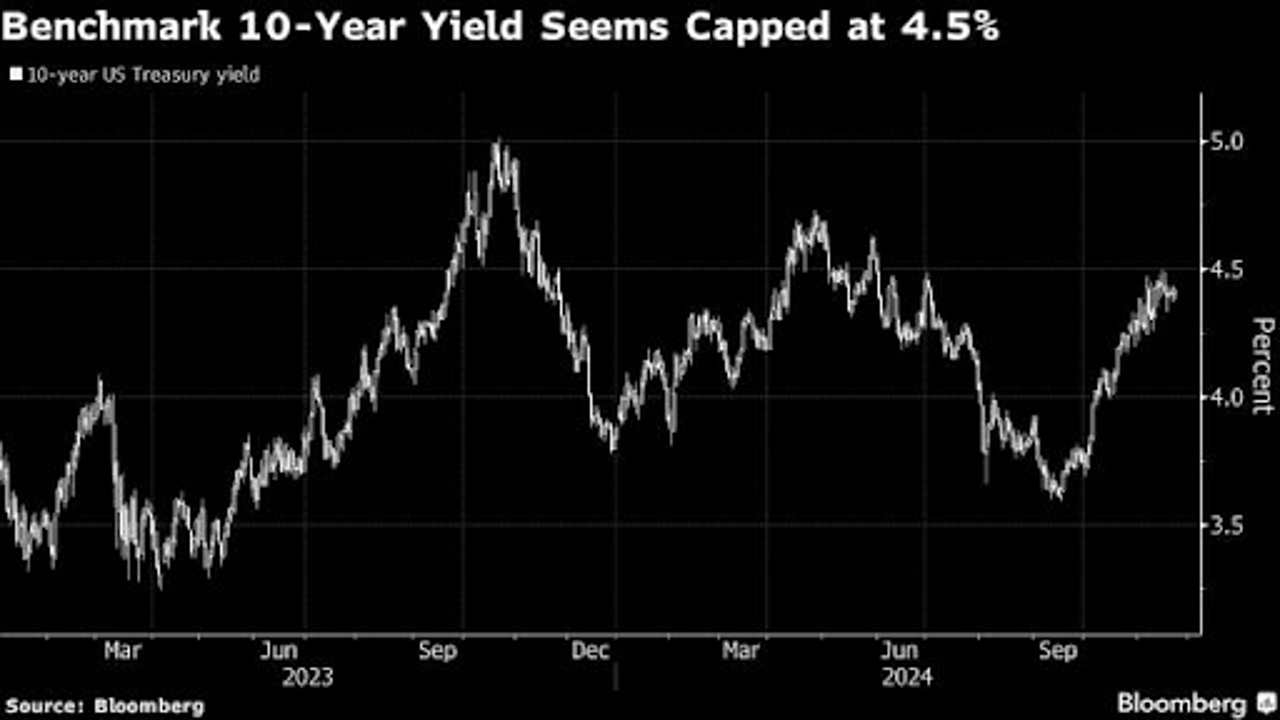

The U.S. bond market is showing signs of stability after a prolonged two-month selloff, as investors take advantage of rising yields. Whenever the 10-year Treasury yield approaches new highs, buyers are stepping in, easing market tensions. After breaching the 4.5% mark on November 15, the yield quickly reversed course, closing at 4.4% last week and slipping further to around 4.36% on Monday.

Many fund managers now see Treasury yields above 4% as an attractive investment. According to Erin Browne of Pacific Investment Management, Treasuries provide solid returns with low volatility and are regaining their role as a hedge against potential stock market downturns. Browne also noted that if the yield rises to 5%, it could trigger more aggressive buying.

The bond market has undergone significant changes over the last two months, defying expectations of a rally after the Federal Reserve began cutting interest rates in September. Strong economic data and Donald Trump’s presidential victory pushed yields higher as traders reassessed the Fed’s trajectory. The appointment of Scott Bessent as the next Treasury Secretary by Trump is also expected to play a significant role in shaping fiscal policy. Known as a fiscal conservative, Bessent has previously criticized federal debt management and large interest rate cuts. Wall Street views his nomination positively, citing his extensive market experience.

However, uncertainty continues to cloud the market’s direction. Many investors are cautious, taking a wait-and-see approach amid questions about how Trump’s policies on tariffs and fiscal stimulus might affect the economy. Subadra Rajappa, a U.S. rates strategist, observed that while investors are reluctant to bet on higher yields, they are also holding back from expecting a major rally.

Portfolio manager Felipe Villarroel considers the 10-year yield's current range of 4.25% to 4.5% reasonable but warns of potential volatility. While inflation appears to have stabilized for now, the uncertainty surrounding Trump’s policies continues to weigh on investor sentiment. Some strategists suggest that yields could climb back to 5% if Trump implements aggressive tax cuts and increases tariffs. Options trading also reflects a cautious stance, with hedges in place for the possibility of rising yields.

This week, the bond market will focus on the release of the Federal Reserve’s preferred inflation gauge, the personal consumption expenditures price index, scheduled for Wednesday. The report could influence market movements, especially with reduced trading hours later in the week due to the Thanksgiving holiday. Thin trading volumes could amplify price swings if the inflation reading deviates significantly from expectations.