Brookfield is looking to raise close to €10 billion to support its potential acquisition of Grifols.

Brookfield Asset Management, based in Toronto, is pursuing a massive €9.5 billion ($10.6 billion) in debt from banks to finance the potential acquisition of Spanish pharmaceutical giant Grifols SA. This deal, if successful, would involve taking the blood plasma-based medicine producer private, according to inside sources. The funds would be utilized to refinance Grifols’ current debts, which include various loans and high-yield bonds. Banks participating in this financing endeavour would first commit to offering the funds and later sell the debt to investors.

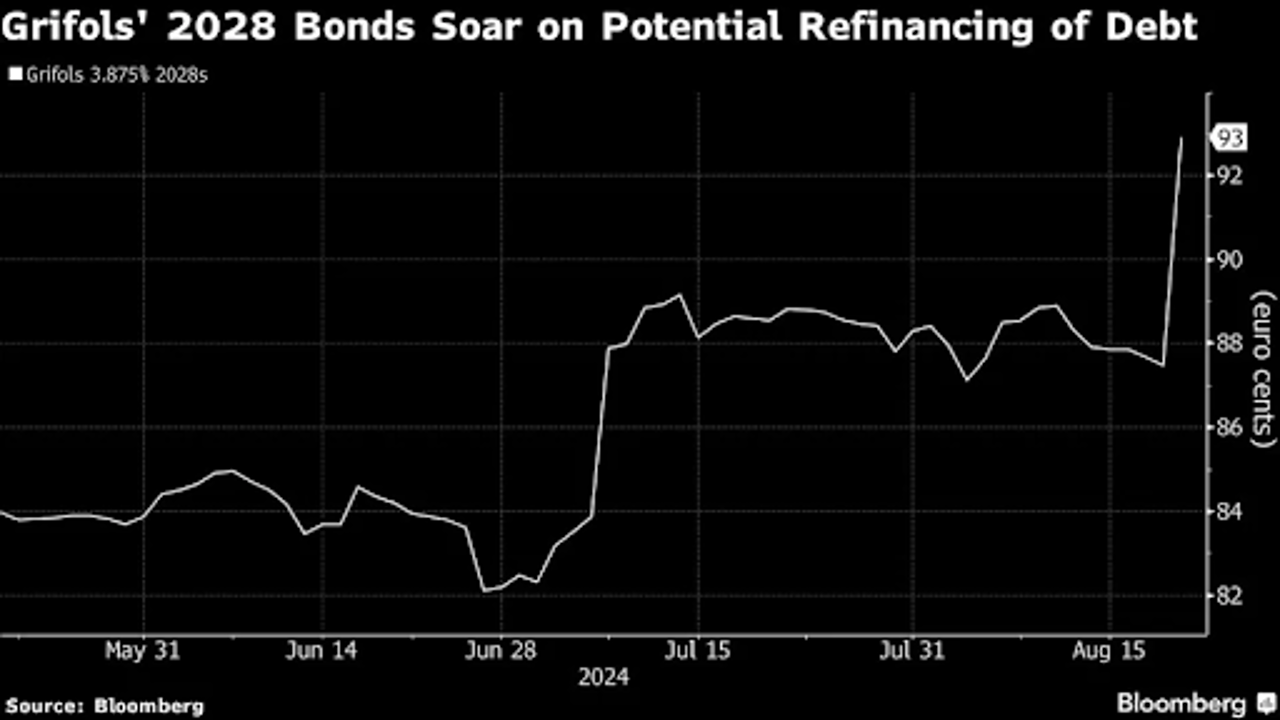

This financing plan is crucial because the acquisition could trigger a clause that enables bondholders to demand repayment at a premium, well above the current trading prices of some of Grifols’ bonds. Following reports of this development, Grifols’ 2028 bonds saw a significant surge, gaining more than six cents to approach 94 cents on the euro. At the same time, the company's shares experienced a jump of up to 6.4% on the Madrid stock exchange.

Brookfield’s interest in Grifols stems from the company's troubled financial situation. Earlier this year, the pharmaceutical firm faced severe pressure after an attack by short-seller Gotham City Research, which sent both its shares and bonds into a nosedive. Subsequent months saw a series of negative developments, including concerns over cash flow and adjustments in its Chinese investments. Grifols attempted to restore confidence by appointing new management and removing the family from executive roles. Despite these efforts, the company has continued to struggle.

If Brookfield and the Grifols family proceed with their buyout plans, the financing package is expected to consist of €8 billion in drawn debt, along with a revolving credit facility of up to €1.5 billion. The majority of the financing is anticipated to be in dollars, with at least one bank reportedly willing to back the entire amount. However, neither Brookfield nor the Grifols family has made any public statements regarding the deal, and Grifols' press representatives have remained silent.

This potential deal could become the largest takeover of a publicly traded European company since 2022, based on data from Bloomberg. For banks, this is an appealing opportunity after a sluggish period of deal-making. Market optimism about interest rates stabilizing has given lenders more confidence in selling debt to investors. However, Brookfield faces limitations on the amount of debt it can pile onto Grifols due to concerns over the firm's leverage. Grifols’ credit rating has been downgraded by three agencies since March, with Moody’s even discontinuing coverage in July.

Brookfield's chair, Mark Carney, who also serves as the chair of Bloomberg Inc., has yet to comment on the matter.