Economists Predict ECB May Speed Up Rate Cuts to Boost Weak Economy (Bloomberg survey of economists c)

The European Central Bank (ECB) is gearing up to slash interest rates at a quicker pace in an effort to revitalize a struggling euro zone economy. A recent Bloomberg survey suggests a 0.25% rate cut next week, followed by reductions at every policy meeting through June, eventually bringing the deposit rate to 2%. Previously, this level wasn’t expected until late next year.

Analysts foresee weaker economic growth and lower inflation projections, prompting a majority to predict that by the end of 2025, borrowing costs will be low enough to encourage growth. This marks a shift from earlier expectations of neutral rates.

Troubling Signs for the Eurozone

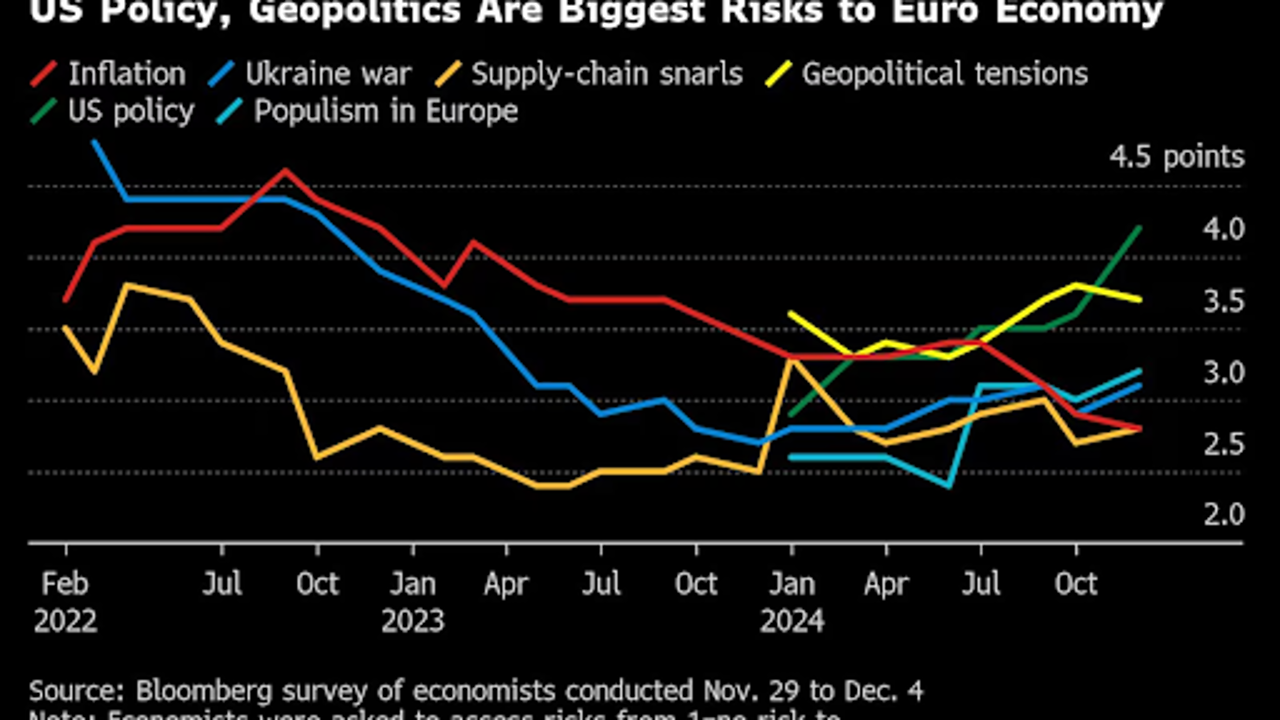

The eurozone’s economic outlook is bleak. The services sector has joined manufacturing in contraction, while political instability in major economies like Germany and France adds to uncertainty. Ongoing global conflicts in Ukraine and the Middle East, alongside threats of U.S. trade tariffs, further complicate the situation.

ECB President Christine Lagarde is expected to maintain a cautious tone in her upcoming press conference, highlighting deteriorating inflation and GDP growth forecasts. Speculation has risen about a potential 0.5% rate cut, but most ECB officials favour gradual, smaller reductions to maintain stability.

Divided Opinions on Policy Direction

While a few officials and economists suggest bold moves like a half-point cut, the consensus leans toward incremental steps. For instance, J.P. Morgan anticipates such a cut in December, while others, like SEB’s Jussi Hiljanen, see it as a possibility in March.

A majority of analysts expect the ECB to tweak its language around rate-setting, hinting at a gradual shift from restrictive to neutral policies. Chief Economist Philip Lane estimates the neutral rate at 1.5% to 2.5%, aligning with survey respondents who largely agree on a range between 2% and 2.5%.

Challenges Ahead

The ECB faces significant challenges. Its restrictive monetary policy has become a risk factor, amplifying structural issues and fears of a U.S.-led trade war. Political turmoil in France has pushed bond yields close to levels seen during the 2012 eurozone debt crisis.

While the ECB has tools like the Transmission Protection Instrument to counter extreme market movements, only 8% of survey respondents expect it to be used within the next year. Lagarde’s task will be to reassure markets without signalling imminent interventions.

Economic growth and inflation projections for 2025 are likely to be revised downward. Over 60% of respondents view missing the ECB’s 2% inflation target as a bigger risk than overshooting it. This reflects rising concerns over the global economic climate, particularly the potential impact of U.S. trade policies.

Striking a Delicate Balance

The ECB’s challenge lies in providing enough monetary support to stave off recession risks while maintaining tight policy to guard against inflation surges. Balancing these competing priorities will be crucial as the eurozone navigates economic turbulence.