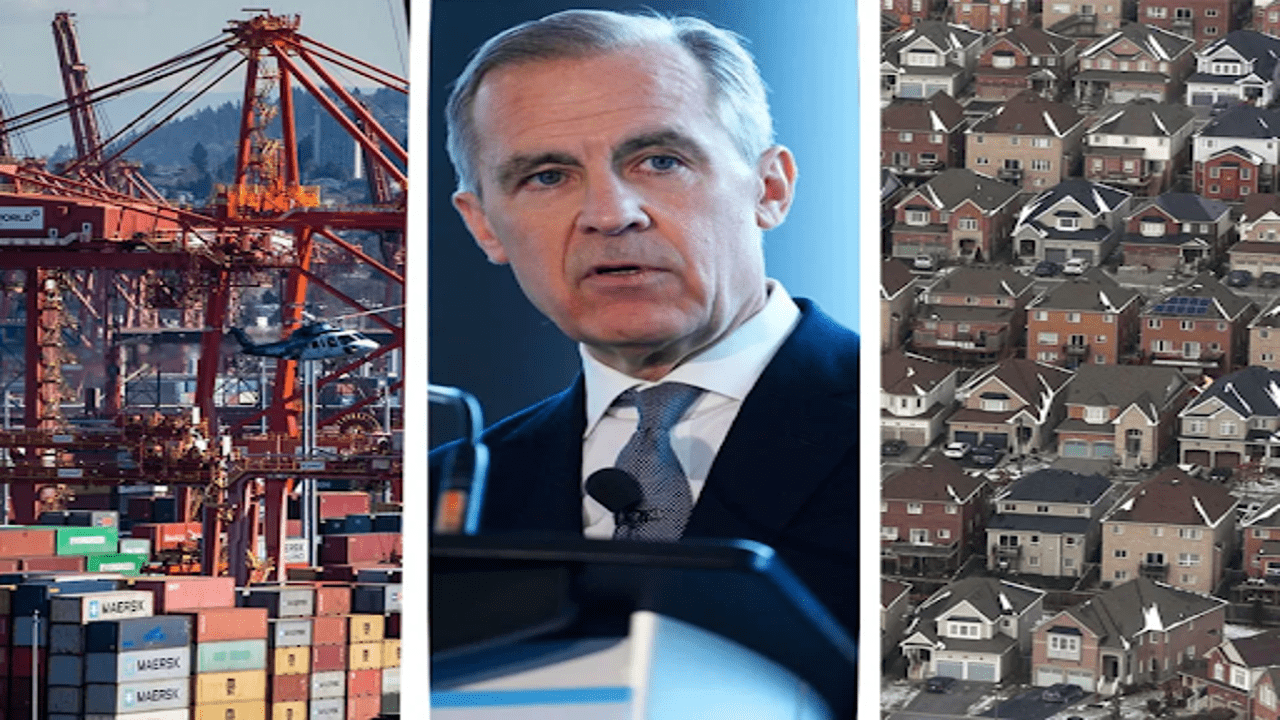

Key issues expected to dominate discussions in Parliament include trade disputes, Mark Carney's role in leading a task force on economic growth, and the ongoing housing crisis.

As Parliament resumes, economic challenges are set to dominate the agenda, particularly following the collapse of the Liberal-NDP support agreement. With trade tensions heating and domestic concerns like housing and tax policy on the rise, the government faces growing pressure from both ends of the political spectrum.

One of the most pressing issues is Canada's ongoing trade disputes, particularly with the U.S. and China. The re-election of Donald Trump as U.S. president could trigger a wave of protectionism, a concern the Trudeau government has been preparing for since renewing its "Team Canada" strategy. Despite meetings between Canadian officials and their U.S. counterparts, tensions remain high, especially over Canada's digital services tax. The U.S. government has expressed strong opposition to the tax, which targets tech giants like Netflix and Google, potentially leading to retaliatory tariffs if no agreement is reached.

Canada is also facing trade challenges with China. In response to Canadian tariffs on electric vehicles, steel, and aluminium, China has launched an investigation into Canadian rapeseed imports, raising concerns over possible trade restrictions. Further tariffs on Chinese products like semiconductors and solar panels may also be introduced, with consultations ending soon.

As trade issues escalate, all eyes are on Mark Carney, the former governor of the Bank of Canada, who has been tasked with leading a new economic growth task force. Carney's return to public service has sparked speculation about his political future, though for now, he remains focused on shaping Canada's economic strategy. His experience and views on carbon-free economies and industrial policy could guide the government’s approach to addressing pressing issues like stagnating productivity and the housing crisis. However, his appointment has faced criticism from the opposition, with Conservative leader Andrew Scheer accusing Carney and Prime Minister Trudeau of being "out of touch elites."

Tax policies, particularly around carbon and capital gains, are also expected to be contentious. The carbon tax has been a focal point of political debate, with NDP leader Jagmeet Singh rethinking the party’s support for it and calling for a more equitable climate strategy that doesn’t overburden working Canadians. Meanwhile, Conservative leader Pierre Poilievre has promised a non-confidence motion aimed at forcing an election over the carbon tax issue.

Recent changes to capital gains tax have also sparked backlash, particularly among businesses. The new policy, which raises the inclusion rate for high earners and corporations, has been criticized despite some efforts by the government to broaden exemptions.

On the housing front, the soaring costs have become a major concern. The Liberal government has been blamed for fuelling the housing crisis through lenient immigration policies that have strained the market. In response, new mortgage measures have been introduced to help more Canadians qualify for home loans. Yet, the opposition parties remain critical. The Conservatives have proposed policies aimed at increasing housing supply, such as withholding federal funds from underperforming municipalities and selling off government buildings for housing.

With these major economic issues at the forefront, the coming months promise to be a challenging period for the federal government, as they seek solutions that satisfy both the left and the right.