Traders dealing in emerging market currencies are paying close attention to the upcoming US election, leading to heightened market volatility. Concerns about potential shifts in US policy and economic direction are driving these fluctuations as investors respond to the uncertainty.

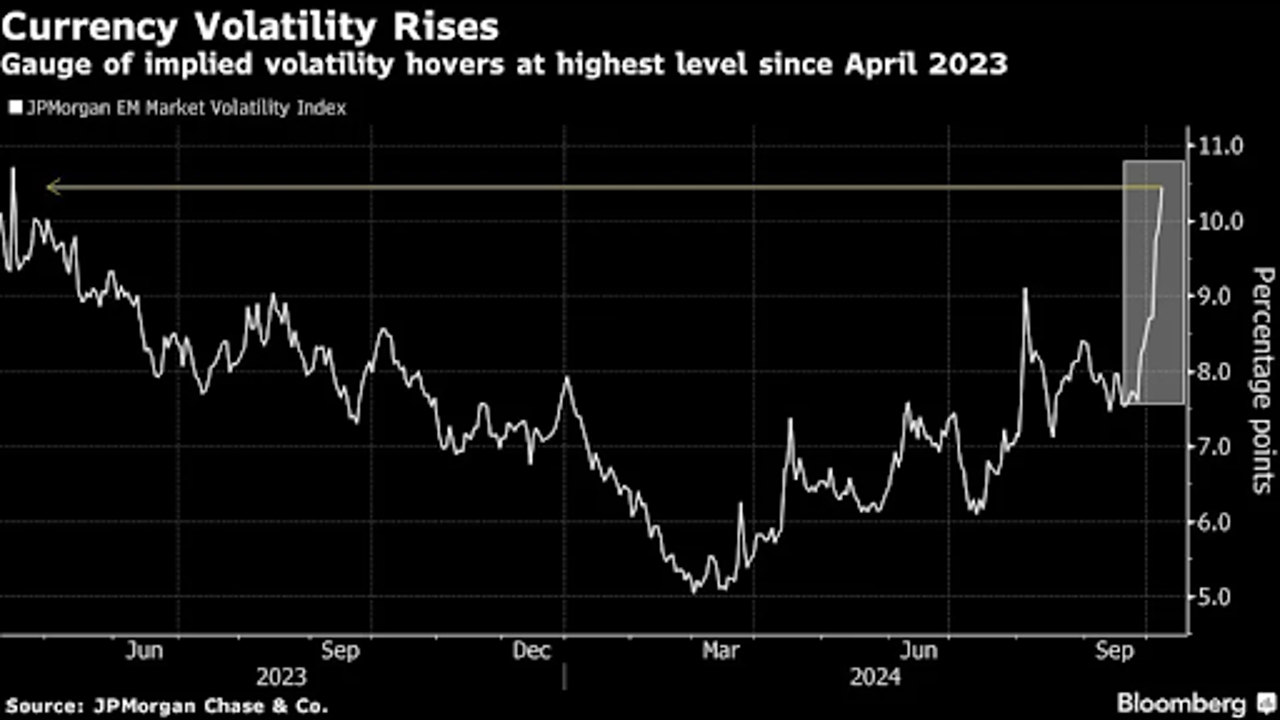

Emerging market currency traders are feeling the impact of the upcoming US presidential election, causing a sharp rise in currency volatility. According to data from JPMorgan Chase & Co., the one-month implied volatility for currencies in developing nations has increased for eight consecutive days, marking the longest such streak since 2019.

This surge in volatility is being driven by concerns over the November 5 election, which has overshadowed other major issues like the COVID-19 pandemic, rising inflation, and several debt defaults. Investors are worried about how the election outcome will affect global markets, particularly in emerging economies.

Adding to the uncertainty is the recent selloff in emerging market assets, partly due to waning optimism about China’s economic stimulus measures. On Tuesday, the MSCI equity index for developing countries dropped by 2.2%, the largest decline in nine weeks. Chinese stocks in Hong Kong were hit especially hard, experiencing their worst performance since 2008.

The currency index for emerging markets also took a hit, dropping by 0.2% as currencies like the South African rand and the Chinese yuan lost ground against the US dollar. This marked the sixth consecutive day of losses for the index, the longest such streak since March.

The two main candidates in the US presidential race—former President Donald Trump and current Vice President Kamala Harris—are expected to have different impacts on emerging market assets. According to a report from UBS Group AG, a victory for Harris would likely lead to policy continuity, which could stabilize the markets and trigger a relief rally. On the other hand, a Trump win could bring greater market disruption as investors re-evaluate risks related to his trade policies and geopolitical approach, potentially leading to even more currency volatility.

This election uncertainty comes on the heels of a three-month rally in emerging market currencies, fuelled by a dovish Federal Reserve and a weakening US dollar. However, recent signs of strength in the US labour market have reduced the likelihood of further aggressive interest rate cuts, and investors are now worried that more expansive fiscal policies after the election could keep interest rates higher for longer.

JPMorgan’s measure of expected future currency volatility surged past 10 percentage points on Monday, the highest it’s been since May 2023. The gap between this measure and a similar index for the Group of Seven advanced economies also widened to its largest since early June.

According to Phoenix Kalen, head of emerging-markets research at Societe Generale in London, "This rise in volatility is largely due to uncertainties surrounding the US election. Investors are placing hedges, which is pushing up volatility." Kalen also noted that polls indicate the race between Trump and Harris is tightening, adding to market anxieties.